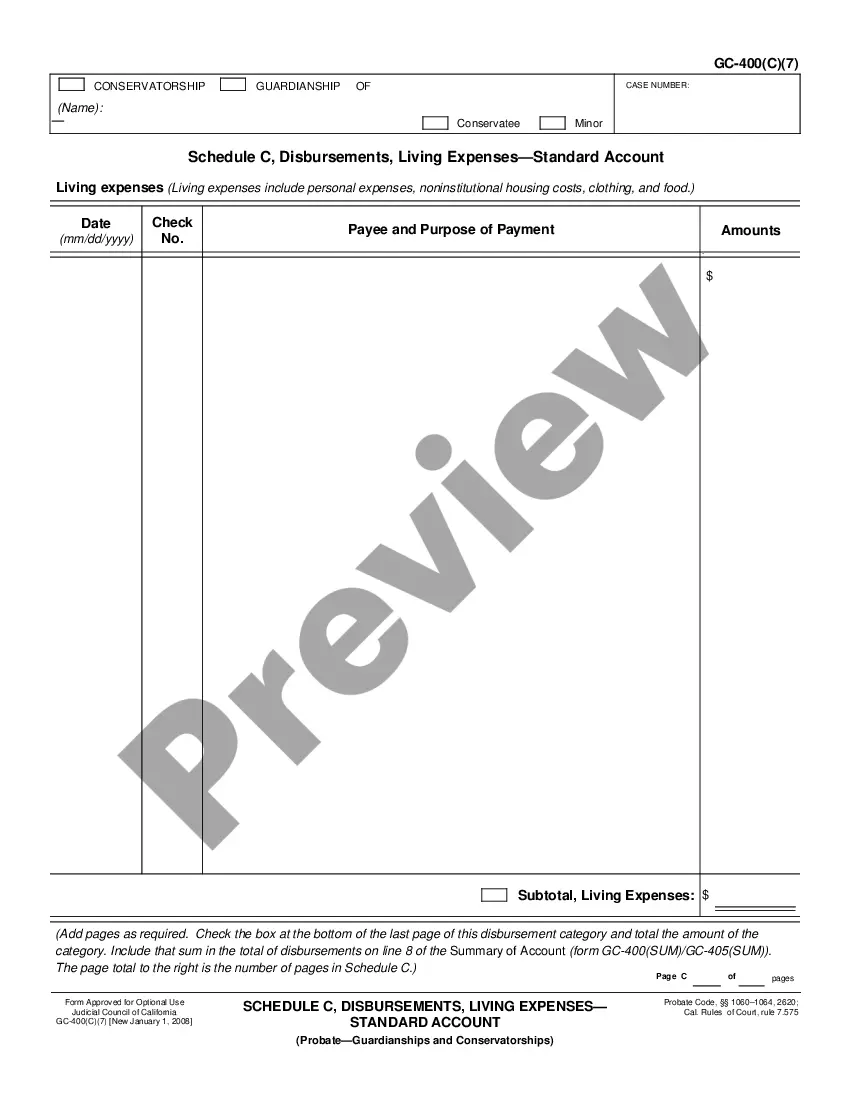

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Downey California Schedule C is a form used by residents of Downey, California to report their business income or loss. It is utilized by individuals who are self-employed or have a sole proprietorship business. Schedule C is an essential part of the annual income tax return, known as Form 1040. Disbursements refer to the payment or distribution of funds from a business account. In the context of Downey California Schedule C, disbursements represent the various expenses incurred by a business during the tax year. These expenses can include payments to suppliers, utilities, employees, rent, advertising, and more. Keeping track of disbursements is crucial as it helps determine the financial health and profitability of a business. Investment expenses, on the other hand, involve the costs incurred in managing investments and generating income from them. These expenses can include advisory fees, custodian fees, trading commissions, and other charges related to investment activities. The Investment Expenses — Standard Account section of Schedule C in Downey California is used to report these expenses. Keywords: Downey California Schedule C, business income, self-employed, sole proprietorship, Form 1040, disbursements, expenses, payments, suppliers, utilities, employees, rent, advertising, financial health, profitability, investment expenses, advisory fees, custodian fees, trading commissions, investment activities. Different types of Downey California Schedule C may include specialized forms for specific types of businesses or industries, such as real estate agents, freelancers, consultants, or contractors. However, the general Schedule C is the most commonly used form for reporting business income and expenses in Downey, California.Downey California Schedule C is a form used by residents of Downey, California to report their business income or loss. It is utilized by individuals who are self-employed or have a sole proprietorship business. Schedule C is an essential part of the annual income tax return, known as Form 1040. Disbursements refer to the payment or distribution of funds from a business account. In the context of Downey California Schedule C, disbursements represent the various expenses incurred by a business during the tax year. These expenses can include payments to suppliers, utilities, employees, rent, advertising, and more. Keeping track of disbursements is crucial as it helps determine the financial health and profitability of a business. Investment expenses, on the other hand, involve the costs incurred in managing investments and generating income from them. These expenses can include advisory fees, custodian fees, trading commissions, and other charges related to investment activities. The Investment Expenses — Standard Account section of Schedule C in Downey California is used to report these expenses. Keywords: Downey California Schedule C, business income, self-employed, sole proprietorship, Form 1040, disbursements, expenses, payments, suppliers, utilities, employees, rent, advertising, financial health, profitability, investment expenses, advisory fees, custodian fees, trading commissions, investment activities. Different types of Downey California Schedule C may include specialized forms for specific types of businesses or industries, such as real estate agents, freelancers, consultants, or contractors. However, the general Schedule C is the most commonly used form for reporting business income and expenses in Downey, California.