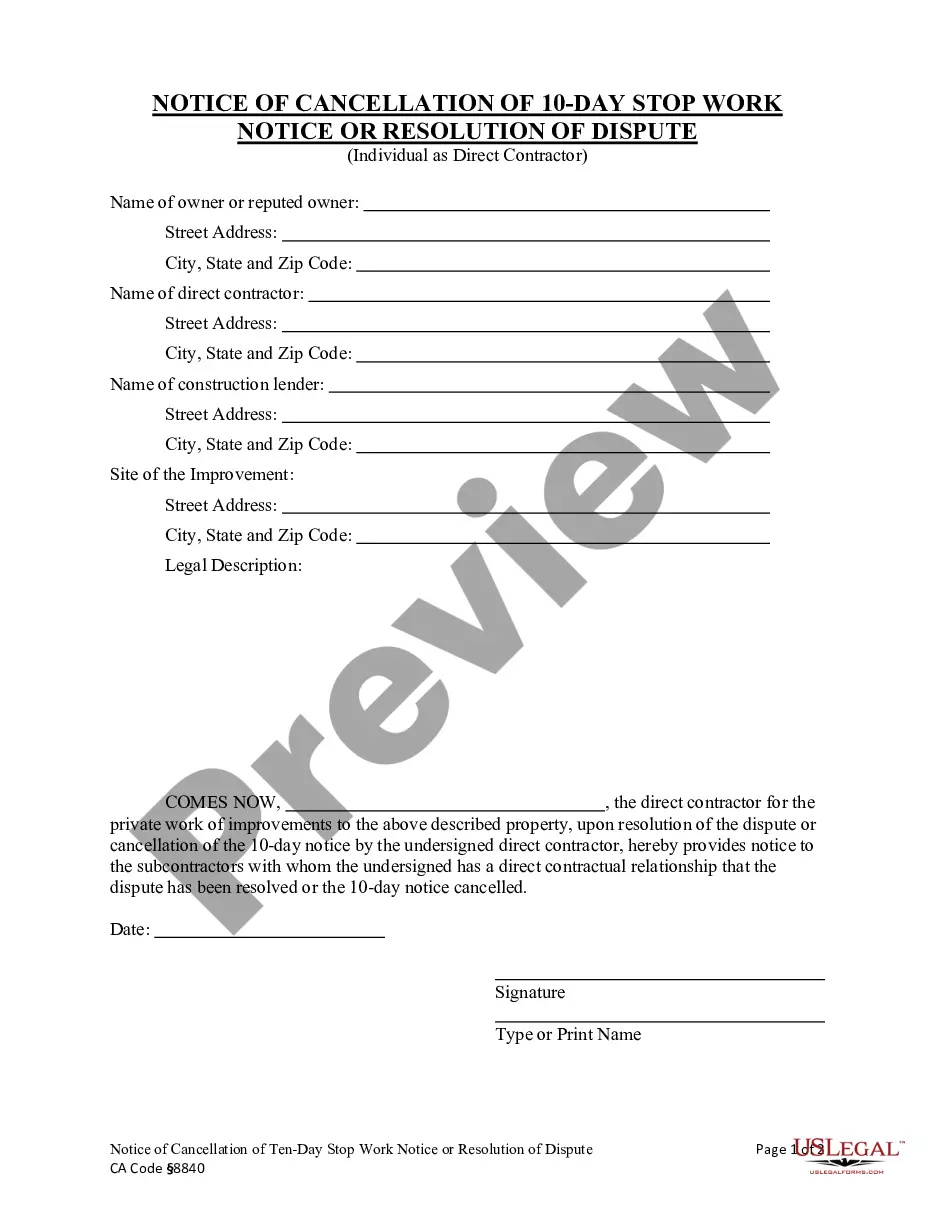

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Stockton California Schedule A is a tax form that is specific to the city of Stockton in California. It is used by individuals and businesses to report their itemized deductions and expenses related to rental properties. Receipts are an essential component of Stockton California Schedule A. Renters and landlords must keep track of all receipts related to their rental activities, including rent payments, property maintenance expenses, repairs, and any other expenses incurred throughout the year. The Rent-Standard Account is a term used to describe the method through which rental income and expenses are accounted for on Stockton California Schedule A. This account allows taxpayers to report their rental income, deduct eligible expenses, and calculate the net income or loss from their rental property. Types of Stockton California Schedule A can include Schedule A (Form 1040), which is the general itemized deductions form used by individuals, and Schedule A (Form 1040NR), which is used by nonresident aliens to report itemized deductions. Keywords: Stockton California, Schedule A, Receipts, Rent-Standard Account, tax form, itemized deductions, rental properties, rent payments, property maintenance expenses, repairs, rental income, eligible expenses, net income, loss, Form 1040, Form 1040NR.Stockton California Schedule A is a tax form that is specific to the city of Stockton in California. It is used by individuals and businesses to report their itemized deductions and expenses related to rental properties. Receipts are an essential component of Stockton California Schedule A. Renters and landlords must keep track of all receipts related to their rental activities, including rent payments, property maintenance expenses, repairs, and any other expenses incurred throughout the year. The Rent-Standard Account is a term used to describe the method through which rental income and expenses are accounted for on Stockton California Schedule A. This account allows taxpayers to report their rental income, deduct eligible expenses, and calculate the net income or loss from their rental property. Types of Stockton California Schedule A can include Schedule A (Form 1040), which is the general itemized deductions form used by individuals, and Schedule A (Form 1040NR), which is used by nonresident aliens to report itemized deductions. Keywords: Stockton California, Schedule A, Receipts, Rent-Standard Account, tax form, itemized deductions, rental properties, rent payments, property maintenance expenses, repairs, rental income, eligible expenses, net income, loss, Form 1040, Form 1040NR.