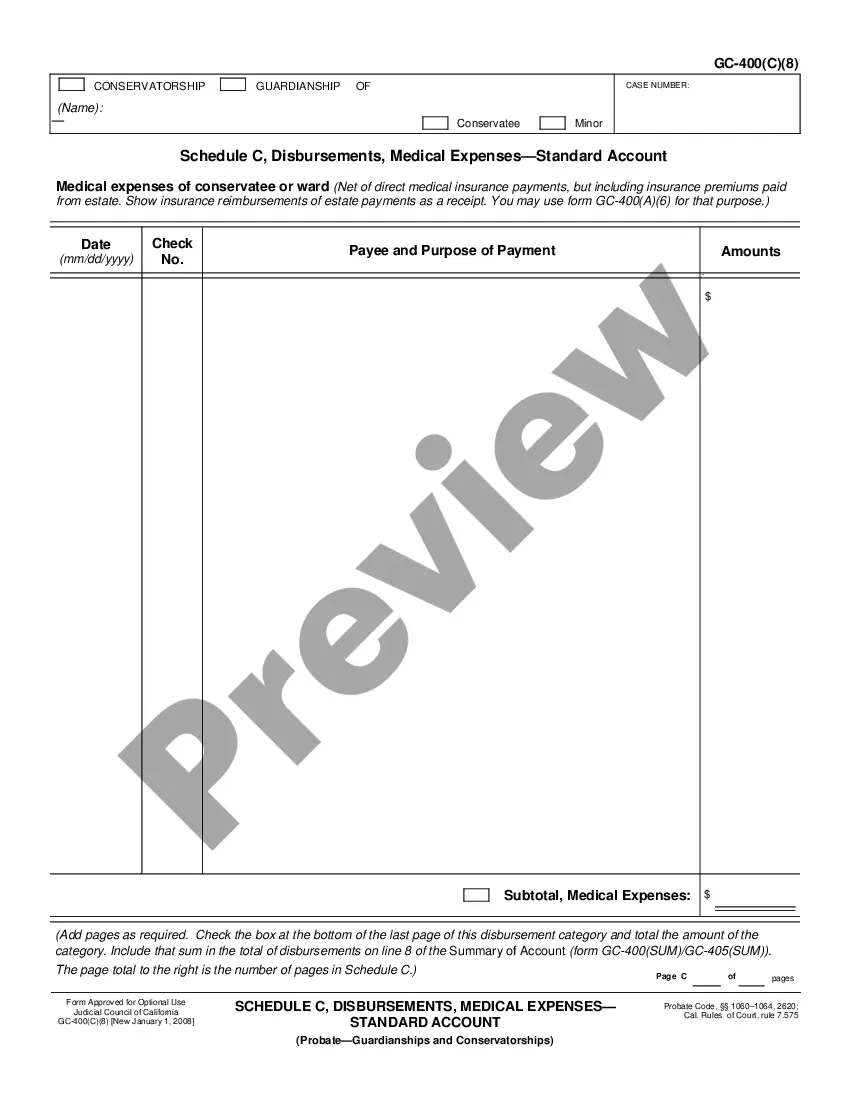

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Santa Ana California Schedule C, Disbursements, General Administration Expenses — Standard Account refers to a specific category of expenses related to the general administration and management of businesses or organizations in Santa Ana, California. These expenses are typically reported on Schedule C, a form used by sole proprietors, to monitor and report business profit or loss to the IRS. General administration expenses encompass various costs incurred while running a business. They are crucial for maintaining smooth operations, complying with legal requirements, and supporting the overall organizational structure. The following are some common types of Santa Ana California Schedule C, Disbursements, General Administration Expenses — Standard Account: 1. Office Supplies and Expenses: This category includes the costs of office supplies, stationery, postage, mailing, phone bills, internet services, printing, and similar expenditures necessary for day-to-day operations. 2. Utilities: Expenses related to utilities such as electricity, water, heating, cooling, and waste management fall under this category. These costs are essential for maintaining a functional and comfortable work environment. 3. Rent and Leasing: The payments made for renting or leasing office space, warehouse, or equipment are considered general administrative expenses. This includes monthly rent, lease payments, and maintenance fees. 4. Insurance: Costs associated with business insurance policies, including general liability insurance, professional liability insurance, property insurance, or workers' compensation insurance are classified as general administration expenses. 5. Legal and Professional Fees: Fees paid to lawyers, accountants, consultants, or any other professionals hired to provide legal, tax, or other business-related services are included in this category. 6. Licenses and Permits: Expenses for obtaining licenses and permits required to conduct business operations legally in Santa Ana, California, are considered general administration expenses. 7. Travel and Entertainment: Costs incurred for business-related travel, meals, accommodation, and entertainment expenses fall under this category. These expenses must be directly related to the business and have a clear business purpose. 8. Training and Professional Development: Investments made in employee training programs, seminars, workshops, or professional development courses are also considered general administration expenses. These costs contribute to the skill enhancement and efficiency of the workforce. It's important to note that this list only represents common examples of general administration expenses for businesses in Santa Ana, California, and may vary depending on the nature of the business and industry. When filing for Schedule C, it is crucial to maintain accurate records and thoroughly review the IRS guidelines to ensure compliance with tax regulations. It is recommended to consult with a certified tax professional or accountant for specific advice tailored to your business's unique circumstances.Santa Ana California Schedule C, Disbursements, General Administration Expenses — Standard Account refers to a specific category of expenses related to the general administration and management of businesses or organizations in Santa Ana, California. These expenses are typically reported on Schedule C, a form used by sole proprietors, to monitor and report business profit or loss to the IRS. General administration expenses encompass various costs incurred while running a business. They are crucial for maintaining smooth operations, complying with legal requirements, and supporting the overall organizational structure. The following are some common types of Santa Ana California Schedule C, Disbursements, General Administration Expenses — Standard Account: 1. Office Supplies and Expenses: This category includes the costs of office supplies, stationery, postage, mailing, phone bills, internet services, printing, and similar expenditures necessary for day-to-day operations. 2. Utilities: Expenses related to utilities such as electricity, water, heating, cooling, and waste management fall under this category. These costs are essential for maintaining a functional and comfortable work environment. 3. Rent and Leasing: The payments made for renting or leasing office space, warehouse, or equipment are considered general administrative expenses. This includes monthly rent, lease payments, and maintenance fees. 4. Insurance: Costs associated with business insurance policies, including general liability insurance, professional liability insurance, property insurance, or workers' compensation insurance are classified as general administration expenses. 5. Legal and Professional Fees: Fees paid to lawyers, accountants, consultants, or any other professionals hired to provide legal, tax, or other business-related services are included in this category. 6. Licenses and Permits: Expenses for obtaining licenses and permits required to conduct business operations legally in Santa Ana, California, are considered general administration expenses. 7. Travel and Entertainment: Costs incurred for business-related travel, meals, accommodation, and entertainment expenses fall under this category. These expenses must be directly related to the business and have a clear business purpose. 8. Training and Professional Development: Investments made in employee training programs, seminars, workshops, or professional development courses are also considered general administration expenses. These costs contribute to the skill enhancement and efficiency of the workforce. It's important to note that this list only represents common examples of general administration expenses for businesses in Santa Ana, California, and may vary depending on the nature of the business and industry. When filing for Schedule C, it is crucial to maintain accurate records and thoroughly review the IRS guidelines to ensure compliance with tax regulations. It is recommended to consult with a certified tax professional or accountant for specific advice tailored to your business's unique circumstances.