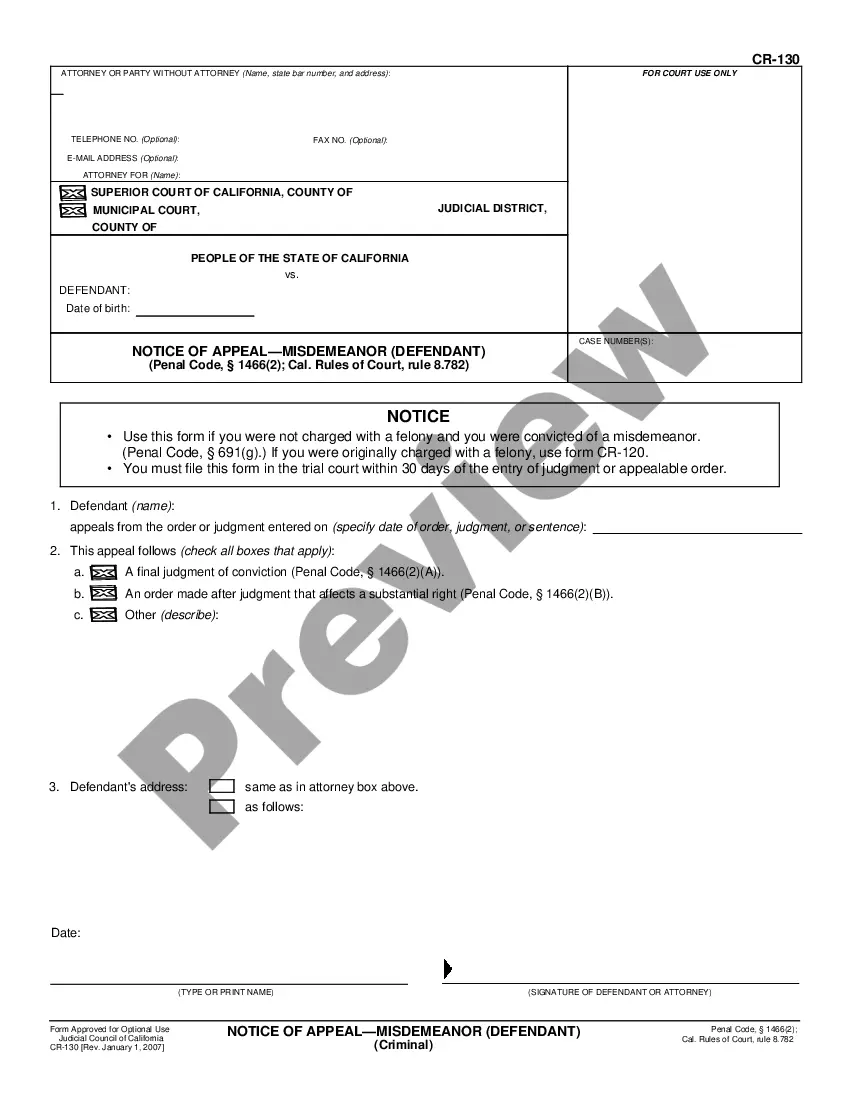

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

West Covina California Schedule C is a financial statement form used by residents of West Covina, California to report income or losses from their business or profession. This form is known as the Profit or Loss from Business form and is an essential part of federal tax filing for self-employed individuals or small business owners. Disbursements refer to the payments or expenses made by a business during a specific period. In the context of West Covina California Schedule C, disbursements would indicate the various expenses incurred by businesses or professionals in West Covina within a given taxable year. These expenses may include but are not limited to: 1. Advertising Expenses: This category encompasses costs associated with promoting or marketing the business, such as print ads, online advertisements, billboards, social media promotions, and other advertising campaigns. 2. Office Expenses: Office expenses include charges related to general office supplies like stationery, computer equipment, software, printer ink, postage, telephone bills, internet charges, and similar operational costs. 3. Rent or Lease Payments: This category includes payments made to rent or lease a commercial space for business purposes, such as an office, store, or warehouse. 4. Utilities: This category covers expenses related to utilities consumed by the business, including electricity, gas, water, internet services, and telephone bills. 5. Insurance Premiums: Any insurance premiums paid by the business for coverage, including liability insurance, property insurance, or professional liability insurance. 6. Travel Expenses: Travel expenses refer to costs incurred during business-related trips, such as airfare, accommodation, meals, and transportation. 7. Maintenance and Repairs: These expenses include costs associated with repairs, maintenance, or servicing of business property, equipment, or vehicles. 8. Professional Services: Fees paid to professionals like accountants, lawyers, consultants, or any outsourced professional services required for the business. 9. Licenses and Permits: Fees paid to obtain necessary licenses, permits, or regulatory certifications required to operate the business legally in West Covina. 10. Depreciation: Depreciation refers to the wear and tear or reduction in value of assets used for business purposes over time. This expense allows businesses to account for the declining value of assets such as vehicles, equipment, or machinery. It is important to note that these are general categories, and specific expenses may vary depending on the nature of each business. Every business owner should carefully maintain records of their expenses and consult with a tax professional to ensure accurate reporting on the West Covina California Schedule C form. Regarding the Living Expenses — Standard Account, it is crucial to clarify that it is not a specific type of Schedule C. The term "Living Expenses — Standard Account" doesn't directly relate to the tax form. However, when completing Schedule C, taxpayers may deduct certain living expenses if they are reasonable and necessary for the operation of their business. These may include a portion of rent or mortgage payments if there is a designated space within a home used exclusively for business activities, home office expenses, or vehicle expenses related to business use. In summary, West Covina California Schedule C is a form used to report business income and expenses for taxpayers in West Covina. Disbursements encompass a wide range of expenses incurred by businesses or professionals, while the Living Expenses — Standard Account refers to reasonable and necessary expenses that can be deducted on Schedule C. It is always advisable to consult with a tax professional or CPA for accurate guidance regarding specific deductions and how they apply to individual situations.