This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

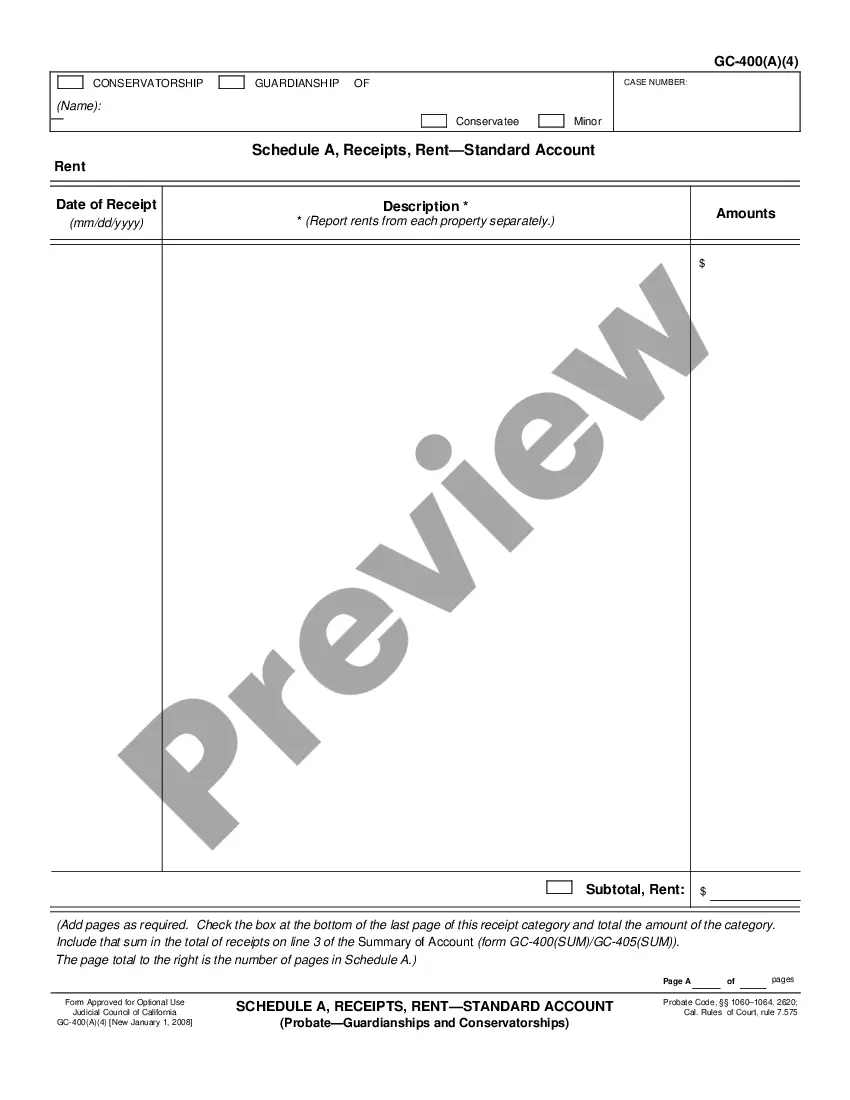

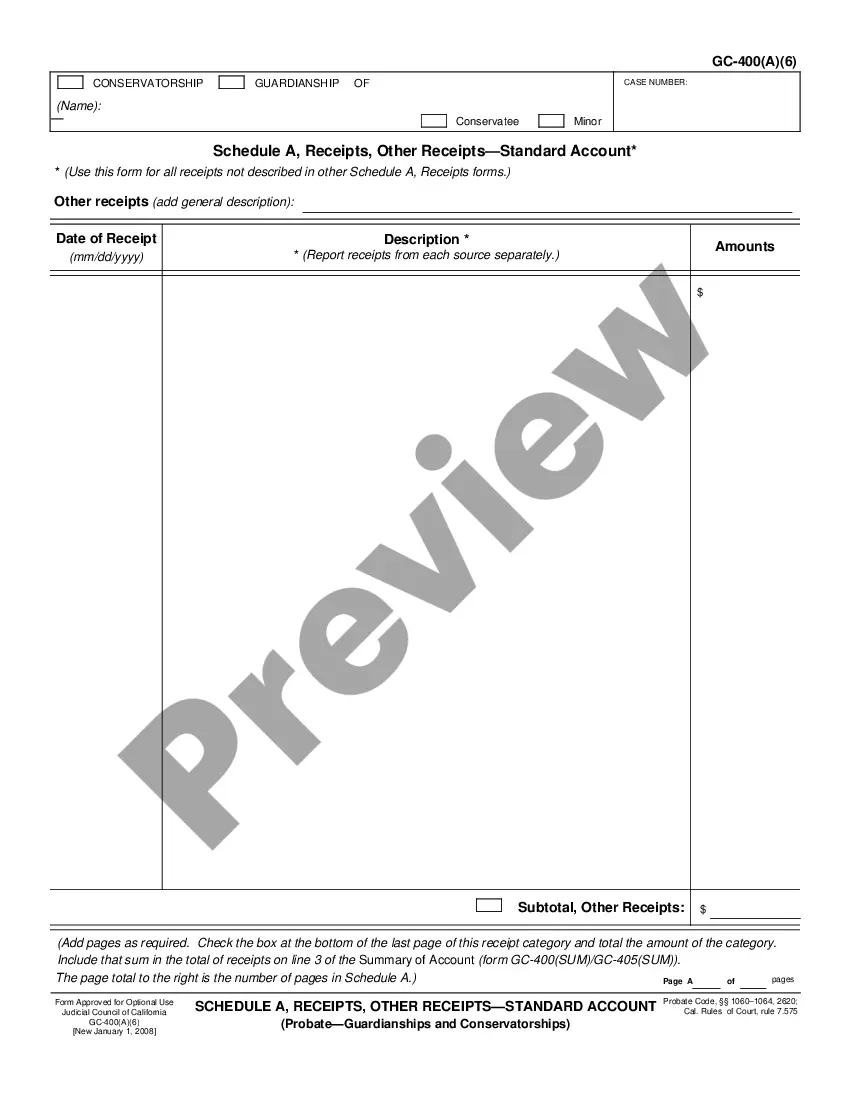

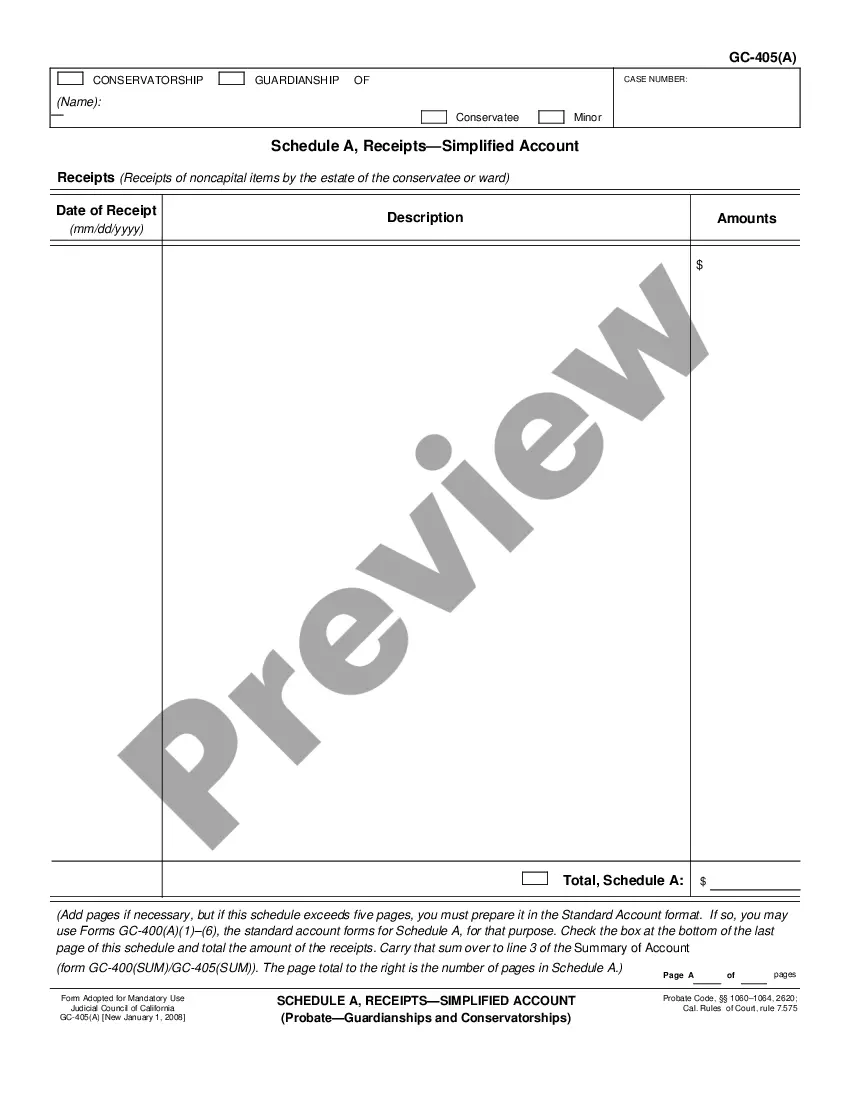

Jurupa Valley California Schedule A and C, Receipts and Disbursements Worksheet-Standard Account

Description

How to fill out California Schedule A And C, Receipts And Disbursements Worksheet-Standard Account?

If you’ve previously utilized our service, Log In to your account and store the Jurupa Valley California Schedule A and C, Receipts and Disbursements Worksheet-Standard Account on your device by clicking the Download button. Ensure that your subscription is active. If not, renew it based on your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your file.

You have continuous access to every document you have purchased: you can find it in your profile under the My documents menu whenever you wish to reuse it. Utilize the US Legal Forms service to swiftly locate and store any template for your personal or business needs!

- Ensure you’ve found an appropriate document. Review the description and use the Preview function, if accessible, to verify if it fulfills your requirements. If it does not meet your expectations, use the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process a payment. Provide your credit card information or utilize the PayPal option to finalize the purchase.

