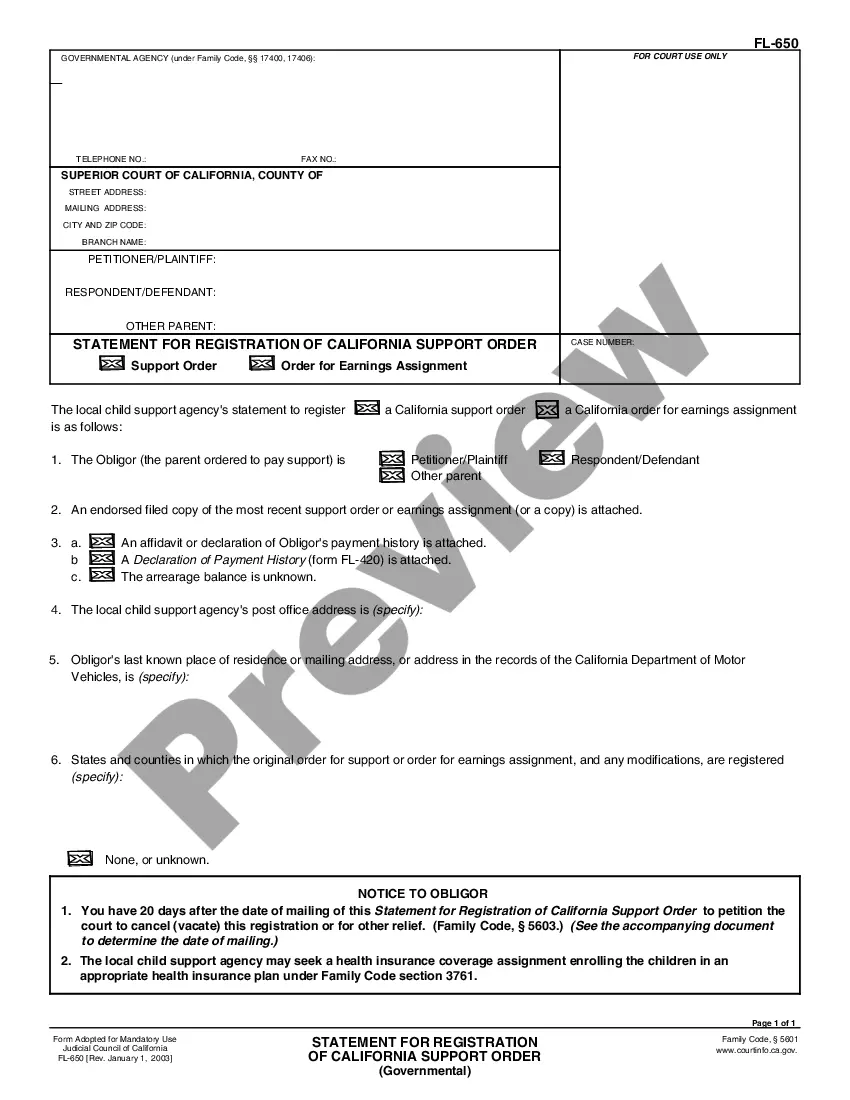

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Burbank California Schedule B, Gains on Sales-Standard and Simplified Accounts is a financial document used by individuals and businesses to report gains on the sale of assets in Burbank, California. It plays a crucial role in recording and documenting taxable gains for accurate assessment of income taxes. This schedule is an integral part of the overall tax filing process and is completed alongside the main tax return. There are two types of Schedule B for reporting gains on sales in Burbank, California: Standard Accounts and Simplified Accounts. These variations cater to the unique needs and circumstances of different taxpayers. 1. Standard Accounts: This version of Schedule B is designed for individuals or businesses with complex financial transactions. It requires more comprehensive reporting, including a detailed breakdown of each transaction and associated gains. Standard Accounts provide a more thorough picture of the taxpayer's financial activities, allowing for precise analysis and calculation of taxable gains. 2. Simplified Accounts: This version of Schedule B is intended for individuals or businesses with relatively simpler financial transactions. It offers a streamlined approach, simplifying the reporting process by allowing consolidated entries. It requires less detailed information compared to the Standard Accounts, which can be suitable for individuals with relatively fewer sales or assets. Both versions of Burbank California Schedule B aim to accurately report gains on sales by considering the purchase price, sale price, associated expenses, and holding period of the assets. They assist in determining the applicable tax rate and ensure compliance with tax regulations in Burbank, California. Some relevant keywords associated with Burbank California Schedule B, Gains on Sales-Standard and Simplified Accounts include: tax filing, taxable gains, financial transactions, asset sales, income taxes, tax assessment, Standard Accounts, Simplified Accounts, reporting process, tax regulations, tax compliance, purchase price, sale price, holding period, tax rate, financial documentation, accurate assessment.Burbank California Schedule B, Gains on Sales-Standard and Simplified Accounts is a financial document used by individuals and businesses to report gains on the sale of assets in Burbank, California. It plays a crucial role in recording and documenting taxable gains for accurate assessment of income taxes. This schedule is an integral part of the overall tax filing process and is completed alongside the main tax return. There are two types of Schedule B for reporting gains on sales in Burbank, California: Standard Accounts and Simplified Accounts. These variations cater to the unique needs and circumstances of different taxpayers. 1. Standard Accounts: This version of Schedule B is designed for individuals or businesses with complex financial transactions. It requires more comprehensive reporting, including a detailed breakdown of each transaction and associated gains. Standard Accounts provide a more thorough picture of the taxpayer's financial activities, allowing for precise analysis and calculation of taxable gains. 2. Simplified Accounts: This version of Schedule B is intended for individuals or businesses with relatively simpler financial transactions. It offers a streamlined approach, simplifying the reporting process by allowing consolidated entries. It requires less detailed information compared to the Standard Accounts, which can be suitable for individuals with relatively fewer sales or assets. Both versions of Burbank California Schedule B aim to accurately report gains on sales by considering the purchase price, sale price, associated expenses, and holding period of the assets. They assist in determining the applicable tax rate and ensure compliance with tax regulations in Burbank, California. Some relevant keywords associated with Burbank California Schedule B, Gains on Sales-Standard and Simplified Accounts include: tax filing, taxable gains, financial transactions, asset sales, income taxes, tax assessment, Standard Accounts, Simplified Accounts, reporting process, tax regulations, tax compliance, purchase price, sale price, holding period, tax rate, financial documentation, accurate assessment.