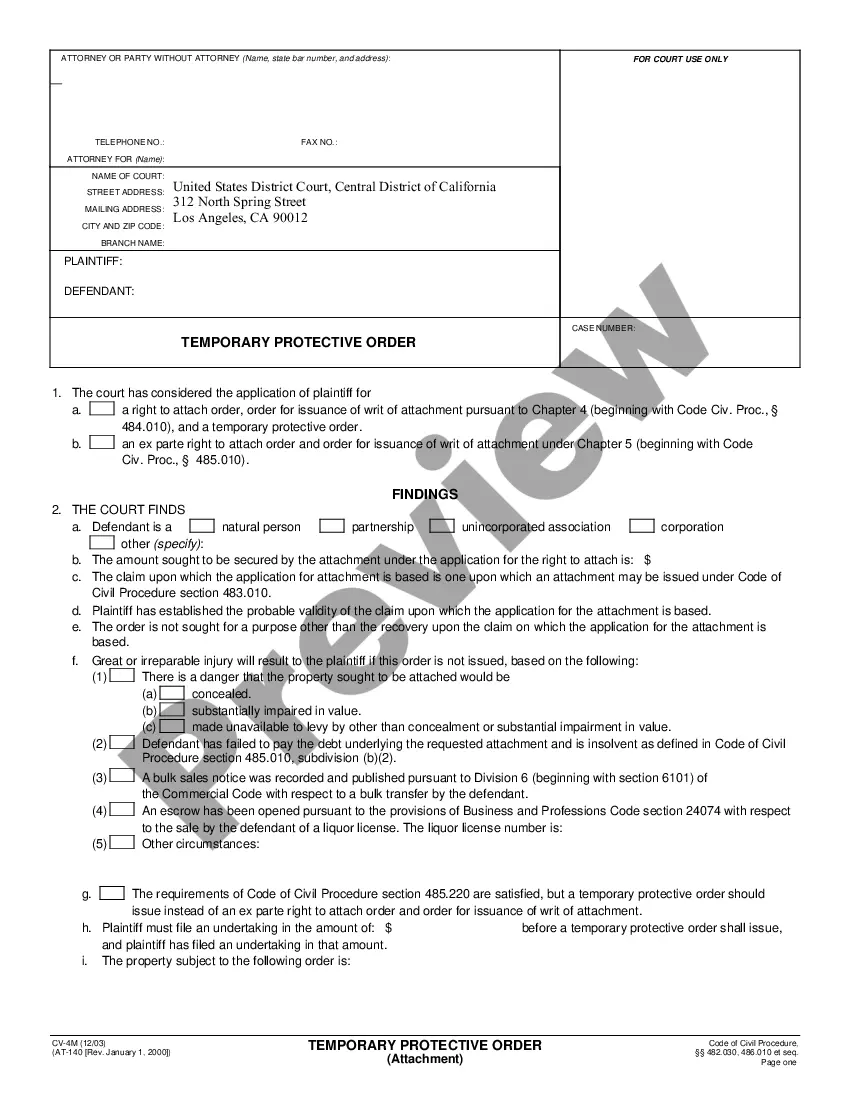

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Elk Grove California Schedule A is a standardized account used for tracking the financial records and transactions related to receipts and expenses in Elk Grove, California. This detailed description will provide an overview of Elk Grove California Schedule A, Receipts, Other Receipts-Standard Account, including its purpose, types, and key features. 1. Purpose of Elk Grove California Schedule A: Elk Grove California Schedule A is a financial tool used by individuals, businesses, and organizations in Elk Grove, California, to maintain a record of their income receipts and expenses. It serves as an organized system to document and monitor financial activities, providing a clear overview of financial inflows and outflows. 2. Types of Elk Grove California Schedule A: a) Receipts — This section of the Elk Grove California Schedule A focuses on recording all types of income receipts received by individuals, businesses, or organizations. It includes details such as the date of receipt, source of income, amount received, and any relevant notes. b) Other Receipts-Standard Account — This category in the Elk Grove California Schedule A includes miscellaneous receipts that do not fall under the conventional income sources. It encompasses various types of receipts such as reimbursed expenses, rental income, dividends, or any other sources of income besides the primary income stream. 3. Key Features of Elk Grove California Schedule A: a) Information Organization: Elk Grove California Schedule A is designed to methodically organize financial records, making it easier to locate specific receipts and understand the financial flow. b) Expense Tracking: In addition to income receipts, the Schedule A also facilitates tracking and documenting expenses incurred. This allows individuals, businesses, or organizations to maintain a comprehensive overview of their financial activities. c) Detailed Documentation: Including key information such as dates, sources, amounts, and notes creates a well-documented record of each receipt. This makes it valuable for future reference, audits, or tax-related purposes. d) Tax Planning and Filing: Elk Grove California Schedule A plays a crucial role during tax planning and filings, as it provides a clear picture of income receipts, which helps individuals or businesses ensure accurate reporting and minimize tax liabilities. e) Support for Financial Decisions: By accurately tracking and documenting receipts, Elk Grove California Schedule A assist in making informed financial decisions. It enables a better understanding of income sources and patterns, helping individuals or businesses make necessary adjustments or improvements. Overall, Elk Grove California Schedule A, Receipts, Other Receipts-Standard Account is an essential financial tool that aids in managing, organizing, and tracking income receipts and expenses. By utilizing this standardized account, individuals, businesses, and organizations in Elk Grove, California can maintain a clear and up-to-date financial record, streamline tax filings, and make informed financial decisions.Elk Grove California Schedule A is a standardized account used for tracking the financial records and transactions related to receipts and expenses in Elk Grove, California. This detailed description will provide an overview of Elk Grove California Schedule A, Receipts, Other Receipts-Standard Account, including its purpose, types, and key features. 