This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

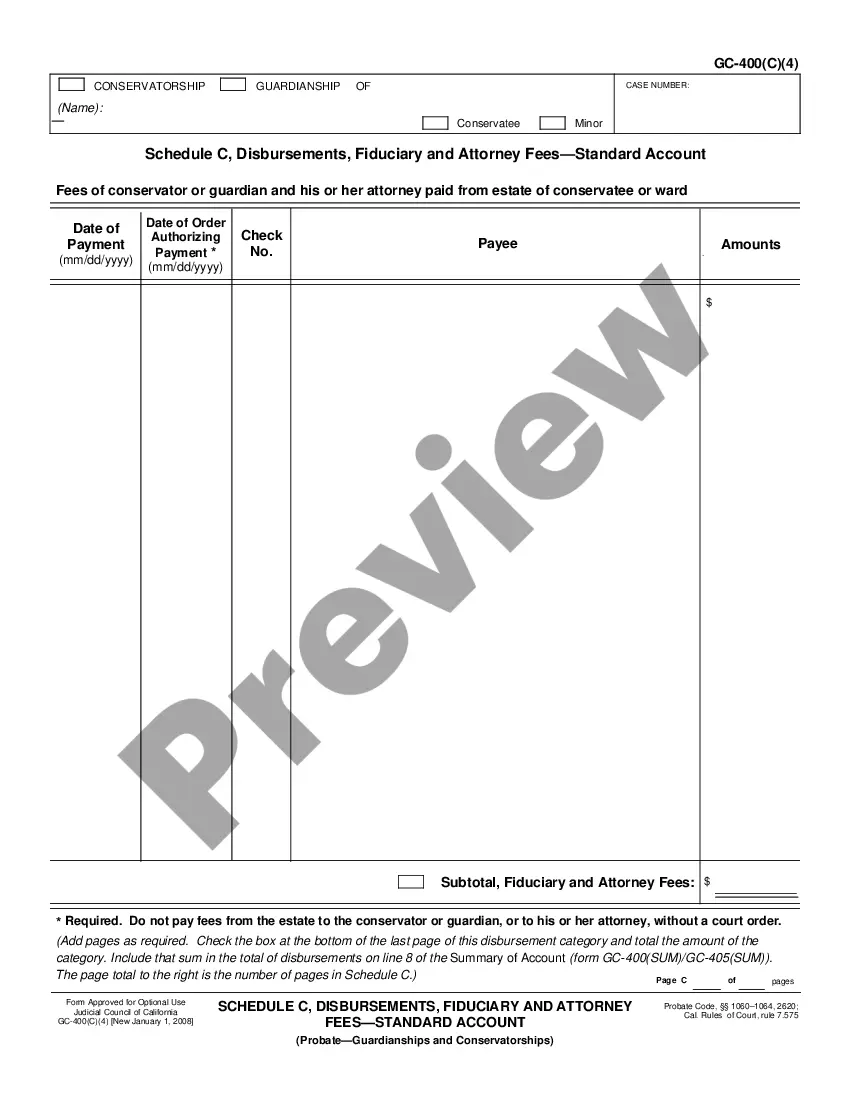

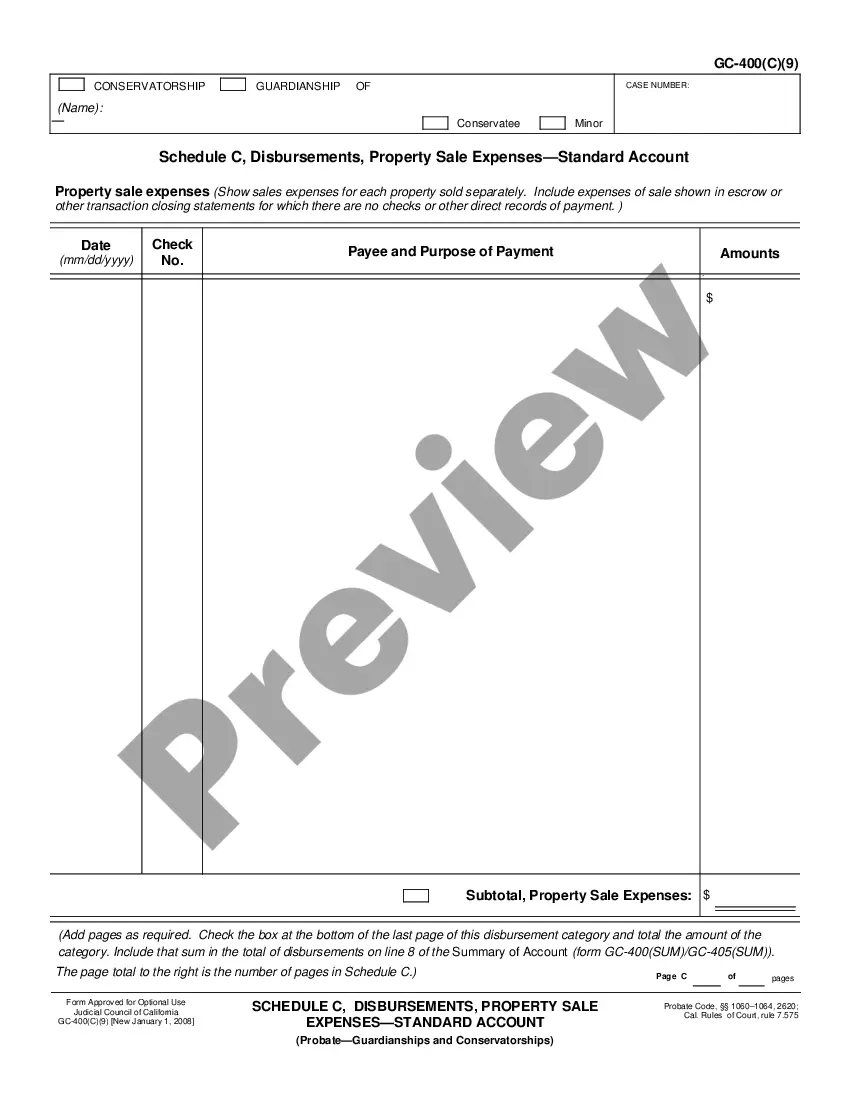

Riverside California Schedule C, Disbursements, Investment Expenses - Standard Account

Description

How to fill out California Schedule C, Disbursements, Investment Expenses - Standard Account?

Are you seeking a reliable and affordable legal forms provider to obtain the Riverside California Schedule C, Disbursements, Investment Expenses - Standard Account? US Legal Forms is your ideal option.

Whether you require a straightforward agreement to set rules for living together with your partner or a bundle of forms to facilitate your separation or divorce through the court system, we've got you covered. Our platform offers over 85,000 current legal document templates for personal and commercial use. All templates that we provide access to are not generic and are tailored based on the requirements of different states and regions.

To download the document, you need to Log In to your account, locate the necessary template, and click the Download button adjacent to it. Please keep in mind that you can download your previously acquired form templates at any time from the My documents tab.

Is this your first time visiting our platform? No problem. You can create an account quickly and easily, but before doing that, ensure to follow these steps.

Now you can register your account. Then choose the subscription option and proceed to payment. After completing the payment, download the Riverside California Schedule C, Disbursements, Investment Expenses - Standard Account in any of the offered file formats. You can revisit the site at any time and redownload the document at no additional expense.

Finding current legal forms has never been simpler. Give US Legal Forms a try now, and stop wasting hours educating yourself about legal paperwork online for good.

- Verify that the Riverside California Schedule C, Disbursements, Investment Expenses - Standard Account complies with your state's and local area's regulations.

- Review the form’s description (if available) to understand who and what the document is designed for.

- Restart your search if the template is not appropriate for your particular situation.