This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

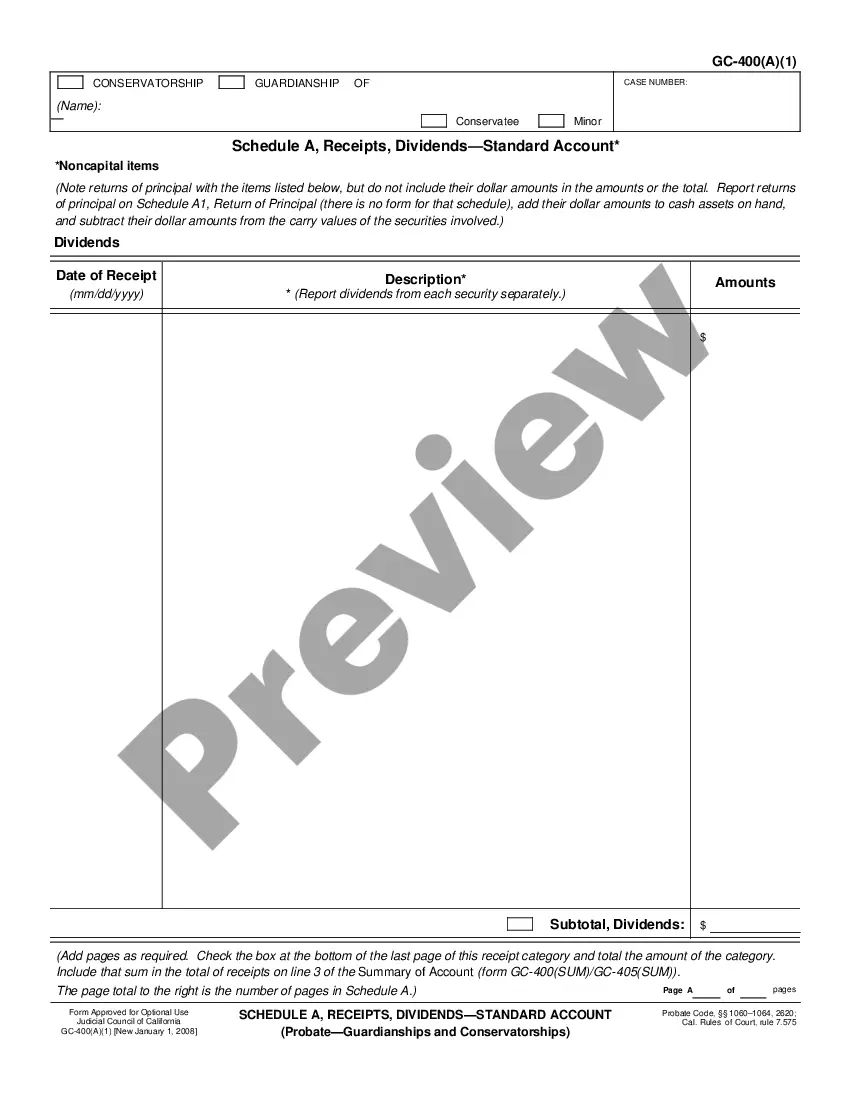

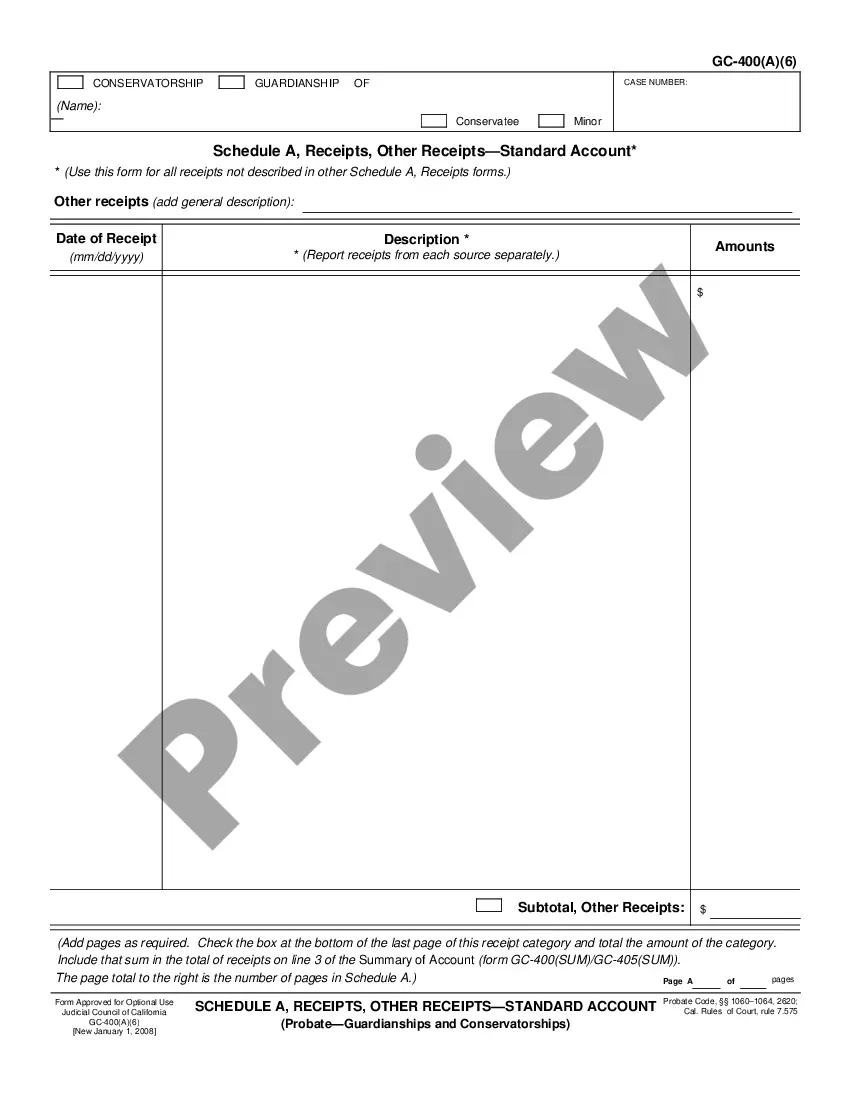

Daly City California Schedule A, Receipts, Social Security, Veterans' Benefits, Other Public Benefits - Standard Account

Description

How to fill out California Schedule A, Receipts, Social Security, Veterans' Benefits, Other Public Benefits - Standard Account?

Regardless of social or occupational rank, filling out legal documents is an unfortunate obligation in the modern era.

Frequently, it’s nearly unfeasible for an individual lacking legal knowledge to compose such documents from scratch due to the intricate terminology and legal subtleties they entail.

This is where US Legal Forms can come to the rescue.

Verify that the template you found is tailored to your area since the regulations of one location may not apply to another.

Examine the form and read through a brief summary (if available) regarding situations the document may be applicable for.

- Our platform offers an extensive array of more than 85,000 ready-to-use state-specific forms suitable for nearly every legal circumstance.

- US Legal Forms also serves as a valuable resource for associates or legal advisors aiming to enhance their efficiency by using our DIY forms.

- Whether you require the Daly City California Schedule A, Receipts, Social Security, Veterans' Benefits, Other Public Benefits - Standard Account or any other documentation that will be beneficial in your jurisdiction, with US Legal Forms, everything is within reach.

- Here’s how to obtain the Daly City California Schedule A, Receipts, Social Security, Veterans' Benefits, Other Public Benefits - Standard Account swiftly using our dependable platform.

- If you are already a subscriber, simply Log In to your account to download the required form.

- If you are new to our collection, ensure you follow these steps prior to acquiring the Daly City California Schedule A, Receipts, Social Security, Veterans' Benefits, Other Public Benefits - Standard Account.

Form popularity

FAQ

Yearly earnings totals are free to the public if you do not require certification. To obtain FREE yearly totals of earnings, visit our website at . Section 205 of the Social Security Act, as amended, allows us to collect this information.

