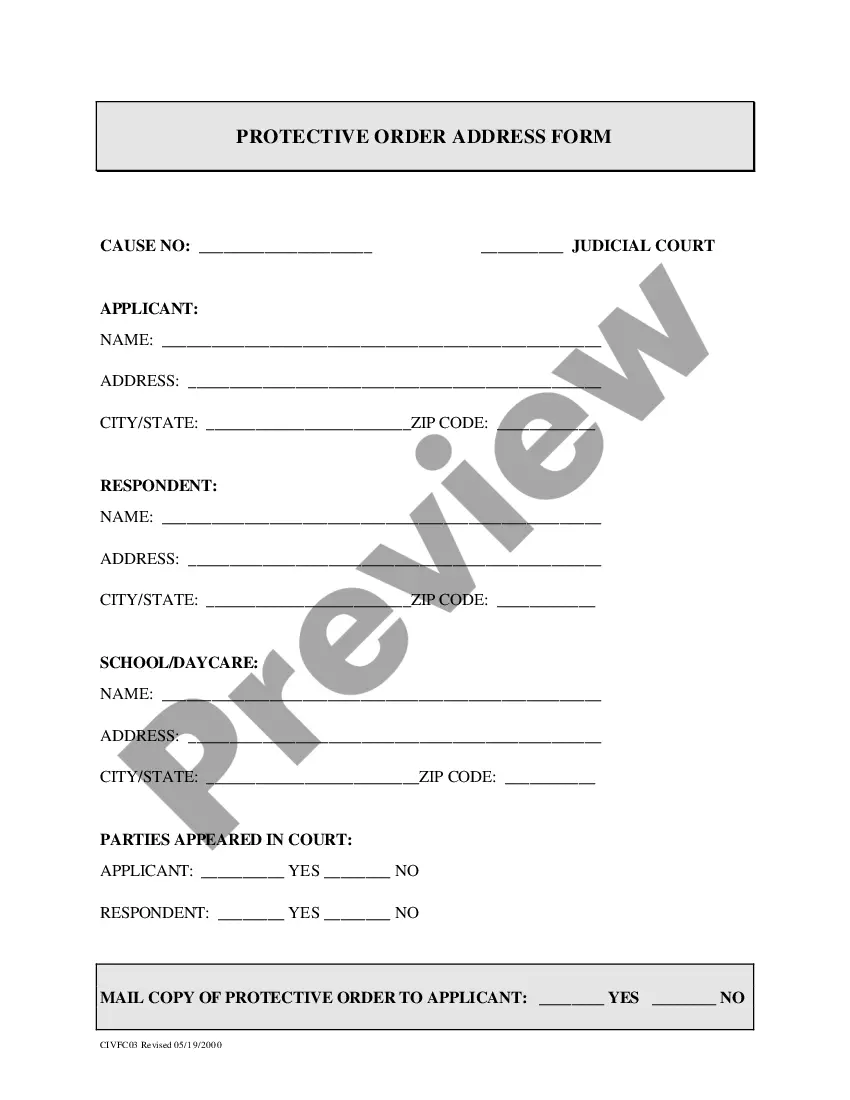

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Thousand Oaks California Schedule A is a document used for tax purposes in the city of Thousand Oaks, California. It contains detailed information about various receipts and expenses related to a standard account. By maintaining this schedule, taxpayers can accurately report their income, deductions, and ultimately calculate their tax liability. The Schedule A form for Thousand Oaks, California consists of several sections where taxpayers need to provide specific details. One of the sections pertains to Receipts, which serves as a record of all income received during the taxable period. Taxpayers are required to include all sources of income, such as wages, self-employment earnings, rental income, dividends, interest, and more. Under the Receipts section, individuals may also need to list other types of income they have received that isn't covered in the standard account format. These additional sources of income can vary greatly and include alimony, capital gains, prizes, or any other form of taxable income not covered elsewhere. Moreover, the Schedule A form also prompts taxpayers to report various deductible expenses they may have incurred throughout the year. These expenses typically fall into categories such as medical and dental expenses, state and local taxes paid, mortgage interest, charitable contributions, and more. By listing these deductions, individuals can potentially reduce their overall tax liability and claim tax benefits. It's important to note that there might be different variants of the Thousand Oaks California Schedule A, Receipts, Other Receipts-Standard Account based on specific circumstances or taxpayer categories. For instance, self-employed individuals usually have additional sections to report business-related income and expenses. To ensure accurate reporting and compliance with tax regulations, it is crucial for taxpayers in Thousand Oaks, California, to carefully review the instructions provided for each section of the Schedule A form. Additionally, it is advisable to seek professional help from certified tax preparers or accountants to accurately complete the form, especially if there are multiple sources of income or complex deductions involved.