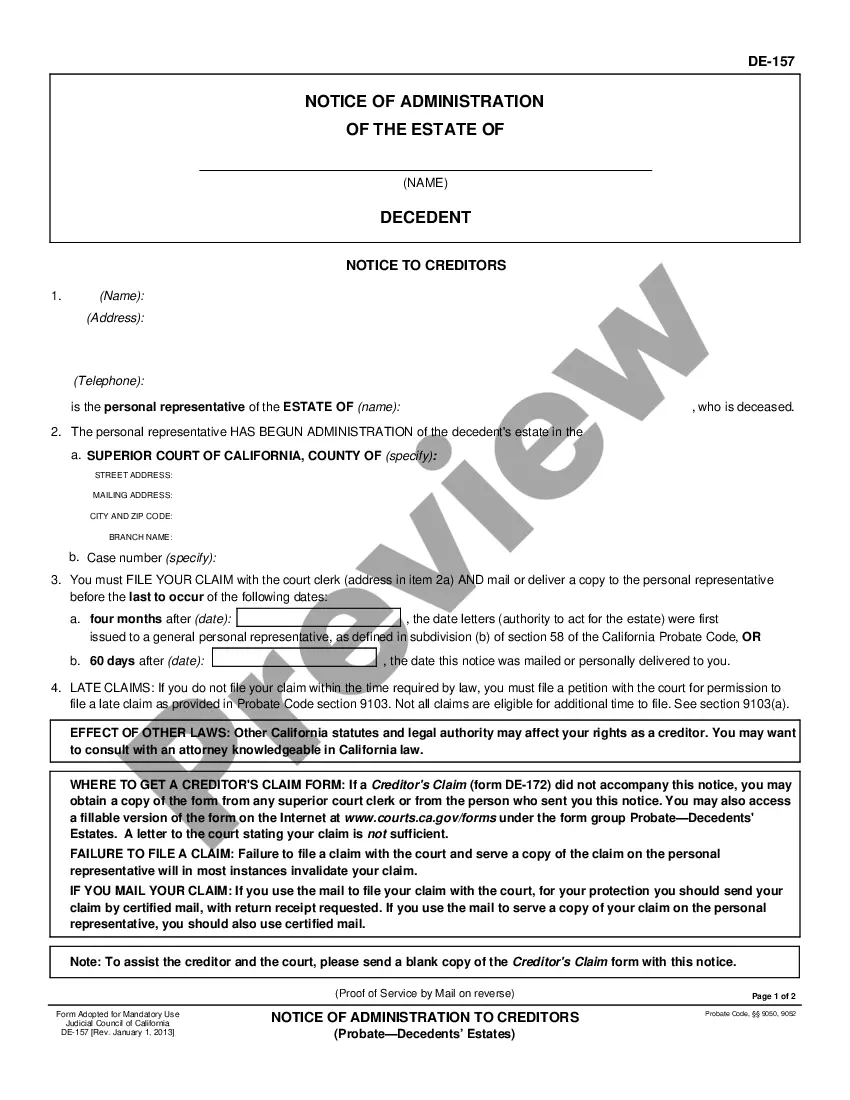

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

El Cajon California Schedule C is a financial document that provides a detailed breakdown of disbursements and investment expenses associated with a standard account in El Cajon, California. This schedule categorizes various expenditures and provides a comprehensive overview of financial activities for the account holder. Disbursements refer to the allocation and distribution of funds or assets from the account. These expenses can include payments made to suppliers, vendors, service providers, or any other outgoing financial transactions. El Cajon California Schedule C lists each disbursement along with its corresponding amount and purpose, allowing for a transparent view of how funds are being utilized. Investment expenses are the costs incurred in managing and maintaining investments within the standard account. This may include fees paid to financial advisors, brokerage commissions, custodial fees, or any other charges associated with investment transactions. These expenses can have a significant impact on the overall performance of the investments, therefore tracking and analyzing them are vital for account management. El Cajon California Schedule C, Disbursements, Investment Expenses — Standard Account can be customized according to specific needs. For example, there could be multiple types of Schedule C, such as: 1. Business Schedule C: This pertains to small business owners or self-employed individuals in El Cajon, California. It would outline disbursements and investment expenses related to business operations and investments. 2. Individual Schedule C: This focuses on personal finances and investments of individuals residing in El Cajon, California. It would include disbursements and investment expenses related to personal accounts and investments. 3. Non-Profit Schedule C: This applies to non-profit organizations operating in El Cajon, California. It would detail the disbursements and investment expenses associated with the organization's accounts and investments. These variations of El Cajon California Schedule C help to address the diverse financial needs and interests of different entities within the community. By providing a clear breakdown of disbursements and investment expenses, individuals and organizations can better manage their finances, monitor their expenditure patterns, and make informed decisions to optimize their financial goals.