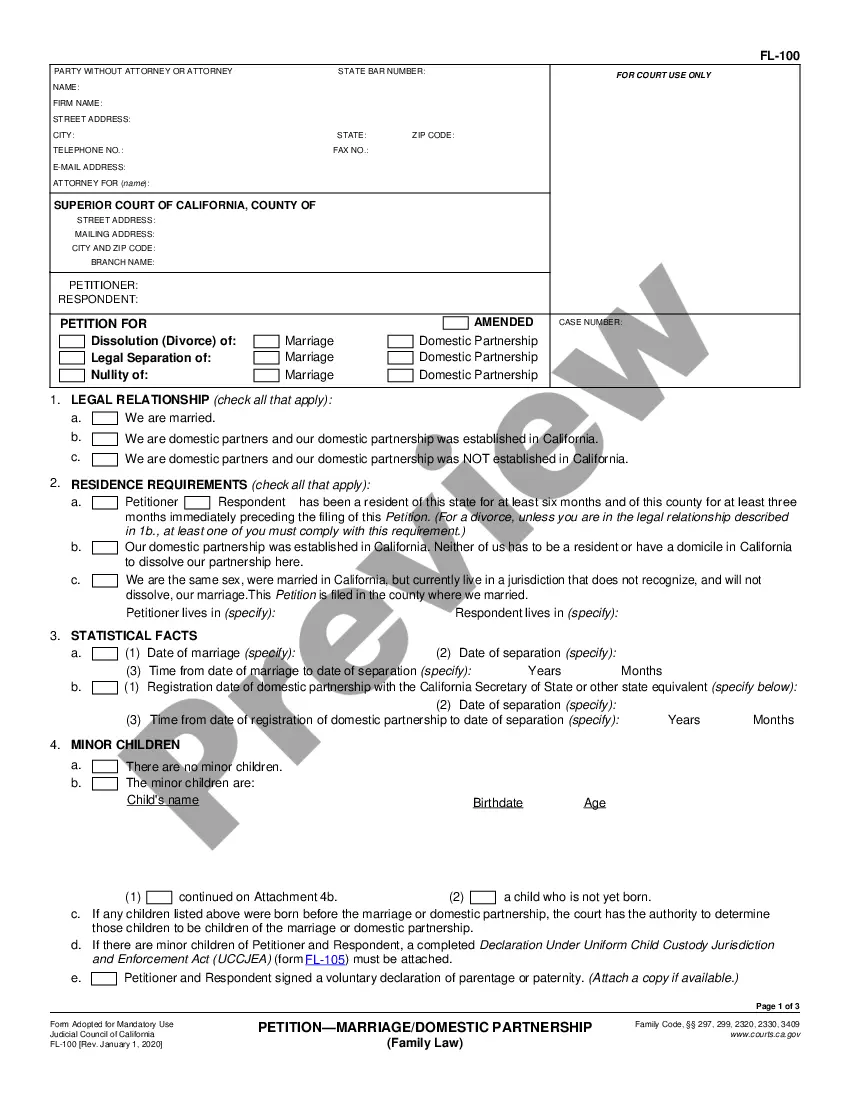

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Long Beach California Schedule C, Disbursements, Fiduciary and Attorney Fees-Standard Account is a document that outlines the expenses, payments, and fees associated with fiduciary services provided in Long Beach, California. It is an essential part of managing financial matters and ensuring transparency in the fiduciary process. Keywords: Long Beach California, Schedule C, Disbursements, Fiduciary, Attorney Fees, Standard Account. 1. Long Beach California Schedule C: This refers to the specific schedule used in Long Beach, California, to record and report disbursements and fees related to fiduciary services. It is a standardized form that provides a detailed breakdown of financial transactions. 2. Disbursements: Disbursements are expenses or payments made by fiduciaries on behalf of their clients. These can include costs for medical bills, property maintenance, legal fees, utilities, insurance, taxes, and other necessary expenditures. The Long Beach California Schedule C outlines these disbursements for proper accounting and review purposes. 3. Fiduciary: A fiduciary is an individual or entity entrusted with managing the financial affairs of another person or organization. This can include trustees, executors, administrators, conservators, or guardians appointed by a court. The Long Beach California Schedule C is used to document the fiduciary's actions and ensure proper accountability. 4. Attorney Fees: Attorney fees may be incurred when legal assistance is required during the fiduciary process. These fees can cover consultations, document drafting, court appearances, and other legal services. The Long Beach California Schedule C itemizes and discloses these fees associated with the fiduciary's engagement of legal professionals. 5. Standard Account: The Standard Account refers to the specific category of fiduciary account in Long Beach, California, that follows established guidelines and regulations. It is a commonly used account type for individuals or entities acting as fiduciaries. The Long Beach California Schedule C for Standard Account provides a standardized format for reporting and documenting the financial activities associated with fiduciary duties. Other types of Long Beach California Schedule C, Disbursements, Fiduciary and Attorney Fees may include: a. Restricted Account Schedule C: This pertains to fiduciary accounts that have restrictions or limitations placed on the disbursements and investments made on behalf of the client. The Schedule C for Restricted Account is tailored to reflect these unique circumstances. b. Special Needs Trust Schedule C: Special Needs Trusts are created to benefit individuals with disabilities. The Schedule C for Special Needs Trusts captures the specific disbursements, fiduciary fees, and any attorney fees associated with managing this type of trust. c. Estate Account Schedule C: Estate Accounts are formed when a fiduciary is appointed to manage the assets and liabilities of a deceased individual. The Schedule C for Estate Accounts highlights the disbursements and fees directly related to the probate process and settling the estate. In summary, the Long Beach California Schedule C, Disbursements, Fiduciary and Attorney Fees-Standard Account is a standardized document that meticulously records the expenses, payments, and professional fees associated with fiduciary services provided in Long Beach, California. Various types of Schedule C may exist, tailored to different account types or specific circumstances such as Restricted Accounts, Special Needs Trusts, or Estate Accounts.Long Beach California Schedule C, Disbursements, Fiduciary and Attorney Fees-Standard Account is a document that outlines the expenses, payments, and fees associated with fiduciary services provided in Long Beach, California. It is an essential part of managing financial matters and ensuring transparency in the fiduciary process. Keywords: Long Beach California, Schedule C, Disbursements, Fiduciary, Attorney Fees, Standard Account. 