- Obtain your Jurupa Valley California Schedule A and C, Receipts and Disbursements Worksheet-Standard Account. Select the file format for your document and save it to your device.

- Finalize your template. Print it or use professional online editors to complete it and sign it electronically.

Form popularity

FAQ

The additional standard deduction for someone who is 65 or older will rise to $1,500 per person from $1,400 in 2022; if that senior is unmarried, the additional deduction will be $1,850 in 2023, up from $1,750.

All tax filers can claim this deduction unless they choose to itemize their deductions. For the 2022 tax year, the standard deduction is $12,950 for single filers, $25,900 for joint filers and $19,400 for heads of household. The deduction amount also increases slightly each year to keep up with inflation.

2021 Standard deduction amounts Filing statusEnter on line 18 of your 540Single or married/Registered Domestic Partner (RDP) filing separately$4,803Married/RDP filing jointly, head of household, or qualifying widow(er)$9,606

The standard deduction for Single and Married with 0 or 1 allowance has changed from $4,601 to $4,803. The standard deduction for Married with 2 or more allowances and Head of Household has changed from $9,202 to $9,606.

For single taxpayers and married individuals filing separately, the standard deduction rises to $12,950 for 2022, up $400, and for heads of households, the standard deduction will be $19,400 for tax year 2022, up $600.

Standard Deduction for Seniors ? If you do not itemize your deductions, you can get a higher standard deduction amount if you and/or your spouse are 65 years old or older. You can get an even higher standard deduction amount if either you or your spouse is blind. (See Form 1040 and Form 1040-SR instructionsPDF.)

If you purchase from a seller who does not hold a California seller's permit and did not pay tax on the purchase of a vehicle, vessel, aircraft, or mobile-home, you may be required to report use tax directly to the CDTFA.

Customs Pre-Notification Letter (CDTFA-400-USC) We received information from U.S. Customs and Border Protection (CBP) indicating that you imported items into California for storage, use, or other consumption in this state during the previous calendar year which may require you to pay use tax.

Not Eligible for the Standard Deduction An individual who files a return for a period of less than 12 months due to a change in his or her annual accounting period. An estate or trust, common trust fund, or partnership.