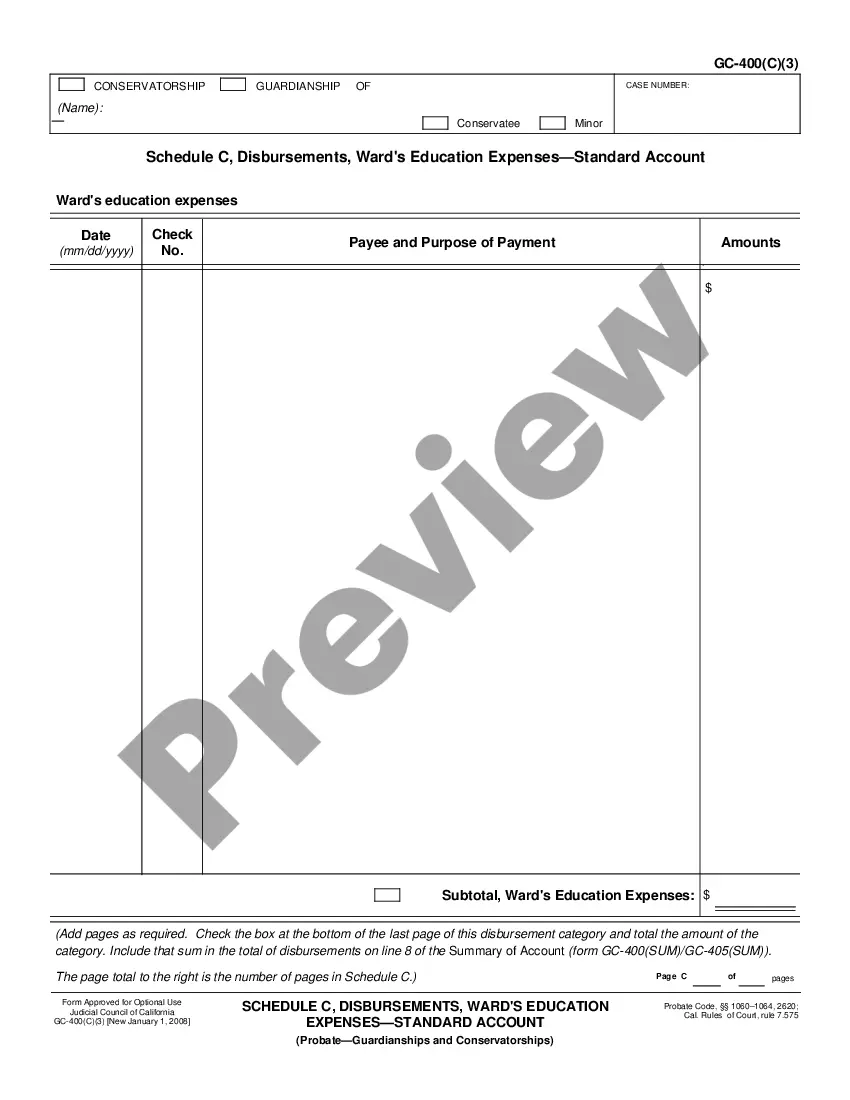

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Jurupa Valley, California Schedule C is a crucial document for taxpayers who operate a business or are self-employed in Jurupa Valley, California. It allows individuals to report their income and expenses as a sole proprietorship or a single-member LLC (Limited Liability Company). In this article, we will delve into the details of Jurupa Valley California's Schedule C, particularly focusing on disbursements and investment expenses in the standard account. Schedule C Disbursements in Jurupa Valley, California: Disbursements refer to the outflow of funds or expenditure made by a business or self-employed individual. When completing Schedule C, taxpayers in Jurupa Valley must carefully track and report their disbursements to accurately calculate their net profit or loss. Disbursements can include various categories such as office supplies, advertising expenses, utilities, insurance, travel expenses, and other ordinary and necessary expenses related to the business operations. Investment Expenses in Jurupa Valley, California: Investment expenses are another essential aspect of Schedule C for taxpayers in Jurupa Valley, California. These expenses are specifically related to investments made by the business or self-employed individual. Investment expenses can encompass a wide range of items, such as brokerage fees, investment advisory fees, custodial fees, and expenses associated with managing investment portfolios. It is crucial to keep detailed records of these expenses to maximize deductions and accurately report them on Schedule C. Jurupa Valley California Schedule C — Standard Account: Within Jurupa Valley, California, Schedule C, there is typically one standard account used to report business income and expenses. The standard account allows individuals to record their disbursements and investment expenses associated with their business operations. Taxpayers must meticulously document all relevant transactions in this account to ensure compliance with tax regulations and to avoid any penalties or audits. Different types of Jurupa Valley California Schedule C, Disbursements, Investment Expenses — Standard Account may include variations based on the types of businesses or professions operating in Jurupa Valley. For instance, if there are specific industries or professions prevalent in the area, the disbursements and investment expenses associated with those fields might require further categorization or specialized reporting. In conclusion, Jurupa Valley, California Schedule C plays a crucial role in accurately reporting business income and expenses for self-employed individuals and sole proprietors. The disbursements and investment expenses sections of the standard account require careful tracking and documentation to ensure compliance with tax laws. By accurately reporting these expenses, individuals can minimize their tax liability while maintaining the necessary records for any potential audits or inquiries from the IRS.Jurupa Valley, California Schedule C is a crucial document for taxpayers who operate a business or are self-employed in Jurupa Valley, California. It allows individuals to report their income and expenses as a sole proprietorship or a single-member LLC (Limited Liability Company). In this article, we will delve into the details of Jurupa Valley California's Schedule C, particularly focusing on disbursements and investment expenses in the standard account. Schedule C Disbursements in Jurupa Valley, California: Disbursements refer to the outflow of funds or expenditure made by a business or self-employed individual. When completing Schedule C, taxpayers in Jurupa Valley must carefully track and report their disbursements to accurately calculate their net profit or loss. Disbursements can include various categories such as office supplies, advertising expenses, utilities, insurance, travel expenses, and other ordinary and necessary expenses related to the business operations. Investment Expenses in Jurupa Valley, California: Investment expenses are another essential aspect of Schedule C for taxpayers in Jurupa Valley, California. These expenses are specifically related to investments made by the business or self-employed individual. Investment expenses can encompass a wide range of items, such as brokerage fees, investment advisory fees, custodial fees, and expenses associated with managing investment portfolios. It is crucial to keep detailed records of these expenses to maximize deductions and accurately report them on Schedule C. Jurupa Valley California Schedule C — Standard Account: Within Jurupa Valley, California, Schedule C, there is typically one standard account used to report business income and expenses. The standard account allows individuals to record their disbursements and investment expenses associated with their business operations. Taxpayers must meticulously document all relevant transactions in this account to ensure compliance with tax regulations and to avoid any penalties or audits. Different types of Jurupa Valley California Schedule C, Disbursements, Investment Expenses — Standard Account may include variations based on the types of businesses or professions operating in Jurupa Valley. For instance, if there are specific industries or professions prevalent in the area, the disbursements and investment expenses associated with those fields might require further categorization or specialized reporting. In conclusion, Jurupa Valley, California Schedule C plays a crucial role in accurately reporting business income and expenses for self-employed individuals and sole proprietors. The disbursements and investment expenses sections of the standard account require careful tracking and documentation to ensure compliance with tax laws. By accurately reporting these expenses, individuals can minimize their tax liability while maintaining the necessary records for any potential audits or inquiries from the IRS.