1. Long Beach California Schedule C: This refers to the specific schedule used in Long Beach, California, to record and report disbursements and fees related to fiduciary services. It is a standardized form that provides a detailed breakdown of financial transactions. 2. Disbursements: Disbursements are expenses or payments made by fiduciaries on behalf of their clients. These can include costs for medical bills, property maintenance, legal fees, utilities, insurance, taxes, and other necessary expenditures. The Long Beach California Schedule C outlines these disbursements for proper accounting and review purposes. 3. Fiduciary: A fiduciary is an individual or entity entrusted with managing the financial affairs of another person or organization. This can include trustees, executors, administrators, conservators, or guardians appointed by a court. The Long Beach California Schedule C is used to document the fiduciary's actions and ensure proper accountability. 4. Attorney Fees: Attorney fees may be incurred when legal assistance is required during the fiduciary process. These fees can cover consultations, document drafting, court appearances, and other legal services. The Long Beach California Schedule C itemizes and discloses these fees associated with the fiduciary's engagement of legal professionals. 5. Standard Account: The Standard Account refers to the specific category of fiduciary account in Long Beach, California, that follows established guidelines and regulations. It is a commonly used account type for individuals or entities acting as fiduciaries. The Long Beach California Schedule C for Standard Account provides a standardized format for reporting and documenting the financial activities associated with fiduciary duties. Other types of Long Beach California Schedule C, Disbursements, Fiduciary and Attorney Fees may include: a. Restricted Account Schedule C: This pertains to fiduciary accounts that have restrictions or limitations placed on the disbursements and investments made on behalf of the client. The Schedule C for Restricted Account is tailored to reflect these unique circumstances. b. Special Needs Trust Schedule C: Special Needs Trusts are created to benefit individuals with disabilities. The Schedule C for Special Needs Trusts captures the specific disbursements, fiduciary fees, and any attorney fees associated with managing this type of trust. c. Estate Account Schedule C: Estate Accounts are formed when a fiduciary is appointed to manage the assets and liabilities of a deceased individual. The Schedule C for Estate Accounts highlights the disbursements and fees directly related to the probate process and settling the estate. In summary, the Long Beach California Schedule C, Disbursements, Fiduciary and Attorney Fees-Standard Account is a standardized document that meticulously records the expenses, payments, and professional fees associated with fiduciary services provided in Long Beach, California. Various types of Schedule C may exist, tailored to different account types or specific circumstances such as Restricted Accounts, Special Needs Trusts, or Estate Accounts.