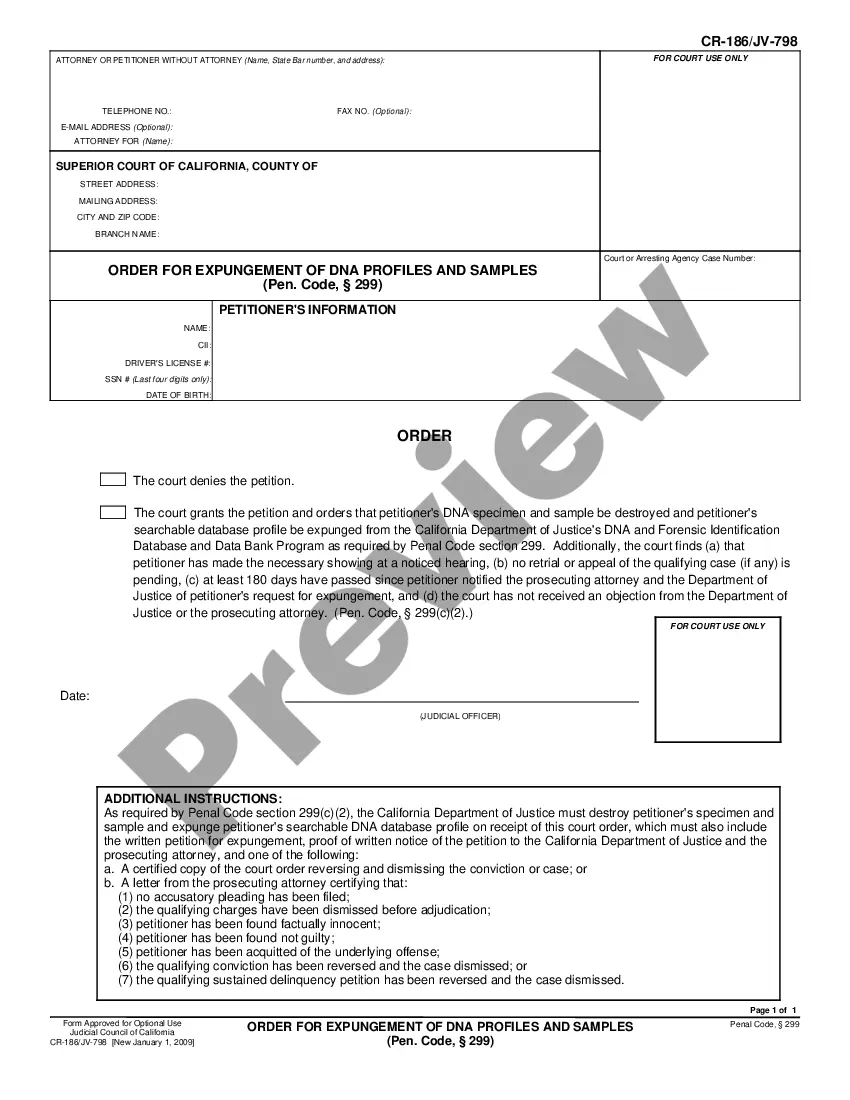

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Huntington Beach California Schedule C, Disbursements, Rental Property Expenses — Standard Account refers to a specific set of financial terms and categories related to managing rental properties in Huntington Beach, California. This schedule provides landlords with a structured breakdown of rental property expenses for tax, accounting, and record-keeping purposes. It helps ensure accurate reporting and documentation of various disbursements associated with managing rental units. Keywords: Huntington Beach California Schedule C, Disbursements, Rental Property Expenses, Standard Account, rental properties, tax reporting, accounting, record-keeping. Types of Huntington Beach California Schedule C, Disbursements, Rental Property Expenses — Standard Account: 1. Repairs and Maintenance: Under this category, landlords can include expenses related to repairing and maintaining their rental property. This may include costs for plumbing repairs, HVAC maintenance, electrical updates, painting, or any other necessary repairs to ensure the property's habitability. 2. Property Management Fees: If a landlord hires a property management company to oversee the rental property, the fees paid to them can be included as a disbursement. These fees cover services such as tenant screening, rent collection, property inspections, advertising, and general property management tasks. 3. Utilities: Expenses related to utilities provided by the landlord can be listed in this category. It includes payments made for water, gas, electric, and sewer services that are included in the property's rent or paid directly by the landlord. 4. Insurance Premiums: Landlords often incur expenses to secure insurance coverage for their rental properties. This category encompasses premiums paid for property insurance, liability insurance, or any other policies related to protecting the property and the landlord's interests. 5. Property Taxes: Property taxes levied by the local government on rental properties are considered a disbursement. Landlords can deduct the portion of property taxes attributable to their rental property from their taxable income. 6. Advertising and Marketing: When landlords advertise their rental properties to attract tenants, expenses associated with marketing efforts can be recorded here. This includes costs for online listings, professional photography, signage, and advertising in local publications. 7. Legal and Professional Fees: Any legal or professional fees incurred by landlords in relation to their rental properties can be included in this category. This might involve fees paid to attorneys for lease agreement drafting, eviction proceedings, or consultations with tax professionals or accountants. 8. HOA Fees: If the rental property is part of a homeowners' association (HOA), any fees paid to the HOA for maintenance, amenities, or community-related services can be included as a disbursement. It's important for landlords to consult with tax professionals or accountants who specialize in rental property management to ensure accurate categorization of expenses and adherence to applicable tax laws and regulations. Utilizing the correct Huntington Beach California Schedule C, Disbursements, Rental Property Expenses — Standard Account is crucial to maintain proper