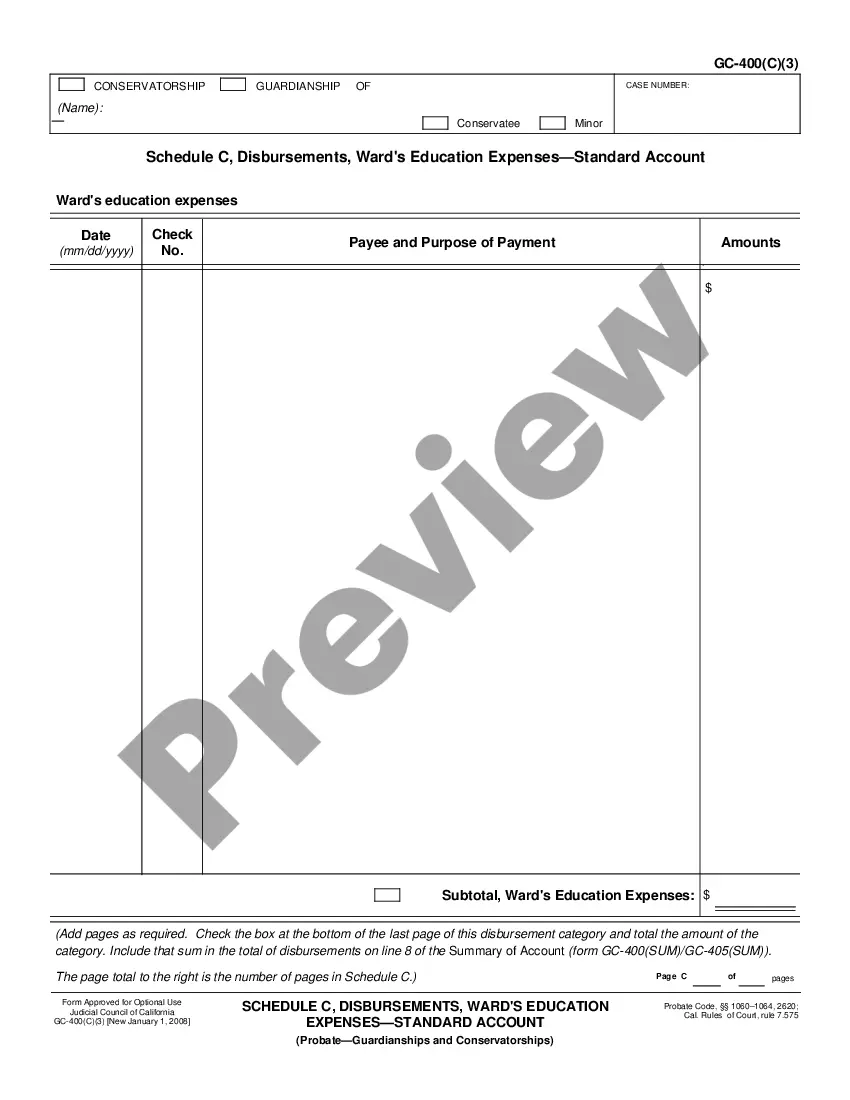

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Temecula California Schedule C is a financial document that specifically refers to the categorization and recording of disbursements and general administration expenses related to the Standard Account of businesses operating in Temecula, California. This schedule helps businesses maintain accurate records of their expenses for tax purposes, tracking their disbursements, and ensuring compliance with the relevant regulations. Disbursements refer to the outgoing payments made by a business for various reasons, such as vendor payments, utility bills, rent, equipment purchases, marketing expenses, and other operational costs. By properly categorizing these disbursements in Schedule C, businesses can provide a detailed breakdown of their expenses, which can be crucial for tax deductions and overall financial analysis. General administration expenses encompass the day-to-day operational costs incurred by a business. These may include office supplies, software subscriptions, insurance premiums, legal fees, professional services, payroll and employee benefits, travel expenses, and other miscellaneous expenditures. By meticulously documenting these expenses under the appropriate categories in Temecula California Schedule C, businesses can easily determine their administrative overheads and make informed financial decisions. Different Types of Temecula California Schedule C, Disbursements, General Administration Expenses — Standard Account: 1. Vendor Payments: This category includes payments made to suppliers, contractors, and service providers for goods and services rendered to the business. 2. Rent and Lease Expenses: This category encompasses rent, lease payments, and related charges for both office space and equipment. 3. Utilities: This refers to the expenses incurred for utilities such as electricity, gas, water, telephone, and internet services used by the business. 4. Equipment and Maintenance: This category accounts for the purchase, repair, and maintenance expenses of equipment used in business operations. 5. Marketing and Advertising: This category includes costs related to advertising campaigns, promotional materials, online marketing, and any other marketing expenses. 6. Professional Services: This category covers legal fees, accounting fees, consulting services, and other professional services necessary for the business. 7. Employee Expenses: This category accounts for payroll expenses, employee benefits, insurance contributions, and other costs associated with the workforce. 8. Travel and Entertainment: This category includes expenses related to business travel, client entertainment, meals, and accommodation for authorized business purposes. 9. Office Supplies: This refers to the costs associated with purchasing office supplies, stationary, printing, and other necessary items for day-to-day operations. 