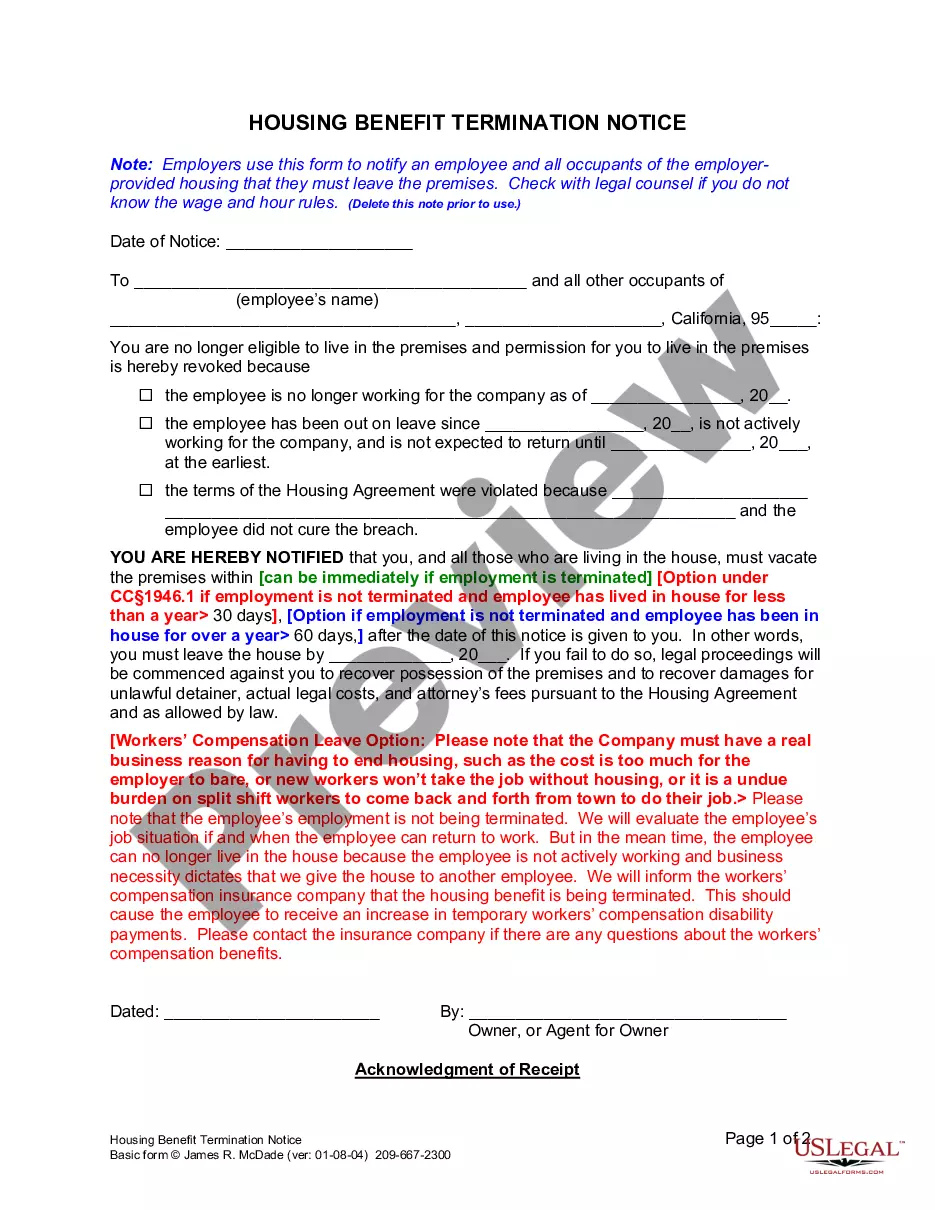

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Santa Maria California Schedule A is a form used for reporting itemized deductions on a federal income tax return. It is specifically designed for taxpayers who choose to itemize their deductions rather than claim the standard deduction. Receipts are essential documents that serve as proof of payment or expenses incurred during a specific time frame. In the context of Santa Maria California Schedule A, receipts play a crucial role in substantiating various deductible expenses, such as medical expenses, charitable contributions, state and local taxes, mortgage interest, and more. The term "Other Receipts-Standard Account" is not a specific category or type of Santa Maria California Schedule A. However, it generally refers to the additional deductible expenses that taxpayers may incur, but are not covered by specific categories listed on the form. These expenses would fall under the broad heading of "miscellaneous deductions." Prior to tax reform in 2018, some common miscellaneous deductions included reimbursed employee expenses, tax preparation fees, certain investment-related expenses, and more. However, it's important to note that as of tax year 2018, most miscellaneous deductions have been eliminated. Keywords: Santa Maria California, Schedule A, receipt, itemized deductions, federal income tax, standard deduction, proof of payment, deductible expenses, medical expenses, charitable contributions, state and local taxes, mortgage interest, other deductions, miscellaneous deductions, tax reform, reimbursed employee expenses, tax preparation fees, investment-related expenses.