Your Social Security Statement (Statement) is available to view online by opening a my Social Security account. It is useful for people of all ages who want to learn about their future Social Security benefits and current earnings history.

Certified yearly earnings totals or an itemized earnings statement (certified or non-certified) can be obtained by completing the Request for Social Security Earnings Information (Form SSA-7050).

You can request Social Security publications at our website, , or by calling us at 1-800-772-1213.

Income is considered wages from an employer and does NOT include investment earnings, government benefits, interest or capital gains. In 2022, the lower limit was $19,560. So for every $2 an individual earns above this amount, the Social Security administration will withhold $1 from a worker's benefit.

How can I get a form SSA-1099/1042S, Social Security Benefit Statement? Using your personal my Social Security account, and if you don't already have an account, you can create one online.Calling us at 1-800-772-1213 (TTY 1-800-325-0778), Monday through Friday, am ? pm.

Your Social Security Statement shows how much you have paid in Social Security and Medicare taxes. It explains about how much you would get in Social Security benefits when you reach full retirement age. If you become disabled and unable to work, you may be eligible for disability benefits.

Tax season is approaching, and we have made replacing your annual Benefit Statement even easier. The Benefit Statement, also known as the SSA-1099 or the SSA-1042S, is a tax form we mail each year in January to people who receive Social Security benefits.

This statement includes the total earnings for each year requested but does not include the names and addresses of employers. If you require one of each type of earnings statement, you must complete two separate forms. Mail each form to SSA with one form of payment attached to each request.

Your Social Security Statement shows how much you have paid in Social Security and Medicare taxes. It explains about how much you would get in Social Security benefits when you reach full retirement age.