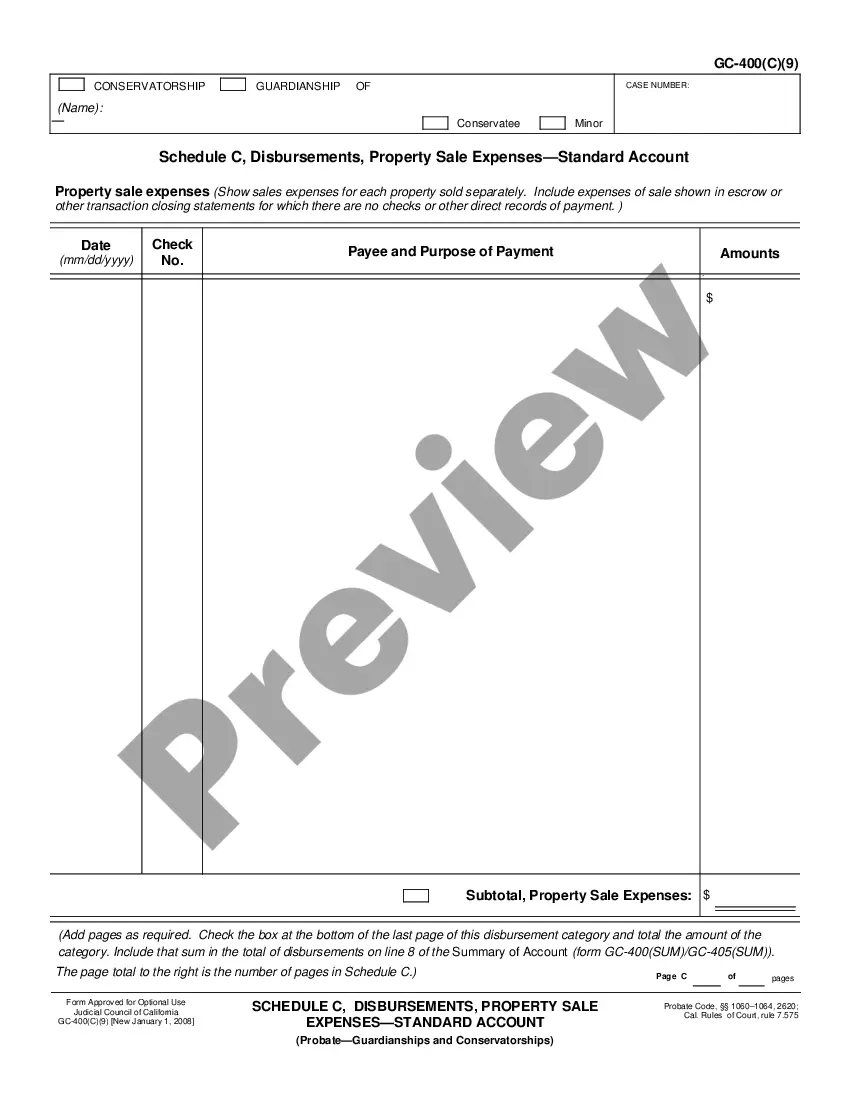

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Corona California Schedule C, Disbursements, Rental Property Expenses - Standard Account

Description

How to fill out California Schedule C, Disbursements, Rental Property Expenses - Standard Account?

If you have previously utilized our service, Log In to your account and store the Corona California Schedule C, Disbursements, Rental Property Expenses - Standard Account on your device by clicking the Download button. Ensure that your subscription is active. If it isn’t, renew it according to your payment plan.

If this is your first time using our service, follow these straightforward steps to acquire your document.

You have continuous access to each document you have purchased: you can find it in your profile under the My documents menu whenever you wish to reuse it. Take advantage of the US Legal Forms service to swiftly find and save any template for your personal or business requirements!

- Ensure you’ve found the correct document. Browse through the description and utilize the Preview feature, if available, to confirm it suits your requirements. If it does not meet your needs, use the Search tab above to find the suitable one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and submit a payment. Enter your credit card information or the PayPal option to finalize the transaction.

- Obtain your Corona California Schedule C, Disbursements, Rental Property Expenses - Standard Account. Select the file format for your document and save it to your device.

- Finalize your sample. Print it out or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

You can deduct rent on Schedule C in the section designated for business expenses. If you lease a property for your rental business, you can include those rental payments as a deduction in Corona, California. This deduction reduces your overall income on your tax return, allowing you to offset some of the costs associated with your operations. Utilizing platforms like US Legal Forms can provide support in understanding and managing these deductions.

Rental income can be considered operating income if derived from a business activity. For properties rented out as part of a business operation in Corona, California, this classification applies. Therefore, recognizing this type of income is essential for your financial reporting on Schedule C. It helps you take advantage of deductions and manage your tax responsibilities.

You can report rental income on Schedule C if your rental activity shows characteristics of a business. In Corona, California, this typically applies to short-term rentals or properties where you provide substantial services. Using Schedule C allows you to capture all related disbursements and rental property expenses effectively. It's important to understand these distinctions to ensure compliance.

Rental income may qualify for business income deduction, depending on its classification. In Corona, California, if your rental activity is treated as a business, you can deduct related expenses on Schedule C. This includes property management fees, repairs, and mortgage interest. This can significantly lower your taxable income and maximize your financial return.

Yes, you can claim rental income on Schedule C if you meet specific criteria. In Corona, California, rental activities that qualify as a business can be reported here. This allows you to deduct business-related expenses and accurately reflect your income to the IRS. Understanding how to navigate Schedule C for rental income is crucial for proper tax reporting.

Yes, Schedule C can be used for reporting income and expenses related to rental properties, particularly for those who are actively involved in managing their rentals. However, if your rental activities are passive, you may need to use a different form. Utilizing the Corona California Schedule C, Disbursements, Rental Property Expenses - Standard Account can provide clarity on your financial standing and maximize your deductions.

Schedule C requires you to report all income generated from your rental activities. This includes rent received, any service fees charged, and additional income like security deposits if they are not returned to the tenant. Reporting this income accurately on your Corona California Schedule C, Disbursements, Rental Property Expenses - Standard Account allows you to assess your net earnings effectively.

Documenting rental property expenses involves collecting and organizing receipts, invoices, and bank statements. You can create a dedicated file or digital folder to store all related documents, making it easier to track your expenses. This documentation streamlines your reporting process when filling out your Corona California Schedule C, Disbursements, Rental Property Expenses - Standard Account, ensuring you claim all eligible deductions.

To record rent expense for your rental property, begin by keeping a clear record of all payments made. Use a spreadsheet or accounting software to log each rent payment with the date, amount, and method of payment. Ensure to categorize these entries under 'Disbursements' related to your property, as this aligns with the requirements for a Corona California Schedule C, Disbursements, Rental Property Expenses - Standard Account.

You can deduct property taxes on Schedule C when the property is used in your business. This deduction is a standard mechanism for landlords to manage their tax liabilities effectively. Understanding how to report these taxes in the context of Corona California Schedule C, Disbursements, Rental Property Expenses - Standard Account can lead to substantial savings. Utilize uslegalforms tools and templates to streamline your deduction process.