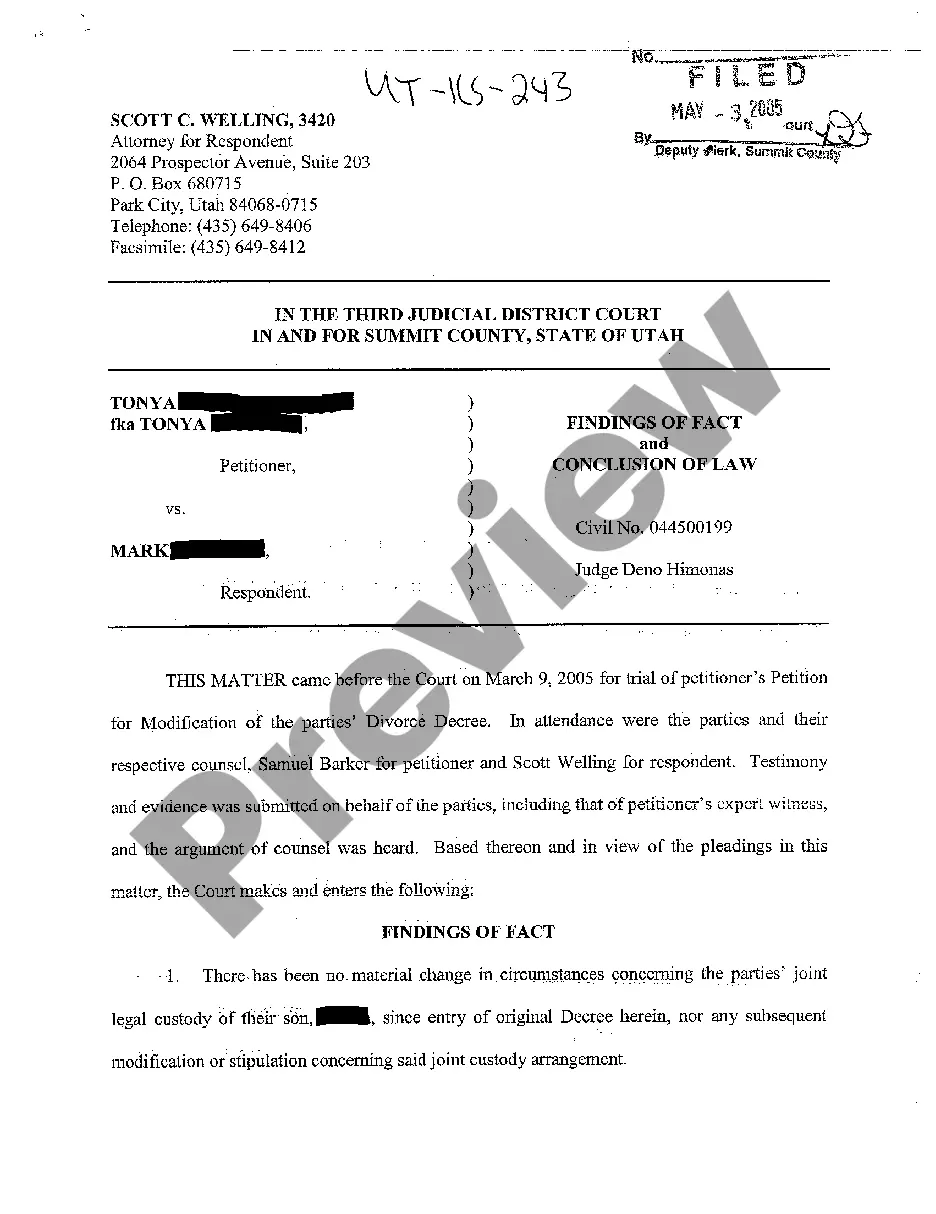

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

In Pomona, California, Schedule C refers to a specific document related to tax filing and financial reporting. It is used by individuals, businesses, and legal entities to report profit or loss from a sole proprietorship, including various deductions related to business activities. This schedule is an essential part of Form 1040, the U.S. Individual Income Tax Return. One type of Pomona California Schedule C revolves around disbursements, which are monetary transactions made by a business or an individual on behalf of its clients, customers, or beneficiaries. These disbursements can encompass a wide range of expenses, such as payments for supplies, utilities, professional services, or any other necessary costs incurred in conducting business. Additionally, the Pomona California Schedule C may also include fiduciary fees. Fiduciary refers to an individual or entity that is entrusted with managing and safeguarding assets on behalf of another party. Fiduciary fees on Schedule C typically pertain to compensation received for fulfilling fiduciary roles, such as administering trusts, managing estates, or handling investments. Likewise, attorney fees-standard account represent fees charged for legal services, specifically those incurred during standard procedures or routine legal matters. The Pomona California Schedule C may require detailed reporting of attorney fees related to contract review, document preparation, legal consultations, and other standard legal services. In summary, Pomona California Schedule C involves reporting financial information related to profit or loss from a sole proprietorship, including various deductions, disbursements, fiduciary fees, and attorney fees-standard account. By accurately completing this schedule, individuals and businesses can comply with tax regulations and properly report their financial activities.