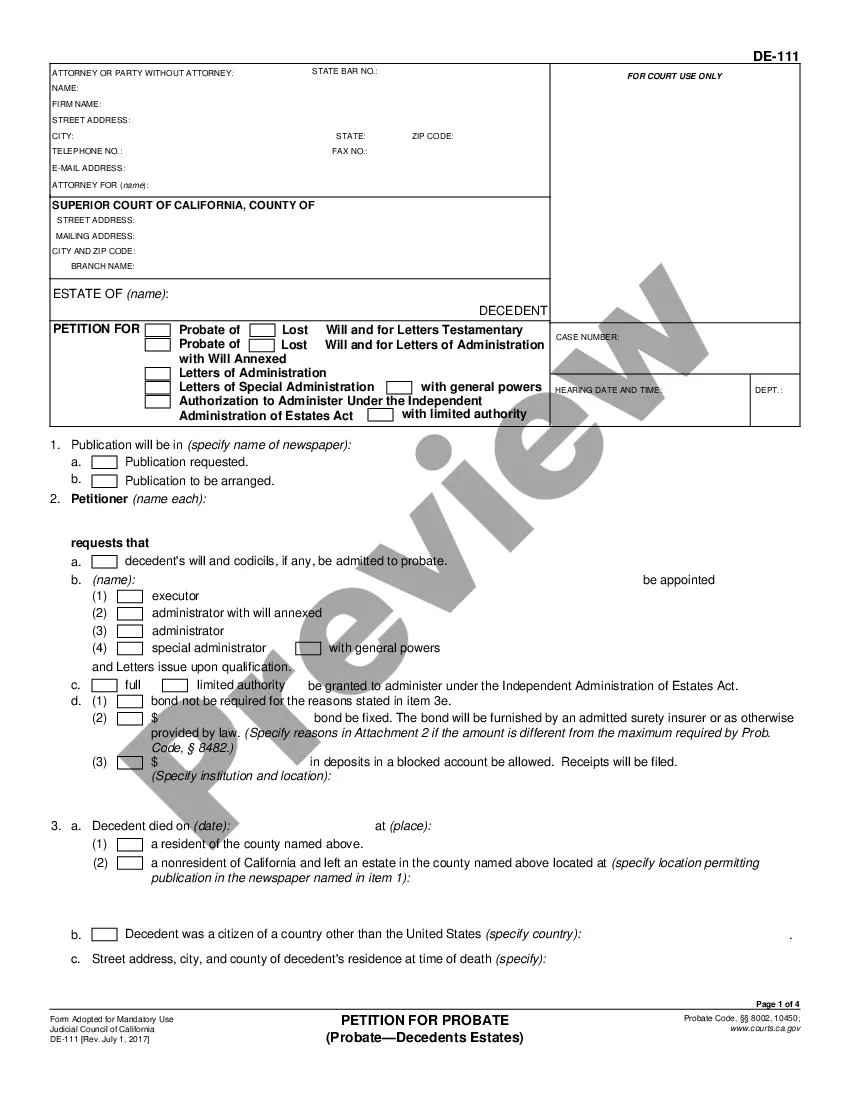

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Contra Costa California Schedule C: In Contra Costa County, California, Schedule C refers to a form used for reporting business income or loss on an individual's tax return. This form is specifically designed for sole proprietors and single-member LCS to report their profit or loss from a business they operate or a profession they practice. Disbursements: Disbursements represent payments made by businesses towards various expenses. In the context of Schedule C in Contra Costa County, disbursements refer to the payments made by sole proprietors or single-member LCS for the purpose of conducting their business operations or to sell their property. Property Sale Expenses — Standard Account: When selling property, such as real estate or other assets, homeowners and investors in Contra Costa County may incur several expenses. These expenses, known as property sale expenses, are associated with the sale and can be deducted from the gain realized on the sale. The Standard Account category refers to standard deductible expenses commonly incurred during property sales. Some examples of property sale expenses that may be included under the Standard Account category on Schedule C in Contra Costa County are: 1. Advertising and marketing expenses for promoting the property sale 2. Real estate agent commissions 3. Legal fees related to the sale process 4. Title insurance and escrow fees 5. Repairs and improvements made to the property before the sale 6. Home inspection fees 7. Transfer taxes and documentation fees 8. Appraisal fees 9. Notary fees 10. Mortgage loan satisfaction fees (if applicable) It's important to note that these expenses must be directly related to the sale of the property in order to qualify for deduction. Additionally, certain expenses may not be deductible or may have limitations, so it's advised to consult with a tax professional or refer to official IRS guidelines for accurate information. Different types of Contra Costa California Schedule C, Disbursements, Property Sale Expenses — Standard Account may vary based on the nature of the business or the specific property being sold. However, within the context of taxation, this standard category encompasses commonly deductible expenses incurred in property sales.Contra Costa California Schedule C: In Contra Costa County, California, Schedule C refers to a form used for reporting business income or loss on an individual's tax return. This form is specifically designed for sole proprietors and single-member LCS to report their profit or loss from a business they operate or a profession they practice. Disbursements: Disbursements represent payments made by businesses towards various expenses. In the context of Schedule C in Contra Costa County, disbursements refer to the payments made by sole proprietors or single-member LCS for the purpose of conducting their business operations or to sell their property. Property Sale Expenses — Standard Account: When selling property, such as real estate or other assets, homeowners and investors in Contra Costa County may incur several expenses. These expenses, known as property sale expenses, are associated with the sale and can be deducted from the gain realized on the sale. The Standard Account category refers to standard deductible expenses commonly incurred during property sales. Some examples of property sale expenses that may be included under the Standard Account category on Schedule C in Contra Costa County are: 1. Advertising and marketing expenses for promoting the property sale 2. Real estate agent commissions 3. Legal fees related to the sale process 4. Title insurance and escrow fees 5. Repairs and improvements made to the property before the sale 6. Home inspection fees 7. Transfer taxes and documentation fees 8. Appraisal fees 9. Notary fees 10. Mortgage loan satisfaction fees (if applicable) It's important to note that these expenses must be directly related to the sale of the property in order to qualify for deduction. Additionally, certain expenses may not be deductible or may have limitations, so it's advised to consult with a tax professional or refer to official IRS guidelines for accurate information. Different types of Contra Costa California Schedule C, Disbursements, Property Sale Expenses — Standard Account may vary based on the nature of the business or the specific property being sold. However, within the context of taxation, this standard category encompasses commonly deductible expenses incurred in property sales.