This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

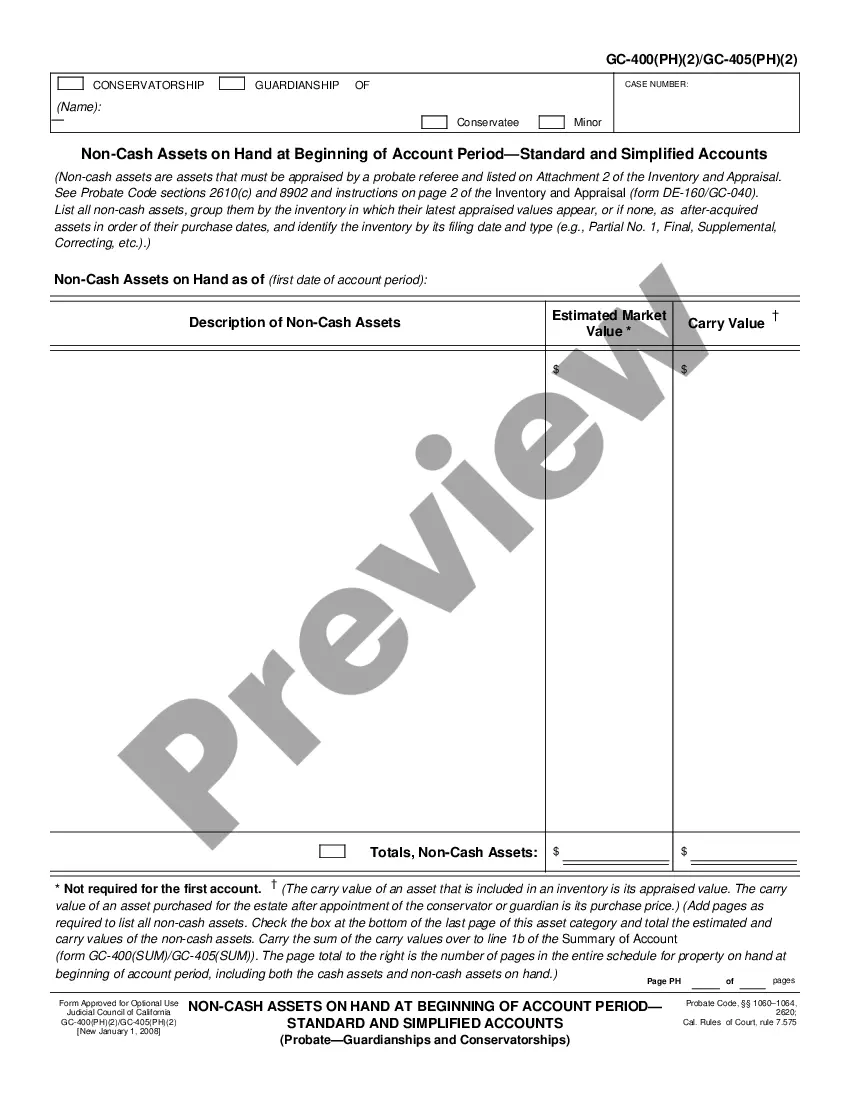

Sacramento California Schedule A and C, Receipts and Disbursements Worksheet-Standard Account refers to a financial reporting document used by businesses, organizations, and individuals in the Sacramento region to track and manage their income, expenses, receipts, and disbursements. These worksheets are specifically designed to comply with the accounting standards and tax regulations in California. Here are the different types of Sacramento California Schedule A and C, Receipts and Disbursements Worksheet-Standard Account: 1. Schedule A: This form focuses on recording and categorizing all the income sources received by the entity or individual throughout the specified reporting period. It includes details about revenue earned from various activities, such as sales, services, investments, rentals, royalties, and any other sources of income. Schedule A helps in understanding the overall financial inflow and helps in accurate tax calculation. 2. Schedule C: This form is dedicated to tracking and classifying all the expenses incurred by the business or individual during the reporting period. It covers both direct and indirect expenses, including supplies, salaries, rent, utilities, maintenance, advertising, and other costs related to the day-to-day operations. Schedule C is highly valuable in determining the net profit or loss and provides essential information for tax purposes. 3. Receipts and Disbursements Worksheet: This worksheet is an integral part of the standard account and serves as an insightful tool for recording and organizing financial transactions. It enables accurate tracking of daily income receipts and expenditure disbursements. The worksheet captures detailed information about each transaction, including the date, description, amount, payment method, and relevant account classification. It provides a comprehensive overview of financial activities and assists in reconciling statements and identifying potential discrepancies. 4. Standard Account: The Standard Account represents a standardized format for maintaining financial records using the Sacramento California Schedule A and C, Receipts and Disbursements Worksheet. This form ensures consistent data organization and simplifies the accounting process. By using the Standard Account, businesses and individuals can easily prepare their financial statements, calculate taxable income, and fulfill their tax reporting obligations efficiently. In conclusion, Sacramento California Schedule A and C, Receipts and Disbursements Worksheet-Standard Account are essential financial tools that aid in keeping accurate records of income, expenses, receipts, and disbursements for businesses and individuals in the region. They enable efficient tax calculation and ensure compliance with California accounting standards. Proper utilization of these worksheets streamlines financial reporting and enhances overall financial management.