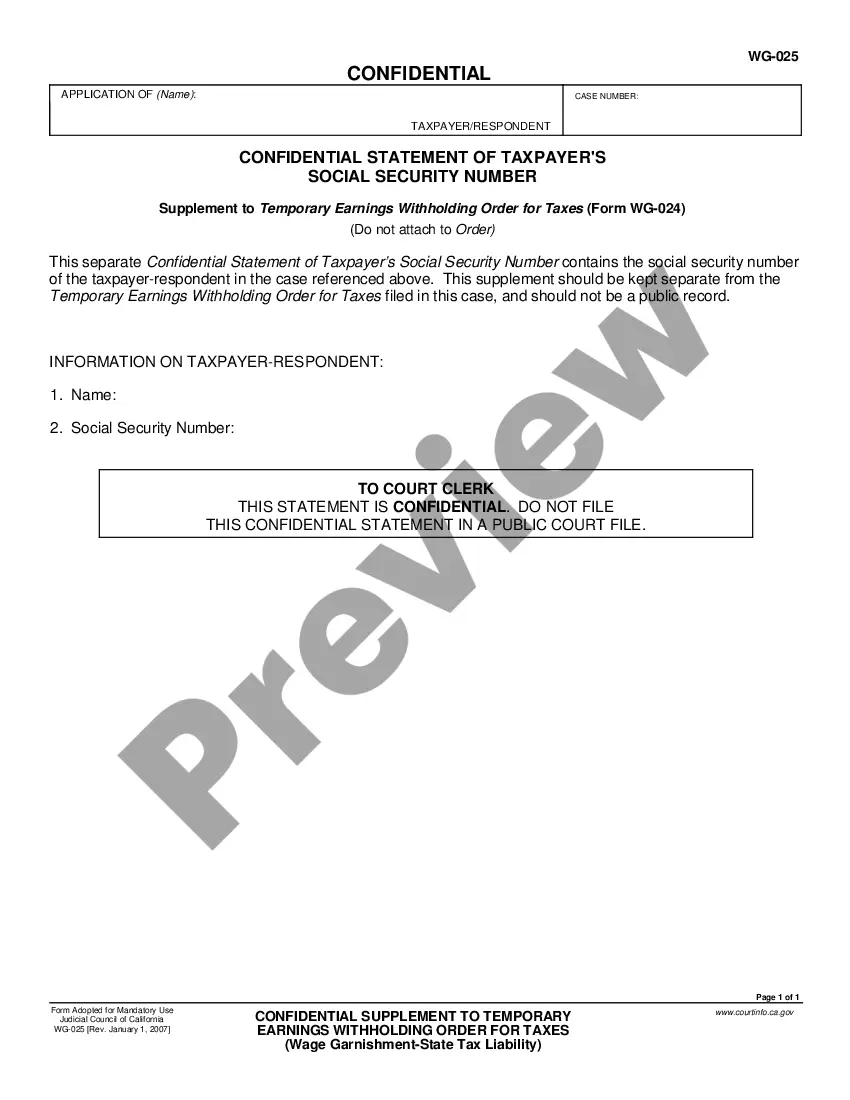

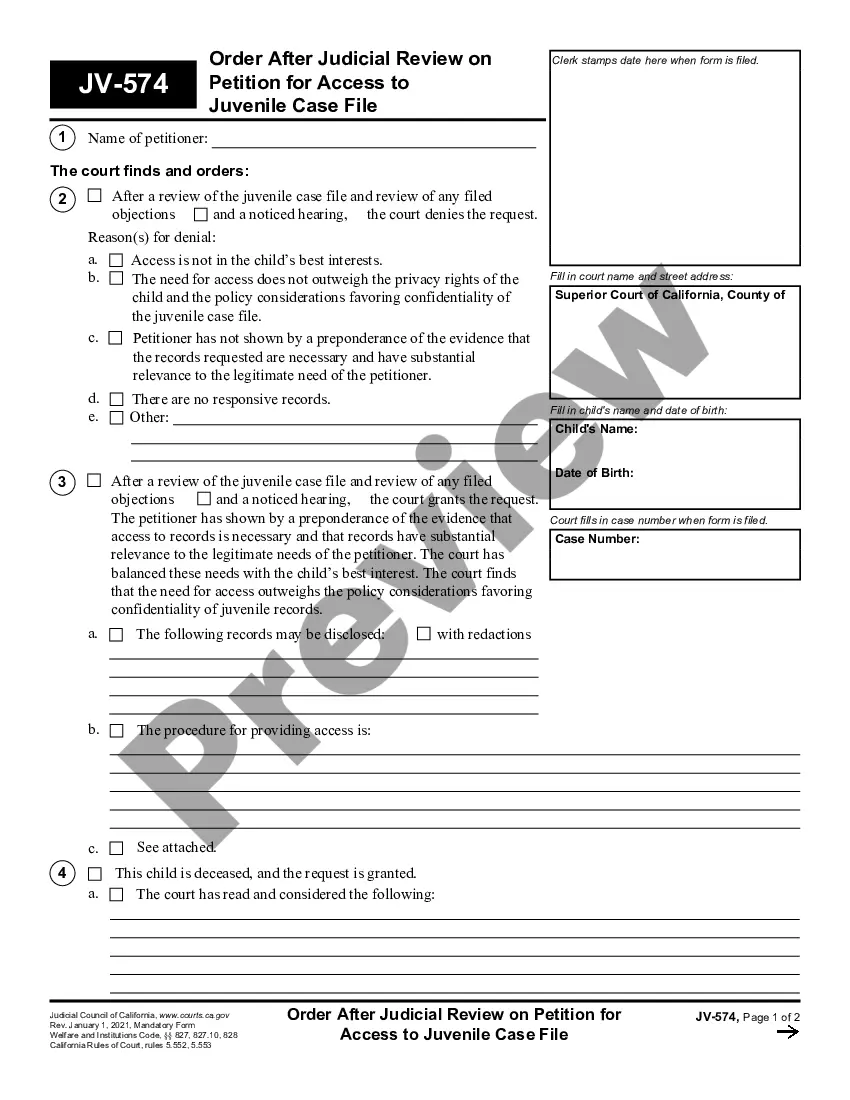

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Anaheim California Schedule C, Disbursements, Rental Property Expenses — Standard Account is a crucial document and accounting tool used by property owners and real estate investors in Anaheim, California. This schedule helps individuals track their rental property income, disbursements, and various expenses associated with maintaining and managing the property. It is an essential part of ensuring accurate tax reporting and maximizing deductions. The primary purpose of Anaheim California Schedule C for rental properties is to calculate the net profit or loss generated by the property. To complete this schedule, property owners need to categorize their disbursements and rental property expenses accurately. By doing so, they can reduce their taxable income and potentially improve their overall return on investment. Here are some key disbursements and rental property expenses that may be included in Anaheim California Schedule C: 1. Mortgage Interest: This expense refers to the interest paid on the loan obtained to purchase or finance the rental property. 2. Property Taxes: This category includes the annual tax payments made to the local government for owning and operating the property. 3. Repairs and Maintenance: Expenses related to repairing and maintaining the rental property, such as fixing plumbing issues, electrical problems, or repainting. 4. Utilities: Costs associated with utilities, including water, electricity, heating, and any other necessary services for the rental property. 5. Insurance: Insurance premiums paid for insuring the rental property against potential risks and damages, such as fire, theft, or liability. 