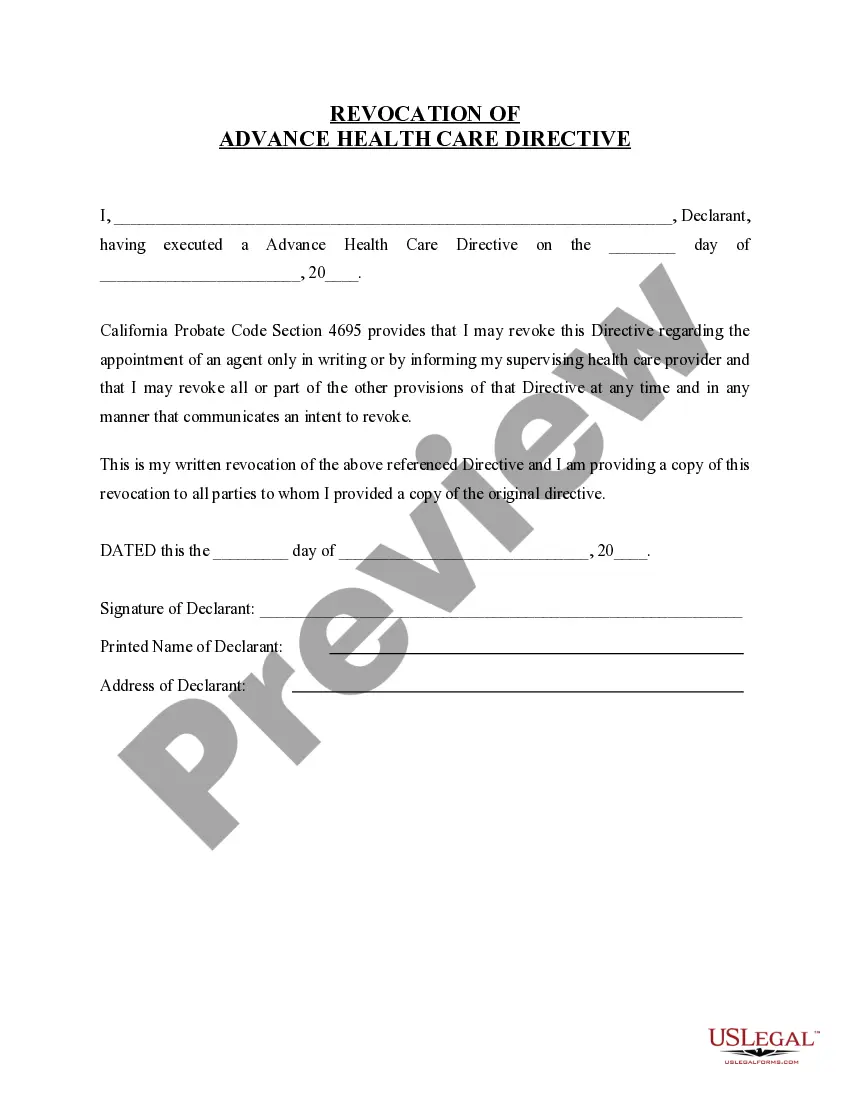

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

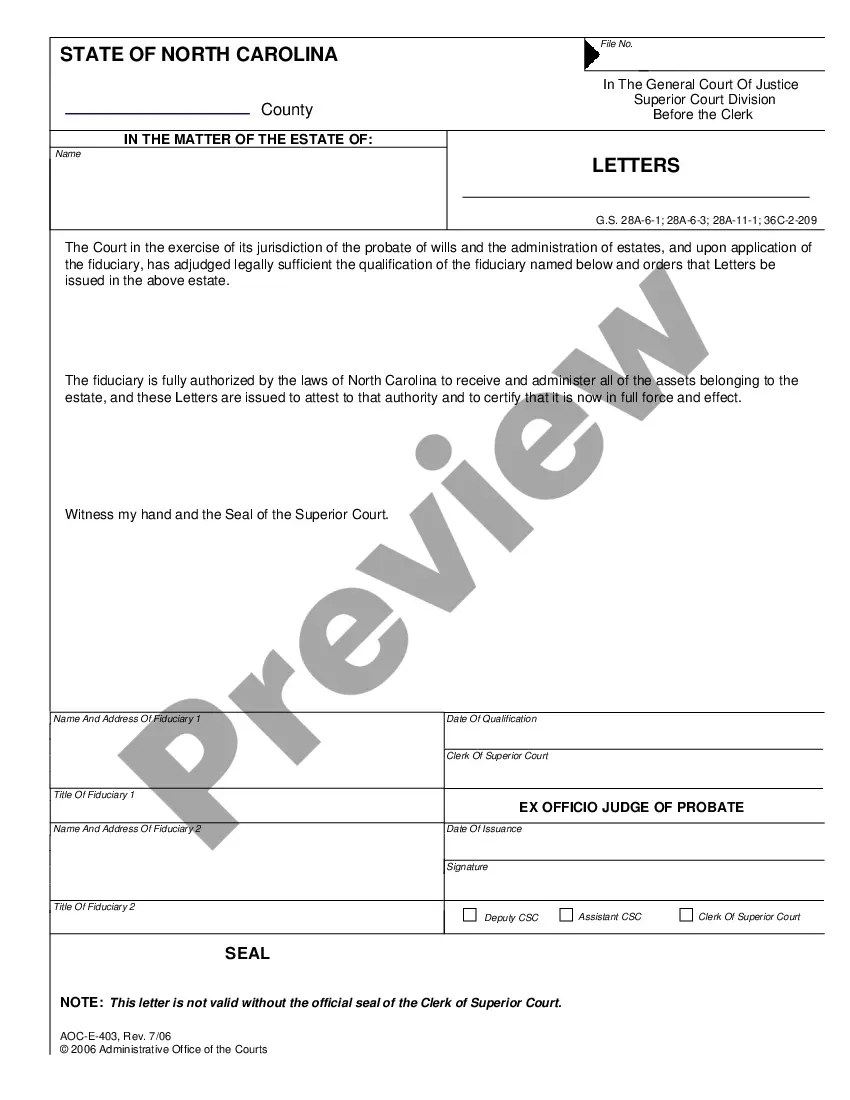

Visalia California Schedule C, Disbursements, Fiduciary, and Attorney Fees-Standard Account is an important aspect of financial management in Visalia, California. This detailed description will provide insights into the definition and various types of Schedule C, disbursements, fiduciary, and attorney fees associated with a standard account in Visalia, California. Visalia California Schedule C: Visalia California Schedule C refers to a form used by individuals or businesses to report income or loss from a sole proprietorship during the tax year. It is specifically designed for self-employed individuals, including freelancers, contractors, and small business owners, who need to itemize their business expenses and deductions. Disbursements: Disbursements are payments made from a specific account, typically related to a particular project, transaction, or financial activity. In the context of Visalia California Schedule C, disbursements refer to the costs or expenses incurred by an individual or business in the process of conducting their sole proprietorship activities. These disbursements may include expenses such as office supplies, utilities, advertising, travel, and professional fees. Fiduciary: Fiduciary refers to a person or entity that has a legal obligation to act in the best interest of another party. In the context of Visalia California Schedule C, fiduciary usually refers to a professional or financial institution entrusted with managing someone else's assets or finances. This could include a trustee, executor, or administrator who oversees a trust or estate on behalf of the beneficiaries. Attorney Fees-Standard Account: Attorney fees refer to the charges incurred for legal services provided by an attorney or law firm. In Visalia, California, attorney fees may vary depending on the complexity of the legal matter and the specific services rendered. The term "standard account" indicates a typical or common type of account used for billing and tracking legal expenses. Different types of Visalia California Schedule C, Disbursements, Fiduciary, and Attorney Fees-Standard Account may include variations based on specific professions or business categories. For instance, there could be Schedule C forms tailored for healthcare professionals, real estate agents, or independent contractors in the construction industry. Disbursements may differ based on the nature of the business, such as inventory costs for a retailer or equipment maintenance expenses for a service provider. Fiduciary roles can also vary, with different responsibilities and fees for trustees managing different types of trusts. Attorney fees can differ depending on the type of legal matter, with separate standards for criminal defense, estate planning, or business litigation. In conclusion, Visalia California Schedule C, Disbursements, Fiduciary, and Attorney Fees-Standard Account play crucial roles in managing finances, reporting business income or loss accurately, and ensuring compliance with tax regulations in Visalia, California. Understanding the specific requirements and variations involved in these aspects is essential for individuals, businesses, and professionals operating in Visalia.