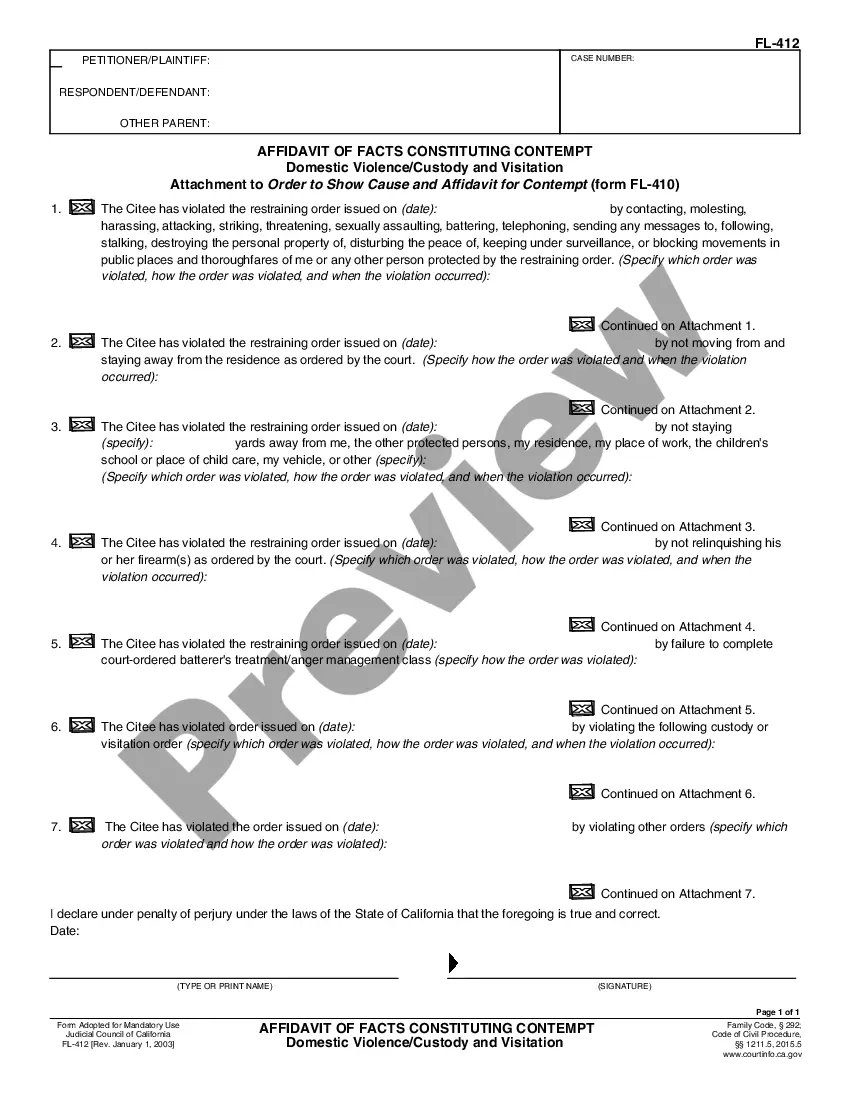

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Inglewood California Schedule C, Disbursements, Property Sale Expenses — Standard Account is a crucial aspect of managing finances and tax implications related to property sales in the city of Inglewood, California. This detailed description will provide insights into the different aspects of this topic, including its definition, types, and relevant keywords. Definition: Schedule C refers to the tax form used by self-employed individuals to report their income and expenses related to a business or profession. In the context of Inglewood, California, Schedule C specifically pertains to property sale expenses incurred by individuals or businesses within the city's jurisdiction. Disbursements: Disbursements reflect the monetary outflows associated with property sales. These expenses encompass a broad range of costs incurred throughout the process, including but not limited to: 1. Real Estate Agent Commissions: The fees paid to real estate agents for their assistance in selling properties. 2. Legal Fees: Expenses related to hiring attorneys or legal professionals for ensuring a smooth property sale transaction. 3. Title Insurance: The cost of obtaining title insurance to protect against any potential future property ownership disputes. 4. Escrow Fees: Charges associated with third-party escrow services involved in facilitating the transfer of property ownership. 5. Inspection Costs: Fees paid to professional inspectors to evaluate the condition of the property before the sale. 6. Transfer Taxes: Taxes imposed by the state or local government on the transfer of property ownership. 7. Recording Fees: Expenses involved in recording the necessary documents with the appropriate government entities. 8. Home Staging: Costs incurred to enhance the visual appeal of the property to attract potential buyers. 9. Marketing and Advertising: Expenses related to promoting the sale of the property through various channels, such as online listings, print media, or open house events. Property Sale Expenses — Standard Account: The term "Standard Account" refers to a general classification of property sale expenses on the Schedule C tax form. It includes all the common and typical disbursements associated with property sales, as mentioned above. The purpose of this classification is to ensure that individuals or businesses can accurately report and deduct their eligible expenses, thereby reducing their overall taxable income. Different Types of Inglewood California Schedule C, Disbursements, Property Sale Expenses: While there are no specific types of Schedule C, Disbursements, Property Sale Expenses exclusively for Inglewood, California, the expense categories mentioned above apply universally to property sales within the city's jurisdiction. However, it's important to note that each property sale transaction may have unique expenses depending on factors such as property type, size, location, and individual circumstances. Keywords: Inglewood California Schedule C, Inglewood CA property sale expenses, California Schedule C property sale, Inglewood property sale disbursements, standard account property sale expenses, Inglewood property sale tax deductions, real estate agent commissions, legal fees, title insurance, escrow fees, inspection costs, transfer taxes, recording fees, home staging, marketing and advertising expenses. By incorporating these relevant keywords and detailed information into the content, readers will gain a comprehensive understanding of Inglewood California Schedule C, Disbursements, Property Sale Expenses — Standard Account and insight into managing their finances and tax obligations when involved in property sales within Inglewood, California.