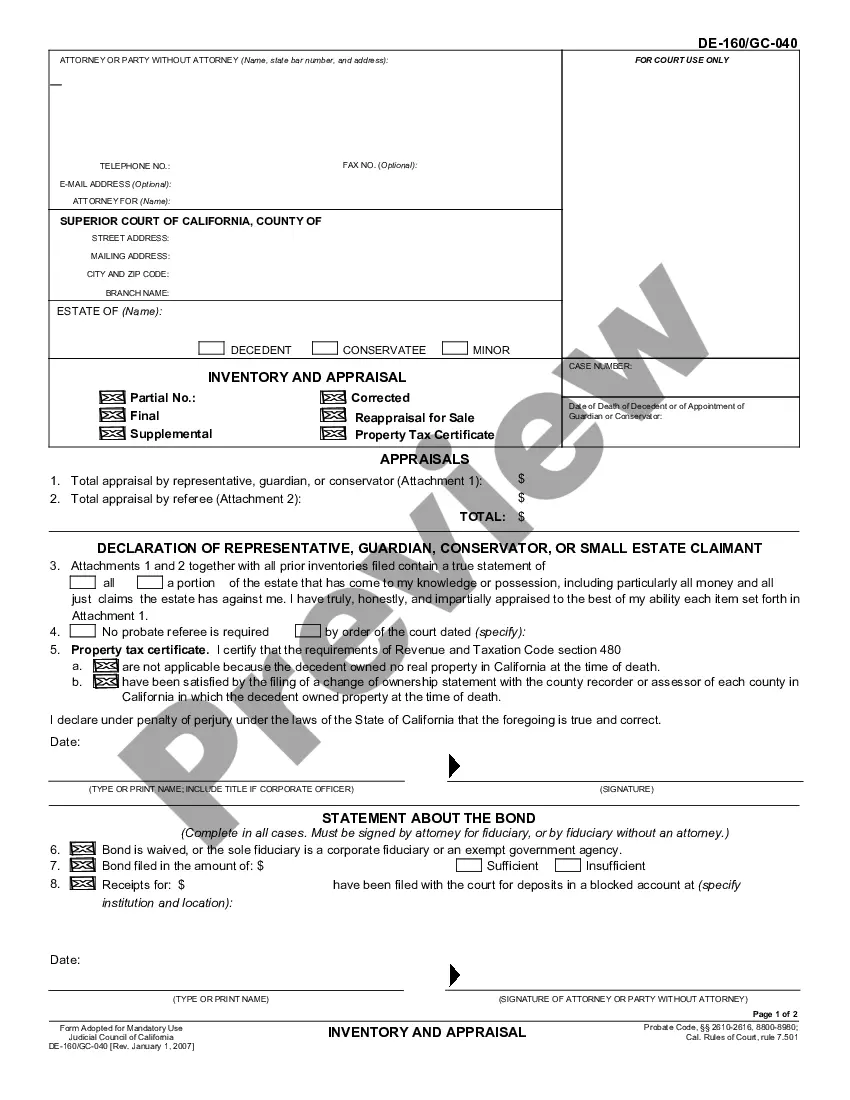

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Murrieta California Schedule C, Disbursements, Conservative's Caregiver Expenses — Standard Account is a specific financial document used in the accounting and reporting process for conservatorship cases in Murrieta, California. This schedule focuses on recording and tracking the various disbursements and expenses related to the care and support of a conservative's caregiver. In Murrieta, California, there are different types of Murrieta California Schedule C, Disbursements, Conservative's Caregiver Expenses — Standard Account, including: 1. Regular Caregiver Expenses: This category covers the typical expenses incurred by the conservator for the caregiver's services. It includes a breakdown of wages, taxes, health insurance, and other benefits provided to the caregiver. These expenses aim to ensure that the caregiver is adequately compensated for their services. 2. Transportation Expenses: This type of expense covers the costs associated with transporting the conservative's caregiver to and from the conservative's residence. It may include gas, mileage, public transportation fares, or any other transportation-related costs incurred during caregiving activities. 3. Training and Education Expenses: This category comprises expenses related to the caregiver's training and education to enhance their skills and knowledge in providing quality care to the conservative. It may include the cost of attending workshops, seminars, or specialized training courses directly relevant to the caregiver's role and responsibilities. 4. Medical Expenses: In some cases, the caregiver may be required to provide medical assistance or perform medical tasks under the supervision of a medical professional. This includes expenses related to medical training or certifications necessary for the caregiver to perform these tasks appropriately. 5. Respite Care Expenses: Respite care refers to temporary relief provided to the caregiver, allowing them to have a break or attend to personal matters while another qualified individual takes over caregiving responsibilities. This category covers the expenses associated with arranging and compensating respite care providers. 6. Administrative Expenses: Administrative expenses include costs related to record-keeping, documentation, and other administrative tasks associated with managing the caregiver's compensation and the conservative's overall financial affairs. This could include expenses for accounting software, legal fees, or consultations related to caregiver compensation. It is important for conservators and caregivers in Murrieta, California, to accurately maintain and report the disbursements and expenses using Murrieta California Schedule C, Disbursements, Conservative's Caregiver Expenses — Standard Account. This document helps ensure transparency, compliance, and proper financial management in conservatorship cases.