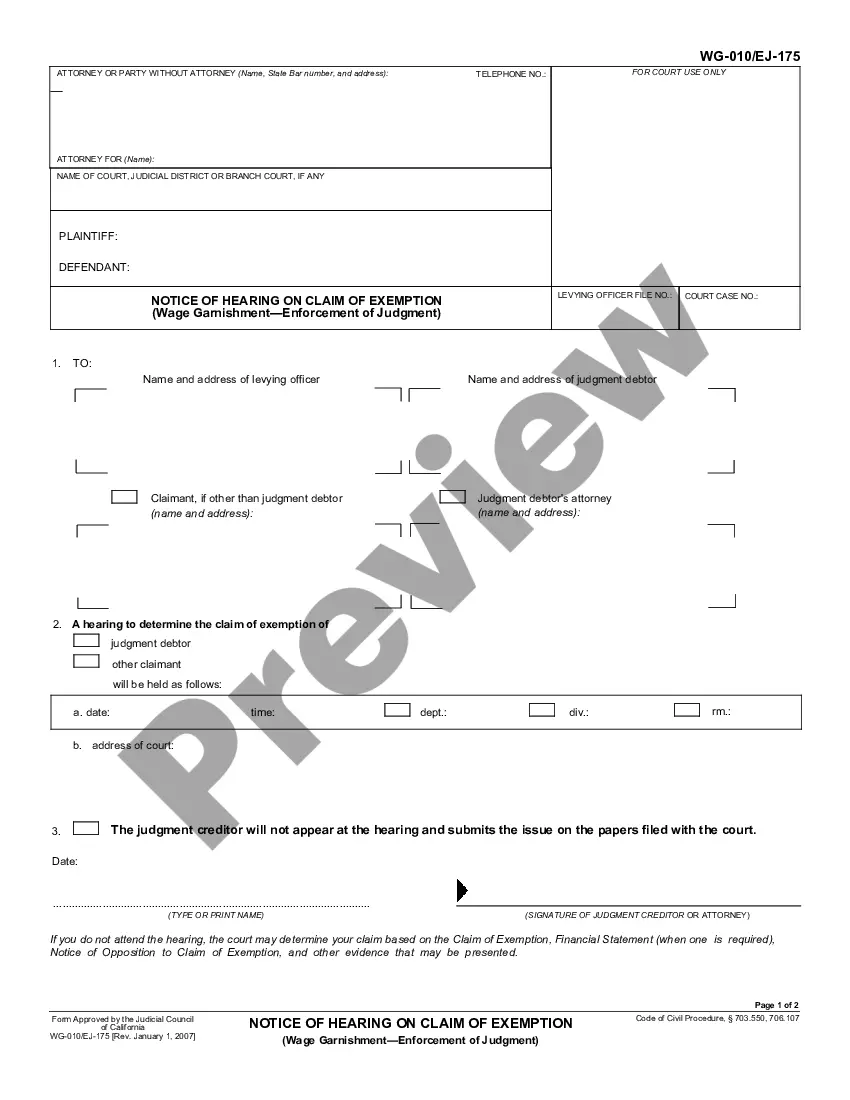

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Victorville, California Schedule B, Gains on Sales-Standard and Simplified Accounts is a tax document that individuals and businesses in the city of Victorville need to file in order to report their gains on sales. This detailed description will provide an overview of the purpose, requirements, and types of Schedule B, Gains on Sales-Standard and Simplified Accounts applicable to Victorville, California. Schedule B serves as an integral part of the tax filing process, used to report capital gains or losses from the sale of assets, investments, or properties. It helps the Internal Revenue Service (IRS) determine the tax liability of the taxpayer based on the gains earned during a given tax year. Residents or businesses in Victorville, California falling within the specified criteria must file Schedule B to account for their gains on sales. This includes selling stocks, mutual funds, bonds, real estate, vehicles, collectibles, and other investments that result in a profit. There are two main types of Victorville, California Schedule B, Gains on Sales-Standard and Simplified Accounts: 1. Standard Schedule B: — The standard version of Schedule B entails providing a detailed breakdown of each transaction that generated a gain or loss. This involves reporting the sale date, description of the asset, purchase price, selling price, and the resulting gain or loss. — Taxpayers must carefully and accurately fill out all the necessary information related to their gains or losses, ensuring that each transaction is individually accounted for. 2. Simplified Schedule B: — The simplified version of Schedule B is applicable for individuals or businesses with a limited number of transactions generating gains or losses. — Taxpayers can utilize the simplified version if they have a maximum of three transactions and a total sales gain or loss of $1,500 or less. — The simplified version provides a condensed format for reporting gains or losses, requiring only the total sales amount and the combined gains or losses realized. It is important for individuals and businesses in Victorville, California to understand the specific guidelines and requirements surrounding Schedule B to accurately report their gains on sales and avoid any potential tax penalties. Failing to report gains can result in inaccurate tax assessments, leading to potential audits or legal consequences. In conclusion, Victorville, California Schedule B, Gains on Sales-Standard and Simplified Accounts are essential tax forms that must be completed by residents and businesses to report their gains on sales. The two types of Schedule B, standard and simplified, cater to varying transaction volumes and allow taxpayers to accurately report and calculate their gains or losses according to the IRS guidelines.

Victorville, California Schedule B, Gains on Sales-Standard and Simplified Accounts is a tax document that individuals and businesses in the city of Victorville need to file in order to report their gains on sales. This detailed description will provide an overview of the purpose, requirements, and types of Schedule B, Gains on Sales-Standard and Simplified Accounts applicable to Victorville, California. Schedule B serves as an integral part of the tax filing process, used to report capital gains or losses from the sale of assets, investments, or properties. It helps the Internal Revenue Service (IRS) determine the tax liability of the taxpayer based on the gains earned during a given tax year. Residents or businesses in Victorville, California falling within the specified criteria must file Schedule B to account for their gains on sales. This includes selling stocks, mutual funds, bonds, real estate, vehicles, collectibles, and other investments that result in a profit. There are two main types of Victorville, California Schedule B, Gains on Sales-Standard and Simplified Accounts: 1. Standard Schedule B: — The standard version of Schedule B entails providing a detailed breakdown of each transaction that generated a gain or loss. This involves reporting the sale date, description of the asset, purchase price, selling price, and the resulting gain or loss. — Taxpayers must carefully and accurately fill out all the necessary information related to their gains or losses, ensuring that each transaction is individually accounted for. 2. Simplified Schedule B: — The simplified version of Schedule B is applicable for individuals or businesses with a limited number of transactions generating gains or losses. — Taxpayers can utilize the simplified version if they have a maximum of three transactions and a total sales gain or loss of $1,500 or less. — The simplified version provides a condensed format for reporting gains or losses, requiring only the total sales amount and the combined gains or losses realized. It is important for individuals and businesses in Victorville, California to understand the specific guidelines and requirements surrounding Schedule B to accurately report their gains on sales and avoid any potential tax penalties. Failing to report gains can result in inaccurate tax assessments, leading to potential audits or legal consequences. In conclusion, Victorville, California Schedule B, Gains on Sales-Standard and Simplified Accounts are essential tax forms that must be completed by residents and businesses to report their gains on sales. The two types of Schedule B, standard and simplified, cater to varying transaction volumes and allow taxpayers to accurately report and calculate their gains or losses according to the IRS guidelines.