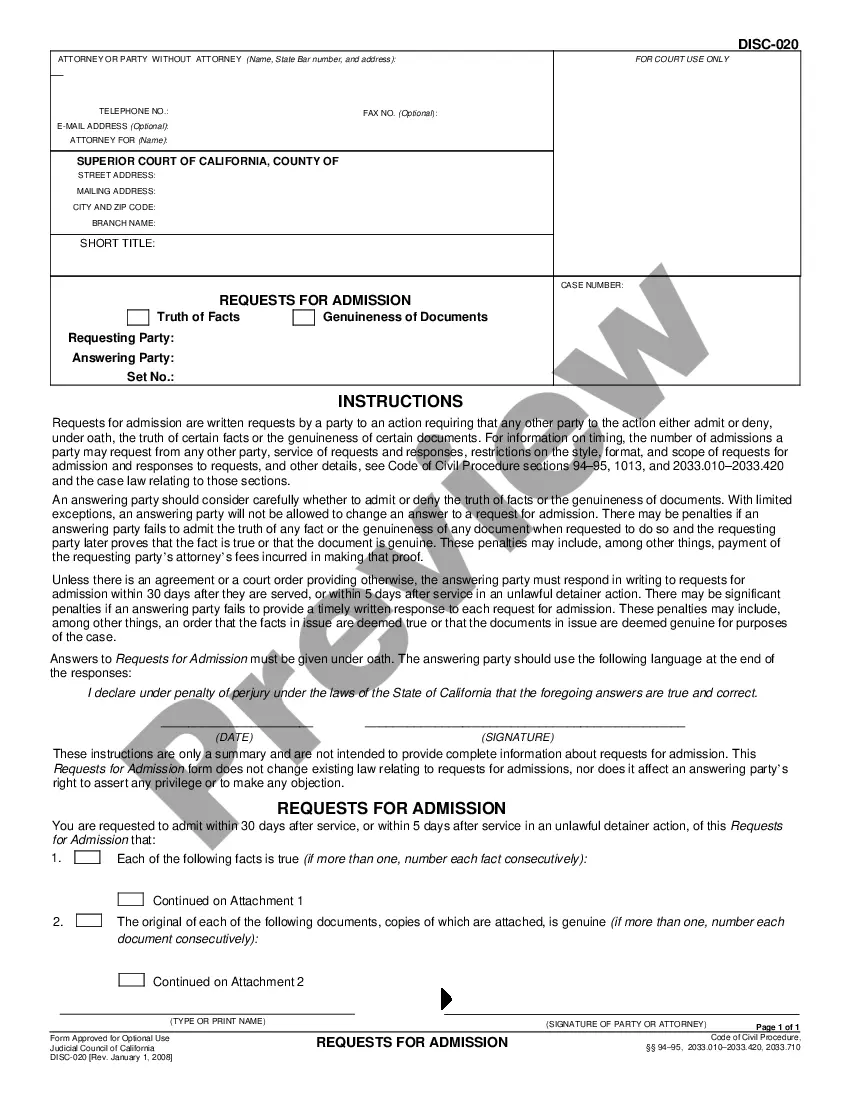

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Antioch California Schedule C, Disbursements, Medical Expenses — Standard Account is a financial document essential for taxpayers in Antioch, California, who are self-employed or operate small businesses. This schedule helps individuals report their income and expenses related to their business, specifically focusing on disbursements and medical expenses. The Schedule C form includes various sections such as income, cost of goods sold, expenses, and information about the business. However, for the purpose of this description, we will primarily focus on disbursements and medical expenses. Disbursements refer to payments made by a business or self-employed individual for various purposes. These can include expenses like office supplies, rent, advertising, utilities, insurance, travel, legal services, and more. By accurately tracking and reporting these disbursements, businesses can deduct them from their income, reducing their taxable income and potentially lowering their tax liability. Medical expenses are another aspect of the Antioch California Schedule C, specifically applicable to self-employed individuals. As per the Internal Revenue Service (IRS) guidelines, self-employed individuals can deduct their medical expenses as a business expense. However, certain conditions must be met, such as the expenses being directly related to the individual's business or trade and not covered by any insurance. It's important to note that there might not be different types of Antioch California Schedule C, Disbursements, Medical Expenses — Standard Account. However, there can be different versions or updates to the form based on yearly changes or revisions made by the IRS. It's crucial to ensure that taxpayers are using the correct version of the form when filing their taxes. To effectively complete the Antioch California Schedule C and accurately report disbursements and medical expenses, individuals should maintain thorough records, including receipts, invoices, and relevant documentation. This information will support any deductions claimed and help ensure compliance with tax regulations. In conclusion, the Antioch California Schedule C, Disbursements, Medical Expenses — Standard Account is a crucial tool for self-employed individuals and small business owners in Antioch, California. It allows them to track and report their disbursements and deductible medical expenses, reducing their taxable income and potentially lowering their tax liability. Keeping accurate records and staying updated with the latest version of the form is essential for proper tax reporting.