financial records and minimize tax liabilities.Huntington Beach California Schedule C, Disbursements, Rental Property Expenses — Standard Account refers to a specific set of financial terms and categories related to managing rental properties in Huntington Beach, California. This schedule provides landlords with a structured breakdown of rental property expenses for tax, accounting, and record-keeping purposes. It helps ensure accurate reporting and documentation of various disbursements associated with managing rental units. Keywords: Huntington Beach California Schedule C, Disbursements, Rental Property Expenses, Standard Account, rental properties, tax reporting, accounting, record-keeping. Types of Huntington Beach California Schedule C, Disbursements, Rental Property Expenses — Standard Account: 1. Repairs and Maintenance: Under this category, landlords can include expenses related to repairing and maintaining their rental property. This may include costs for plumbing repairs, HVAC maintenance, electrical updates, painting, or any other necessary repairs to ensure the property's habitability. 2. Property Management Fees: If a landlord hires a property management company to oversee the rental property, the fees paid to them can be included as a disbursement. These fees cover services such as tenant screening, rent collection, property inspections, advertising, and general property management tasks. 3. Utilities: Expenses related to utilities provided by the landlord can be listed in this category. It includes payments made for water, gas, electric, and sewer services that are included in the property's rent or paid directly by the landlord. 4. Insurance Premiums: Landlords often incur expenses to secure insurance coverage for their rental properties. This category encompasses premiums paid for property insurance, liability insurance, or any other policies related to protecting the property and the landlord's interests. 5. Property Taxes: Property taxes levied by the local government on rental properties are considered a disbursement. Landlords can deduct the portion of property taxes attributable to their rental property from their taxable income. 6. Advertising and Marketing: When landlords advertise their rental properties to attract tenants, expenses associated with marketing efforts can be recorded here. This includes costs for online listings, professional photography, signage, and advertising in local publications. 7. Legal and Professional Fees: Any legal or professional fees incurred by landlords in relation to their rental properties can be included in this category. This might involve fees paid to attorneys for lease agreement drafting, eviction proceedings, or consultations with tax professionals or accountants. 8. HOA Fees: If the rental property is part of a homeowners' association (HOA), any fees paid to the HOA for maintenance, amenities, or community-related services can be included as a disbursement. It's important for landlords to consult with tax professionals or accountants who specialize in rental property management to ensure accurate categorization of expenses and adherence to applicable tax laws and regulations. Utilizing the correct Huntington Beach California Schedule C, Disbursements, Rental Property Expenses — Standard Account is crucial to maintain proper financial records and minimize tax liabilities.