1. Purpose of Elk Grove California Schedule A: Elk Grove California Schedule A is a financial tool used by individuals, businesses, and organizations in Elk Grove, California, to maintain a record of their income receipts and expenses. It serves as an organized system to document and monitor financial activities, providing a clear overview of financial inflows and outflows. 2. Types of Elk Grove California Schedule A: a) Receipts — This section of the Elk Grove California Schedule A focuses on recording all types of income receipts received by individuals, businesses, or organizations. It includes details such as the date of receipt, source of income, amount received, and any relevant notes. b) Other Receipts-Standard Account — This category in the Elk Grove California Schedule A includes miscellaneous receipts that do not fall under the conventional income sources. It encompasses various types of receipts such as reimbursed expenses, rental income, dividends, or any other sources of income besides the primary income stream. 3. Key Features of Elk Grove California Schedule A: a) Information Organization: Elk Grove California Schedule A is designed to methodically organize financial records, making it easier to locate specific receipts and understand the financial flow. b) Expense Tracking: In addition to income receipts, the Schedule A also facilitates tracking and documenting expenses incurred. This allows individuals, businesses, or organizations to maintain a comprehensive overview of their financial activities. c) Detailed Documentation: Including key information such as dates, sources, amounts, and notes creates a well-documented record of each receipt. This makes it valuable for future reference, audits, or tax-related purposes. d) Tax Planning and Filing: Elk Grove California Schedule A plays a crucial role during tax planning and filings, as it provides a clear picture of income receipts, which helps individuals or businesses ensure accurate reporting and minimize tax liabilities. e) Support for Financial Decisions: By accurately tracking and documenting receipts, Elk Grove California Schedule A assist in making informed financial decisions. It enables a better understanding of income sources and patterns, helping individuals or businesses make necessary adjustments or improvements. Overall, Elk Grove California Schedule A, Receipts, Other Receipts-Standard Account is an essential financial tool that aids in managing, organizing, and tracking income receipts and expenses. By utilizing this standardized account, individuals, businesses, and organizations in Elk Grove, California can maintain a clear and up-to-date financial record, streamline tax filings, and make informed financial decisions.