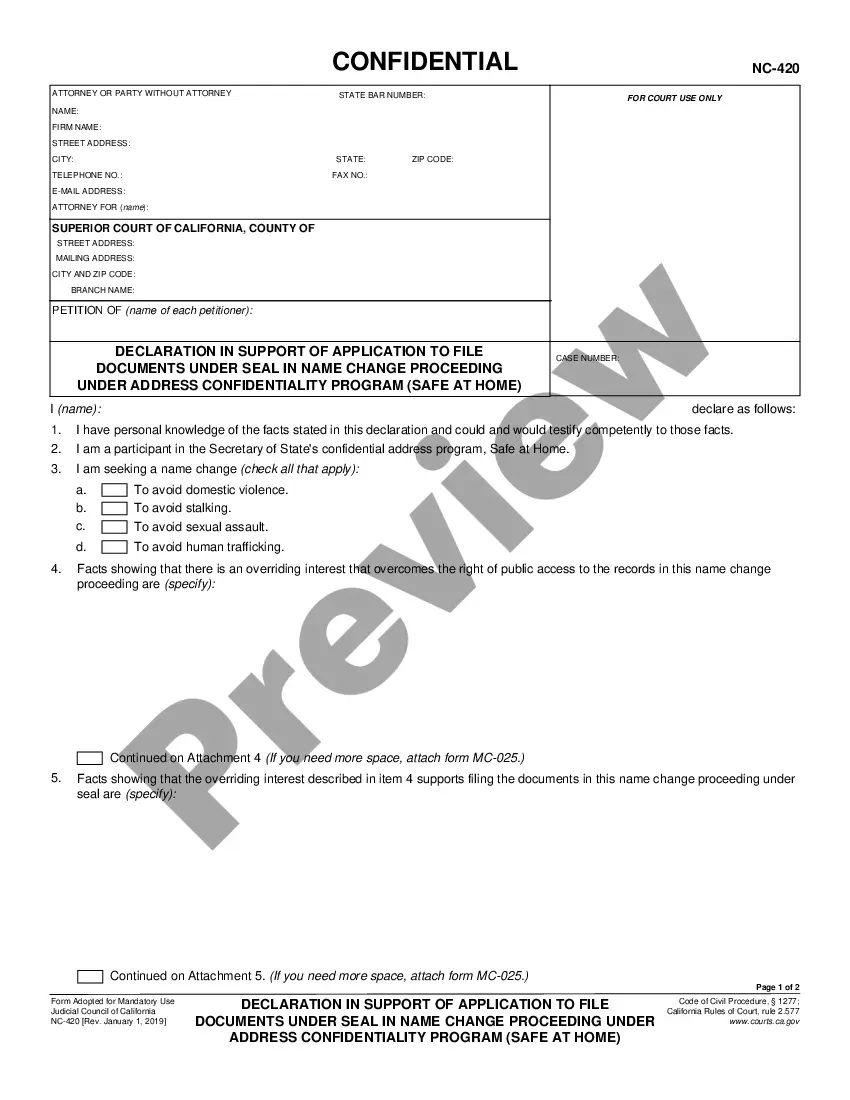

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Sunnyvale California Schedule B, Gains on Sales-Standard and Simplified Accounts, is a financial form utilized by businesses and individuals in Sunnyvale, California, to report their gains on sales for both standard and simplified accounts. This schedule is an essential part of the annual tax return filing process, enabling taxpayers to accurately report their financial gains made through the sales of assets, stocks, or other valuable properties. The main purpose of Schedule B is to provide the Internal Revenue Service (IRS) with a breakdown of these gains, helping to determine the taxable income and the appropriate tax liability. The Standard account and Simplified account variations of Sunnyvale California Schedule B serve a similar purpose but differ in complexity and reporting requirements. The Standard account version is suitable for taxpayers with more complex financial transactions and larger volumes of sales, requiring a more detailed breakdown of the gains. It necessitates reporting each sale individually, providing comprehensive information such as the sale date, description of the asset sold, purchase price, sales price, and the resulting gain or loss from the transaction. Taxpayers may need to attach additional supporting documents, such as sales contracts or transaction receipts, to substantiate their reported gains accurately. On the other hand, the Simplified account version of Sunnyvale California Schedule B is designed for taxpayers with fewer sales and straightforward financial transactions. This option allows for a more condensed reporting format, enabling taxpayers to aggregate their sales gains and report them in a summarized manner. While the Simplified account version may require less detailed information for each individual sale, it is still important to accurately calculate and report the total gains achieved during the tax year. When filling out Sunnyvale California Schedule B, it is crucial to include all relevant information and adhere to the specific instructions provided by the IRS. Moreover, accuracy is paramount to avoid potential audit triggers or penalties. Taxpayers should gather all necessary documentation, such as brokerage statements, asset purchase details, and sales records, to ensure the completeness and accuracy of their Schedule B submission. In summary, Sunnyvale California Schedule B, Gains on Sales-Standard and Simplified Accounts, is a crucial financial reporting form used by taxpayers in Sunnyvale, California, to report gains made on sales of various assets. The Standard account version requires detailed reporting of each individual sale, while the Simplified account version allows for aggregated reporting. Adhering to the specific instructions and maintaining accuracy when filling out this form is essential to meet tax obligations and avoid potential repercussions.

Sunnyvale California Schedule B, Gains on Sales-Standard and Simplified Accounts, is a financial form utilized by businesses and individuals in Sunnyvale, California, to report their gains on sales for both standard and simplified accounts. This schedule is an essential part of the annual tax return filing process, enabling taxpayers to accurately report their financial gains made through the sales of assets, stocks, or other valuable properties. The main purpose of Schedule B is to provide the Internal Revenue Service (IRS) with a breakdown of these gains, helping to determine the taxable income and the appropriate tax liability. The Standard account and Simplified account variations of Sunnyvale California Schedule B serve a similar purpose but differ in complexity and reporting requirements. The Standard account version is suitable for taxpayers with more complex financial transactions and larger volumes of sales, requiring a more detailed breakdown of the gains. It necessitates reporting each sale individually, providing comprehensive information such as the sale date, description of the asset sold, purchase price, sales price, and the resulting gain or loss from the transaction. Taxpayers may need to attach additional supporting documents, such as sales contracts or transaction receipts, to substantiate their reported gains accurately. On the other hand, the Simplified account version of Sunnyvale California Schedule B is designed for taxpayers with fewer sales and straightforward financial transactions. This option allows for a more condensed reporting format, enabling taxpayers to aggregate their sales gains and report them in a summarized manner. While the Simplified account version may require less detailed information for each individual sale, it is still important to accurately calculate and report the total gains achieved during the tax year. When filling out Sunnyvale California Schedule B, it is crucial to include all relevant information and adhere to the specific instructions provided by the IRS. Moreover, accuracy is paramount to avoid potential audit triggers or penalties. Taxpayers should gather all necessary documentation, such as brokerage statements, asset purchase details, and sales records, to ensure the completeness and accuracy of their Schedule B submission. In summary, Sunnyvale California Schedule B, Gains on Sales-Standard and Simplified Accounts, is a crucial financial reporting form used by taxpayers in Sunnyvale, California, to report gains made on sales of various assets. The Standard account version requires detailed reporting of each individual sale, while the Simplified account version allows for aggregated reporting. Adhering to the specific instructions and maintaining accuracy when filling out this form is essential to meet tax obligations and avoid potential repercussions.