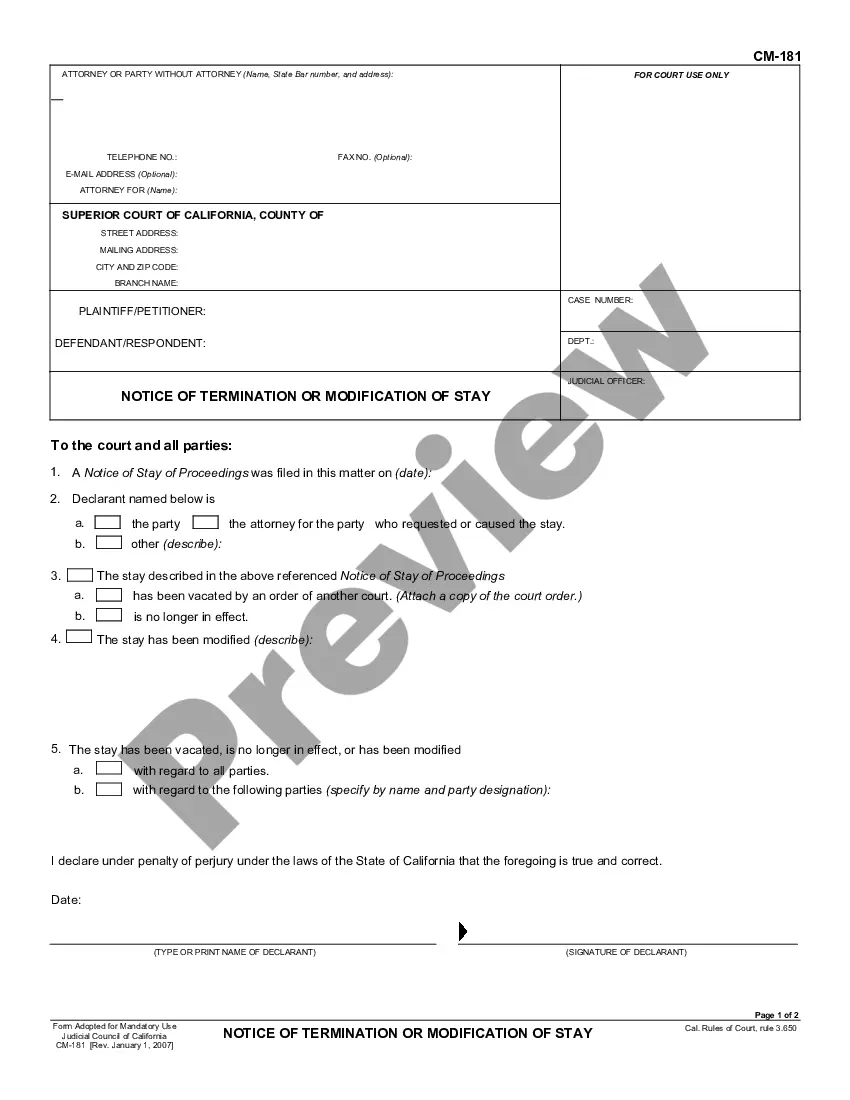

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Chico California Schedule C is a financial document used for reporting business income and expenses for taxpayers who are self-employed or engage in certain business activities. It is an important part of the federal tax return process and provides a detailed breakdown of various expenses related to the operation of a business in Chico, California. Disbursements refer to the payments made by a business or individual for the purpose of fulfilling obligations or expenses. In terms of Chico California Schedule C, disbursements typically include expenses such as rent, utilities, insurance, advertising, office supplies, employee wages, and other costs directly related to the business. Investment expenses, on the other hand, are expenses incurred in the process of investing or managing investments. These expenses can include fees paid to financial advisors, subscription fees for investment services, custodian fees, research expenses, legal and professional fees related to investment activities, and other expenses that are directly associated with the management of investments. The Standard Account refers to a regular business account where all financial transactions related to the business are recorded. This includes income received, expenses incurred, disbursements made, and investment-related costs. The Standard Account provides a comprehensive overview of the financial activity and performance of the business. Different types of Chico California Schedule C may include specialized versions for specific types of businesses, such as Schedule C for sole proprietorship, partnerships, limited liability companies (LCS), corporations, or professional associations. These variations are tailored to meet the specific reporting requirements and provisions applicable to each business structure. It's important to note that the details and requirements of Chico California Schedule C, disbursements, and investment expenses may vary over time or be subject to change based on updates to tax laws and regulations. It is recommended to consult with a qualified tax professional or refer to the official Internal Revenue Service (IRS) guidelines to ensure accurate and compliant reporting.