10. Miscellaneous Expenses: This category covers any other miscellaneous expenses that do not fit into the above categories. By diligently recording all disbursements and general administration expenses under the appropriate categories in Temecula California Schedule C, businesses ensure accurate financial reporting, easier tax filings, and a clearer understanding of their financial performance.Temecula California Schedule C is a financial document that specifically refers to the categorization and recording of disbursements and general administration expenses related to the Standard Account of businesses operating in Temecula, California. This schedule helps businesses maintain accurate records of their expenses for tax purposes, tracking their disbursements, and ensuring compliance with the relevant regulations. Disbursements refer to the outgoing payments made by a business for various reasons, such as vendor payments, utility bills, rent, equipment purchases, marketing expenses, and other operational costs. By properly categorizing these disbursements in Schedule C, businesses can provide a detailed breakdown of their expenses, which can be crucial for tax deductions and overall financial analysis. General administration expenses encompass the day-to-day operational costs incurred by a business. These may include office supplies, software subscriptions, insurance premiums, legal fees, professional services, payroll and employee benefits, travel expenses, and other miscellaneous expenditures. By meticulously documenting these expenses under the appropriate categories in Temecula California Schedule C, businesses can easily determine their administrative overheads and make informed financial decisions. Different Types of Temecula California Schedule C, Disbursements, General Administration Expenses — Standard Account: 1. Vendor Payments: This category includes payments made to suppliers, contractors, and service providers for goods and services rendered to the business. 2. Rent and Lease Expenses: This category encompasses rent, lease payments, and related charges for both office space and equipment. 3. Utilities: This refers to the expenses incurred for utilities such as electricity, gas, water, telephone, and internet services used by the business. 4. Equipment and Maintenance: This category accounts for the purchase, repair, and maintenance expenses of equipment used in business operations. 5. Marketing and Advertising: This category includes costs related to advertising campaigns, promotional materials, online marketing, and any other marketing expenses. 6. Professional Services: This category covers legal fees, accounting fees, consulting services, and other professional services necessary for the business. 7. Employee Expenses: This category accounts for payroll expenses, employee benefits, insurance contributions, and other costs associated with the workforce. 8. Travel and Entertainment: This category includes expenses related to business travel, client entertainment, meals, and accommodation for authorized business purposes. 9. Office Supplies: This refers to the costs associated with purchasing office supplies, stationary, printing, and other necessary items for day-to-day operations. 10. Miscellaneous Expenses: This category covers any other miscellaneous expenses that do not fit into the above categories. By diligently recording all disbursements and general administration expenses under the appropriate categories in Temecula California Schedule C, businesses ensure accurate financial reporting, easier tax filings, and a clearer understanding of their financial performance.