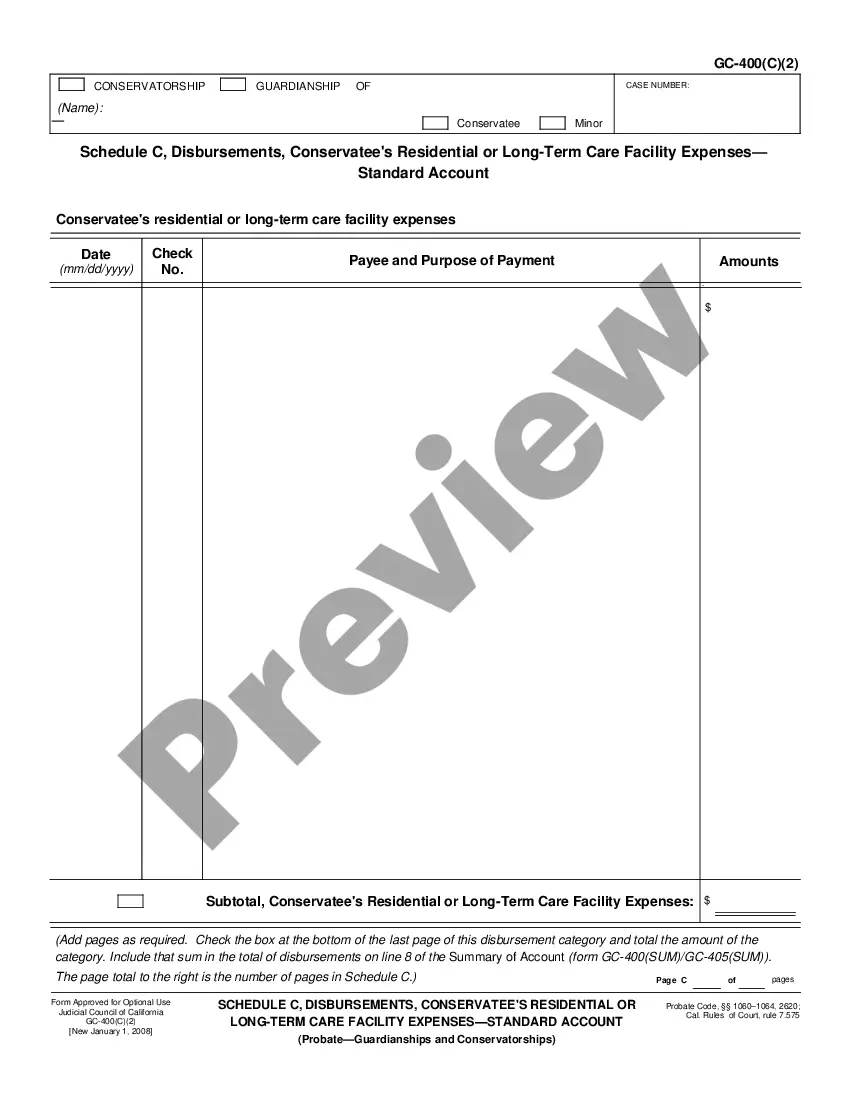

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Burbank California Schedule C, Disbursements, Other Expenses — Standard Account refers to a specific section of the financial record keeping for businesses in Burbank, California. Schedule C, also known as Form 1040, is a tax form used to report income or loss from a sole proprietorship or single-member LLC. In Burbank, California, businesses are required to carefully track and categorize their expenses in order to accurately complete their tax filings. The Disbursements section of Schedule C includes various expenses incurred during the normal course of business operations. These expenses may include but are not limited to: 1. Advertising expenses: This category covers costs related to promoting the business such as online advertising, print ads, billboard rentals, or sponsorship expenses. 2. Office supplies and equipment: Businesses often need to purchase supplies like paper, pens, ink cartridges, as well as larger office equipment like printers, computers, and furniture. 3. Rent and utilities: Burbank businesses may have expenditures related to renting office space, storefronts, or warehouses. Utilities such as electricity, water, internet, and phone bills also fall under this category. 4. Professional services: This category encompasses fees paid to lawyers, accountants, consultants, or other professionals for their expert advice or assistance. 5. Insurance premiums: Businesses may need to pay for various insurance policies, such as general liability insurance or workers' compensation coverage to protect themselves and their employees. 6. Travel and entertainment expenses: This category covers costs related to business trips, including airfare, accommodation, meals, and entertainment for clients or business partners. 7. Repairs and maintenance: Expenses incurred for repairs and maintenance of business assets, including vehicles, equipment, or premises, qualify under this category. 8. Licenses and permits: Businesses may need to obtain licenses or permits operating legally in Burbank, and the associated fees can be claimed as deductions. 9. Subscriptions and memberships: Costs associated with subscriptions to professional journals, industry associations, or memberships to business networking groups may be included in this category. 10. Other miscellaneous expenses: This catch-all category includes any other necessary business expenses not covered by the above categories, such as bank fees, postage, or shipping costs. It is important to note that while these expense categories are common, each business may have unique expenses that would fall into different categories based on their nature and industry. Different variations or additional types of Burbank California Schedule C, Disbursements, Other Expenses — Standard Account may not exist in terms of different form names, but the specific expenses claimed can differ depending on the nature of the business. It is crucial for business owners to consult with a tax professional or familiarize themselves with the IRS guidelines to ensure accurate reporting and deduction of expenses.Burbank California Schedule C, Disbursements, Other Expenses — Standard Account refers to a specific section of the financial record keeping for businesses in Burbank, California. Schedule C, also known as Form 1040, is a tax form used to report income or loss from a sole proprietorship or single-member LLC. In Burbank, California, businesses are required to carefully track and categorize their expenses in order to accurately complete their tax filings. The Disbursements section of Schedule C includes various expenses incurred during the normal course of business operations. These expenses may include but are not limited to: 1. Advertising expenses: This category covers costs related to promoting the business such as online advertising, print ads, billboard rentals, or sponsorship expenses. 2. Office supplies and equipment: Businesses often need to purchase supplies like paper, pens, ink cartridges, as well as larger office equipment like printers, computers, and furniture. 3. Rent and utilities: Burbank businesses may have expenditures related to renting office space, storefronts, or warehouses. Utilities such as electricity, water, internet, and phone bills also fall under this category. 4. Professional services: This category encompasses fees paid to lawyers, accountants, consultants, or other professionals for their expert advice or assistance. 5. Insurance premiums: Businesses may need to pay for various insurance policies, such as general liability insurance or workers' compensation coverage to protect themselves and their employees. 6. Travel and entertainment expenses: This category covers costs related to business trips, including airfare, accommodation, meals, and entertainment for clients or business partners. 7. Repairs and maintenance: Expenses incurred for repairs and maintenance of business assets, including vehicles, equipment, or premises, qualify under this category. 8. Licenses and permits: Businesses may need to obtain licenses or permits operating legally in Burbank, and the associated fees can be claimed as deductions. 9. Subscriptions and memberships: Costs associated with subscriptions to professional journals, industry associations, or memberships to business networking groups may be included in this category. 10. Other miscellaneous expenses: This catch-all category includes any other necessary business expenses not covered by the above categories, such as bank fees, postage, or shipping costs. It is important to note that while these expense categories are common, each business may have unique expenses that would fall into different categories based on their nature and industry. Different variations or additional types of Burbank California Schedule C, Disbursements, Other Expenses — Standard Account may not exist in terms of different form names, but the specific expenses claimed can differ depending on the nature of the business. It is crucial for business owners to consult with a tax professional or familiarize themselves with the IRS guidelines to ensure accurate reporting and deduction of expenses.