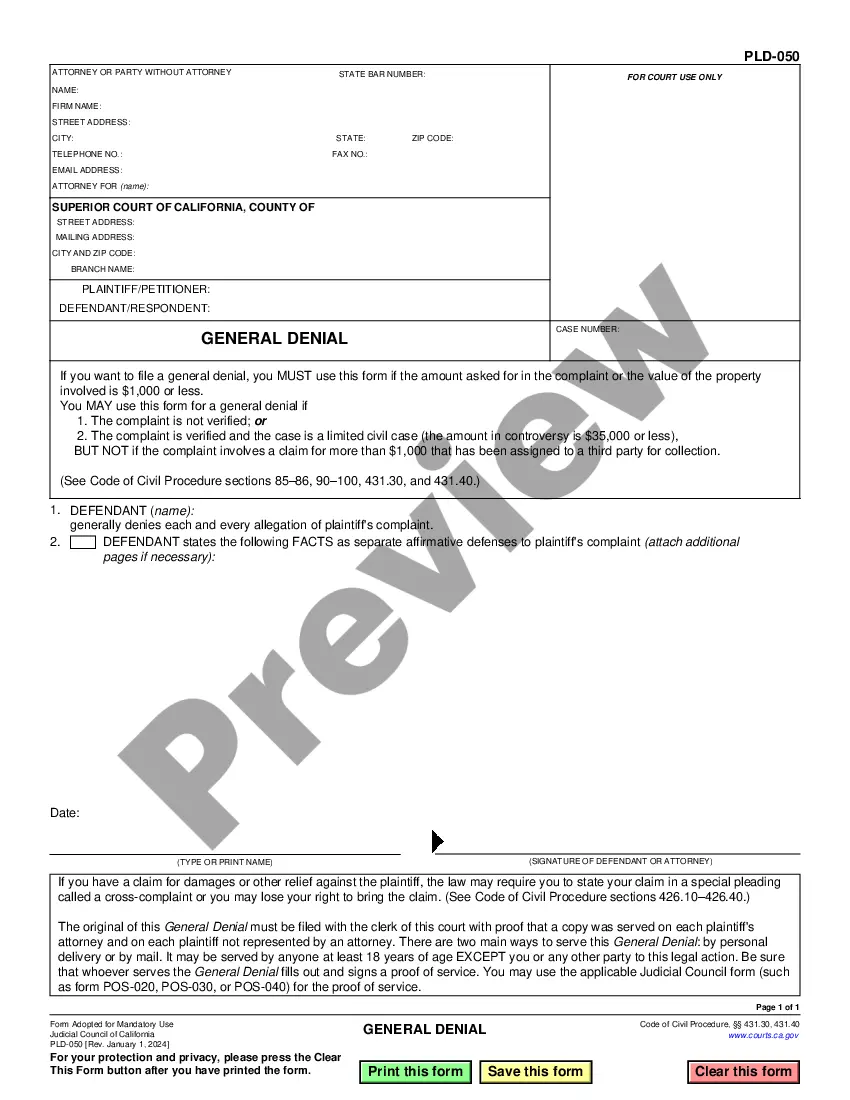

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Santa Clarita California Schedule C, Disbursements, Investment Expenses — Standard Account allows individuals and businesses in Santa Clarita, California to track their financial transactions related to investments and deduct eligible expenses from their taxable income. Here is a detailed description along with relevant keywords: 1. Definition of Santa Clarita California Schedule C: Santa Clarita California Schedule C is an official tax form used by individuals, self-employed individuals, and small business owners in Santa Clarita, California. It pertains specifically to investment-related disbursements and deductions. 2. Importance of Santa Clarita California Schedule C: Completing and submitting Schedule C enables taxpayers to report their investment-related expenses accurately and claim tax deductions, thereby reducing their taxable income. This form is necessary for individuals or businesses engaged in investment activities, such as buying, holding, or selling securities, bonds, mutual funds, or real estate. 3. Disbursements on Santa Clarita California Schedule C: Disbursements refer to the outflow of funds from an individual or business account. On Santa Clarita California Schedule C, taxpayers disclose disbursements made for investment-related purposes, including transaction fees, commissions, dividends reinvestment, interest paid on loans taken for investment purposes, and professional fees paid to investment advisors or financial planners. 4. Investment Expenses on Santa Clarita California Schedule C: Investment expenses are costs incurred during investment activities that can be deducted from taxable income. These expenses include research materials, subscriptions to investment publications, software for tracking investments, tax preparation fees related to investment income, and expenses incurred for attending investment-related seminars or workshops. 5. Different types of Santa Clarita California Schedule C, Disbursements, Investment Expenses — Standard Account: The Santa Clarita California Schedule C, Disbursements, Investment Expenses — Standard Account does not have different types; it is a standard form applicable to all individuals and businesses in Santa Clarita, California engaged in investment activities. 6. Other relevant keywords: — Tax deduction— - Taxable income - Investment-related expenses — California tax regulation— - Tax forms — Itemized deductions - Taplanningin— - IRS guidelines — Tax-advantaged investment— - Qualified dividends — Capital gains - Long-term and short-term investments Note: It is always recommended consulting a certified tax professional or the IRS guidelines for up-to-date and accurate information regarding Santa Clarita California Schedule C, Disbursements, Investment Expenses — Standard Account.Santa Clarita California Schedule C, Disbursements, Investment Expenses — Standard Account allows individuals and businesses in Santa Clarita, California to track their financial transactions related to investments and deduct eligible expenses from their taxable income. Here is a detailed description along with relevant keywords: 1. Definition of Santa Clarita California Schedule C: Santa Clarita California Schedule C is an official tax form used by individuals, self-employed individuals, and small business owners in Santa Clarita, California. It pertains specifically to investment-related disbursements and deductions. 2. Importance of Santa Clarita California Schedule C: Completing and submitting Schedule C enables taxpayers to report their investment-related expenses accurately and claim tax deductions, thereby reducing their taxable income. This form is necessary for individuals or businesses engaged in investment activities, such as buying, holding, or selling securities, bonds, mutual funds, or real estate. 3. Disbursements on Santa Clarita California Schedule C: Disbursements refer to the outflow of funds from an individual or business account. On Santa Clarita California Schedule C, taxpayers disclose disbursements made for investment-related purposes, including transaction fees, commissions, dividends reinvestment, interest paid on loans taken for investment purposes, and professional fees paid to investment advisors or financial planners. 4. Investment Expenses on Santa Clarita California Schedule C: Investment expenses are costs incurred during investment activities that can be deducted from taxable income. These expenses include research materials, subscriptions to investment publications, software for tracking investments, tax preparation fees related to investment income, and expenses incurred for attending investment-related seminars or workshops. 5. Different types of Santa Clarita California Schedule C, Disbursements, Investment Expenses — Standard Account: The Santa Clarita California Schedule C, Disbursements, Investment Expenses — Standard Account does not have different types; it is a standard form applicable to all individuals and businesses in Santa Clarita, California engaged in investment activities. 6. Other relevant keywords: — Tax deduction— - Taxable income - Investment-related expenses — California tax regulation— - Tax forms — Itemized deductions - Taplanningin— - IRS guidelines — Tax-advantaged investment— - Qualified dividends — Capital gains - Long-term and short-term investments Note: It is always recommended consulting a certified tax professional or the IRS guidelines for up-to-date and accurate information regarding Santa Clarita California Schedule C, Disbursements, Investment Expenses — Standard Account.