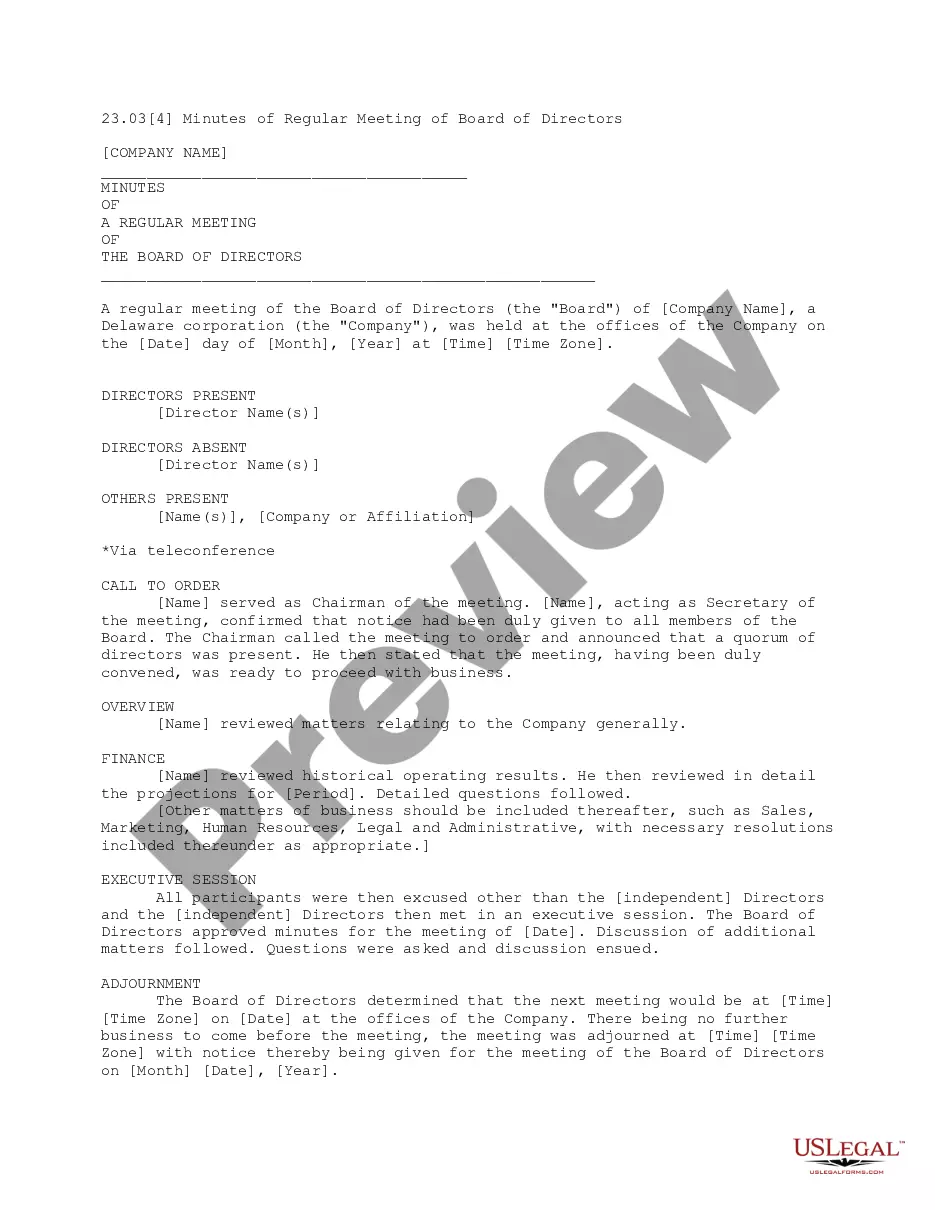

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Visalia California Schedule B is a form that individuals and businesses in Visalia, California need to fill out in order to report gains on sales. This form is used to report any profit made from the sale of assets, such as stocks, real estate, or business assets. The Schedule B, Gains on Sales-Standard and Simplified Accounts, includes two types: the standard and simplified accounts. The standard account of Visalia California Schedule B is a more comprehensive option, where detailed information about the sale transactions is required. It includes detailed records of the assets sold, the cost basis, date of acquisition, and the sale price. This type of account is recommended for individuals or businesses with complex sales transactions, multiple assets sold, or those who need to report capital gains from investments. On the other hand, the simplified account is designed for individuals or businesses with simpler sales transactions or those who want to save time while reporting gains on sales. This simplified option requires less detailed information, such as a summary of total gains or losses from sales transactions, without the need for individual asset-specific details. This option is ideal for those who have straightforward sales transactions or want to avoid the hassle of providing detailed information for each sale. Filing Visalia California Schedule B is crucial as it ensures compliance with the tax laws of the state and enables individuals or businesses to accurately report their gains on sales. It is important to carefully review the instructions provided with the form to ensure accurate reporting and to avoid any potential penalties or audits. Keywords: Visalia California, Schedule B, gains on sales, standard account, simplified account, assets, stocks, real estate, business assets, profit, Form, transactions, cost basis, date of acquisition, sale price, capital gains, investments, compliance, tax laws, accurate reporting, penalties, audits.