6. Property Management Fees: If property owners hire a professional property management company to handle day-to-day operations, these fees should be recorded as a deduction. 7. Advertising and Marketing: Expenses incurred for advertising the rental property to find suitable tenants, such as online listings, signage, or print advertisements. 8. Legal and Professional Services: Fees paid to attorneys, accountants, or other professionals who provide legal, financial, or tax advice specific to the rental property. 9. Office Supplies and Administrative Expenses: Costs associated with purchasing office supplies, software, or hiring administrative support to manage rental property documentation and record-keeping. 10. Travel Expenses: If property owners need to travel to the rental property for maintenance, inspections, or other property-related purposes, the incurred expenses such as fuel, accommodation, or meals can be claimed. These are just a few examples of possible disbursements and rental property expenses that can be included in Anaheim California Schedule C. It is important to note that the IRS provides guidelines and restrictions on each expense, and property owners should consult with a tax professional or refer to the IRS guidelines for accurate reporting. Different variations or types of Anaheim California Schedule C may exist based on the specific circumstances or complexities of the rental property. For instance, if the rental property operates as a vacation home, short-term rental, or if it is part of a multi-unit property, there could be additional regulations or expenses unique to those types of properties. To ensure compliance and accuracy in reporting expenses, property owners are advised to maintain thorough records, receipts, and invoices to substantiate their claims and deductions on Anaheim California Schedule C.