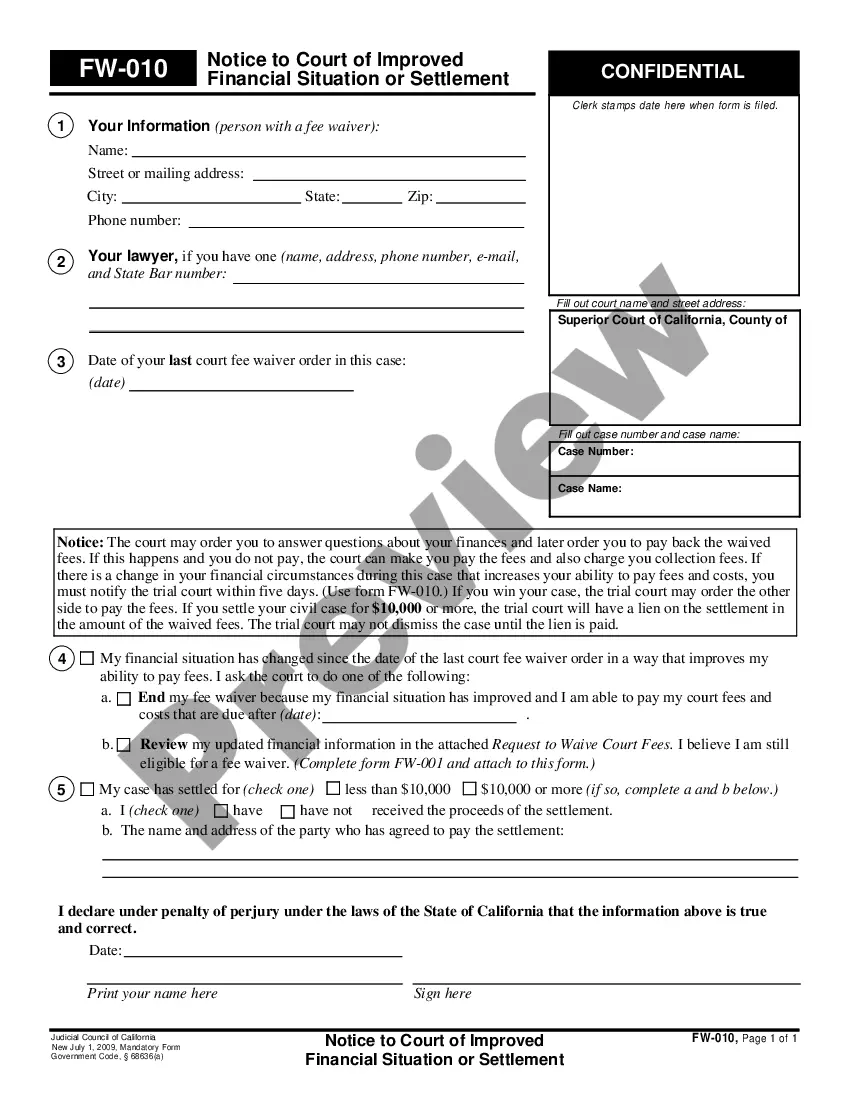

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Temecula California Schedule C is a financial record-keeping form used by residents of Temecula, California, to report income and expenses related to self-employment or small business activities to the Internal Revenue Service (IRS). The Schedule C form is an essential document for self-employed individuals who operate a business as a sole proprietor or single-member LLC. It allows them to report their income and deductible expenses, which ultimately determine their net profit or loss. This information is crucial for calculating the self-employment tax liability. Disbursements, including living expenses, are costs or expenditures made by self-employed individuals in the course of running their business. Various types of disbursements can be categorized into operating expenses, overhead costs, and standard living expenses. The Standard Account is a method of tracking income and expenses using predetermined average costs. By using this method, self-employed individuals don't have to keep track of every single expense but instead utilize an average cost based on their industry's standard. The Standard Account is widely used as a simplified way of calculating business expenses, especially for small businesses. In Temecula, California, some additional types of Schedule C, Disbursements, Living Expenses accounts may be utilized: 1. Home Office Expenses — This category includes expenses directly related to the use of a home office for business purposes. It may encompass utilities, rent or mortgage interest, property taxes, and maintenance costs associated with the dedicated space used as an office. 2. Vehicle Expenses — This account is specifically for deducting expenses related to using a personal vehicle for business purposes. It can cover fuel costs, maintenance and repairs, insurance, registration fees, and depreciation. Self-employed individuals in Temecula may choose between the actual expense method or the mileage method to calculate these deductions. 3. Advertising and Marketing Expenses — This category records expenses related to promoting the business, such as print advertisements, online advertising, website development, business cards, and other marketing materials. 4. Professional Services Expenses — This account includes fees paid to lawyers, accountants, consultants, or any other professional hired to provide services related to the business. 5. Travel and Entertainment Expenses — This category encompasses expenses related to business travel, including airfare, lodging, meals, and transportation costs. Entertainment expenses for clients or potential business associates are also included here. 6. Supplies and Materials Expenses — This account tracks expenses related to office supplies, raw materials, or any other products directly used or consumed by the business. By carefully tracking these various types of expenses and documenting them using the appropriate Schedule C forms, self-employed individuals in Temecula, California can minimize their taxable income and maximize their eligible deductions. Keeping accurate records is essential to ensure compliance with IRS regulations and avoid any potential issues during tax audits.