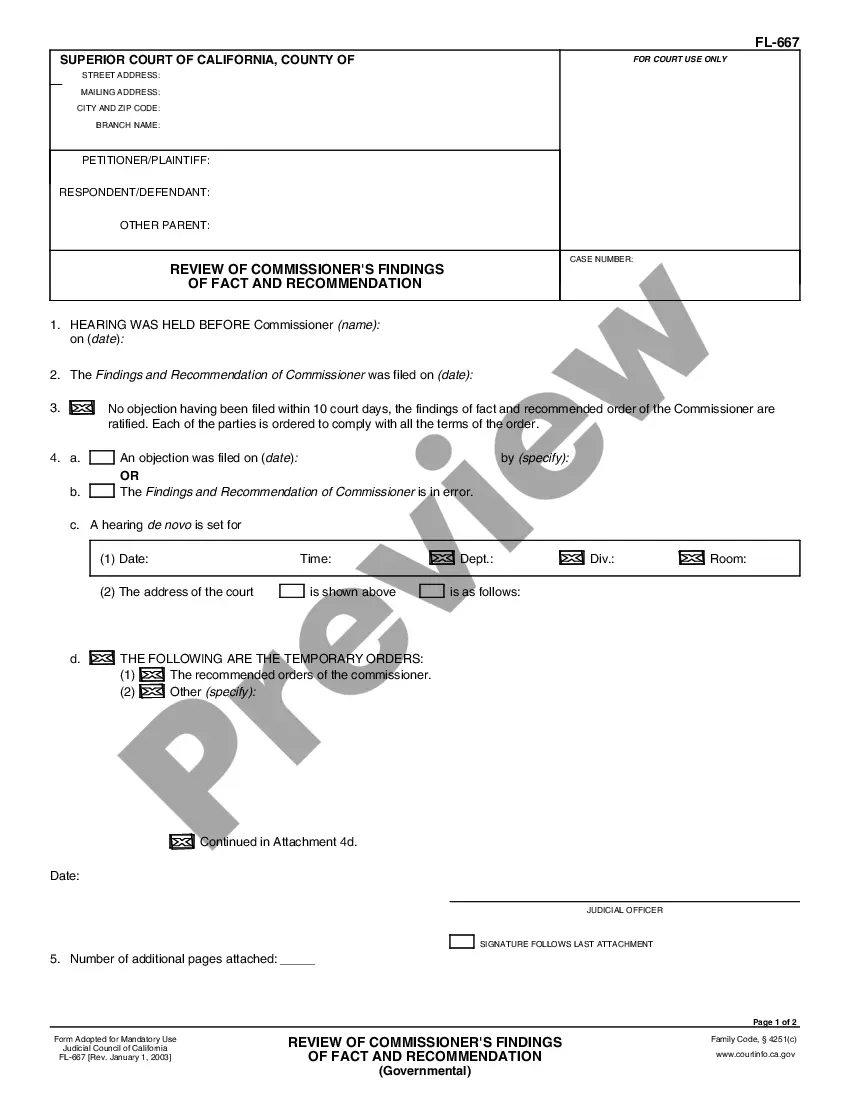

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Elk Grove California Schedule C, Disbursements, and Property Sale Expenses — Standard Account provide a comprehensive overview of the financial aspects associated with property sales in Elk Grove, California. These categories help individuals and businesses track and manage their expenses efficiently. Let's delve into the details of each element: 1. Elk Grove California Schedule C: Elk Grove California Schedule C is a tax form used by self-employed individuals or sole proprietors to report their business income and expenses. It allows them to calculate their net profit or loss for the tax year. The Schedule C form requires detailed information regarding income sources, expenses, and deductions to determine the taxable amount accurately. 2. Disbursements: Disbursements refer to the outflow of funds or payments made by a person or organization. In the context of Elk Grove California Schedule C, disbursements primarily include various property-related expenses incurred during the sale process. These expenses can range from marketing costs to legal fees and brokerage commissions. By tracking disbursements, property owners can assess the financial impact of their property sale. 3. Property Sale Expenses — Standard Account: Property Sale Expenses — Standard Account is a specific classification within Elk Grove California Schedule C that encompasses the regular expenses associated with selling a property. These expenses are considered standard as they occur in most property sales transactions. Common property sale expenses may include: — Marketing and Advertising Costs: expenses for listing the property, hiring photographers, creating promotional materials, and advertising on various platforms. — Appraisal and Inspection Fees: costs associated with property appraisals, home inspections, and pest inspections. — Escrow and Title Fees: charges for escrow services, title search, title insurance, and any associated closing costs. — Legal and Professional Fees: fees paid to attorneys, real estate agents, accountants, or other professionals involved in the sale process. — Brokerage Commissions: compensation paid to real estate agents or brokers involved in the property sale. — Transfer Taxes and Recording Fees: taxes or fees levied by the local government for transferring ownership and recording the sale's documents. — Loan Payoff and Prepayment Penalties: fees associated with paying off existing mortgage loans or any applicable prepayment penalties. — Home Warranty Costs: expenses related to providing a home warranty to the buyers as an incentive. Different Types: While the Elk Grove California Schedule C, Disbursements, Property Sale Expenses — Standard Account cover the general expenses related to property sales, it is essential to note that individual cases may differ. Property sale expenses may vary depending on factors such as property type, location, transaction value, and personal preferences. Therefore, the types and amounts of expenses can vary for each property sale. Overall, understanding Elk Grove California Schedule C, Disbursements, and Property Sale Expenses — Standard Account allows property owners to keep their finances in order, accurately report income and expenses, and maximize their deductions while meeting their tax obligations efficiently.