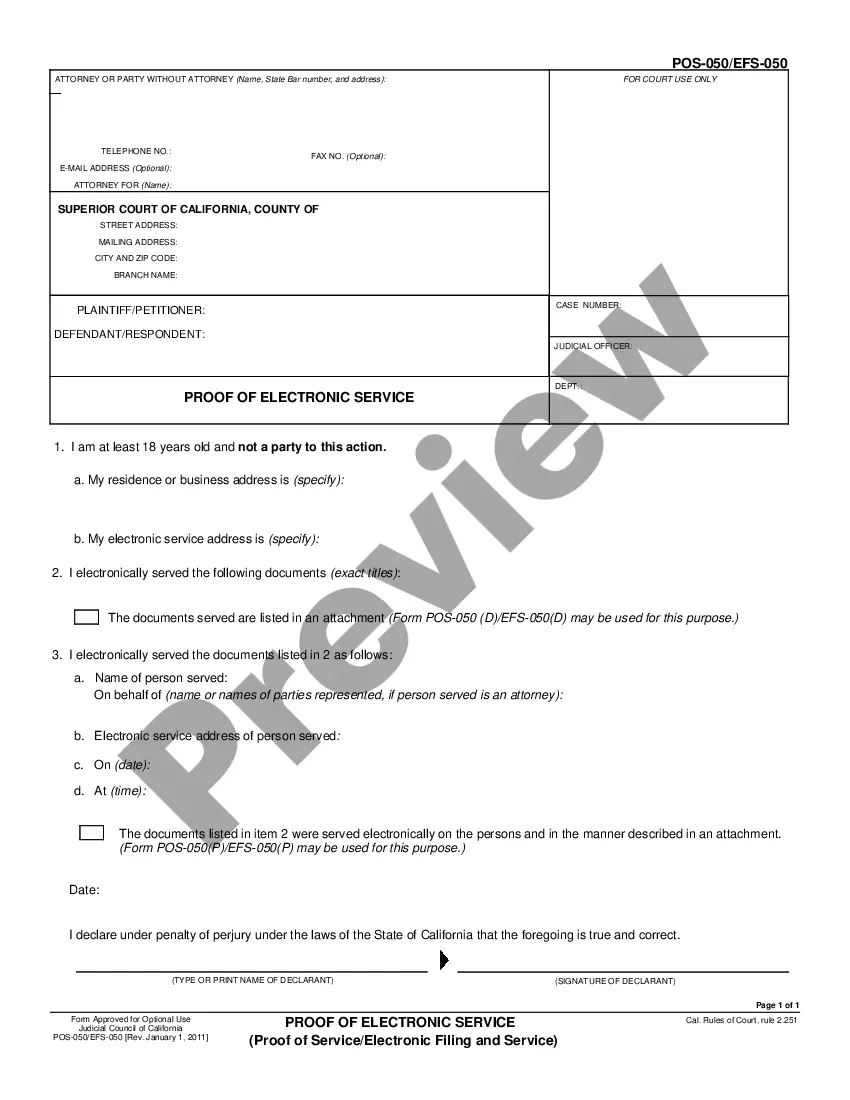

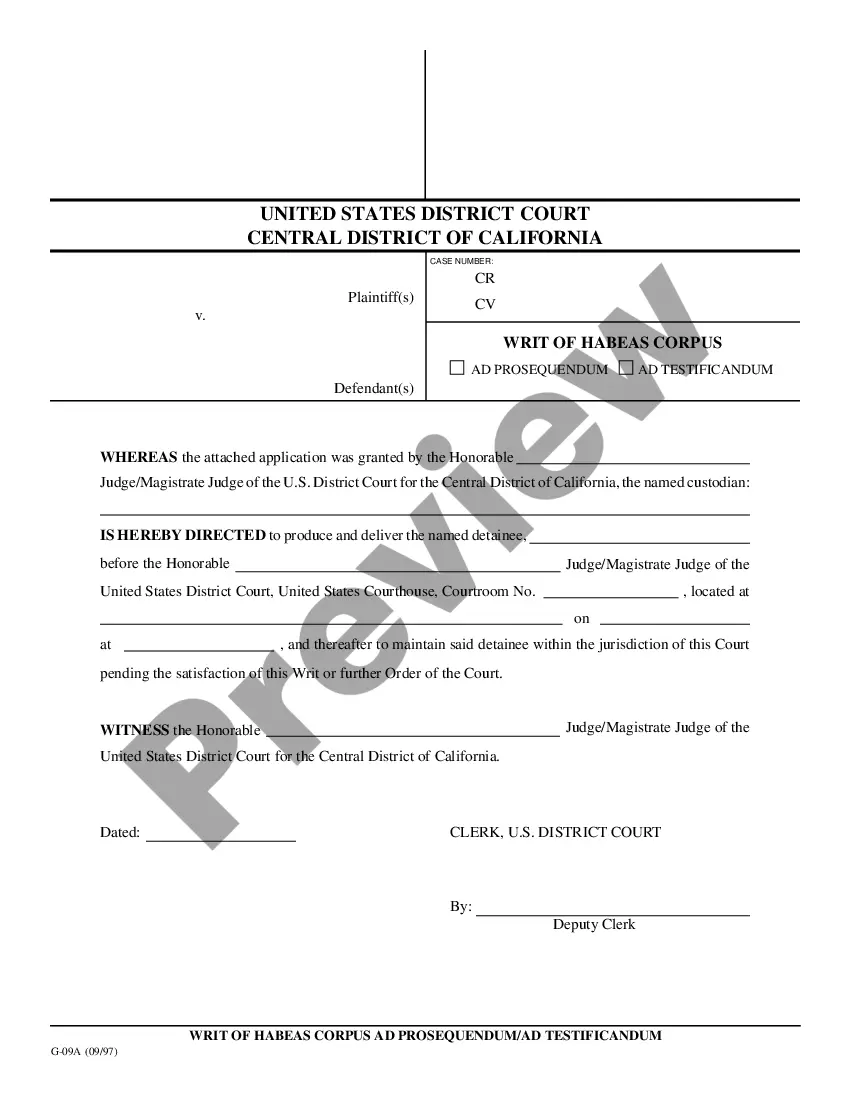

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Jurupa Valley California Schedule C is a specific form used by self-employed individuals or sole proprietors to report their business income and expenses to the Internal Revenue Service (IRS). This form is commonly used by small business owners, freelancers, and independent contractors who file their taxes using a standard accounting method. Disbursements, as referred to in Jurupa Valley California Schedule C, are expenses incurred by the business that are necessary and ordinary for operating the business. These expenses can include various categories such as advertising, office supplies, travel, utilities, insurance, and more. It is important for the business owner to accurately track and document each disbursement to ensure accurate reporting on the Schedule C. Property sale expenses are also included in this form if the business owner has sold any property related to their business during the tax year. These expenses can vary and may include costs such as commissions paid to real estate agents, legal fees, advertisement fees, title search fees, and any other expenses directly related to the property sale. The Standard Account refers to the regular method of accounting used by most businesses, where income is reported when it is earned and expenses are deducted when incurred. It is the most commonly used accounting method for small businesses. While there are no specific types of Jurupa Valley California Schedule C, Disbursements, Property Sale Expenses — Standard Account, the form itself may have variations depending on the individual business's specific circumstances. However, the general purpose of the form remains the same — to report business income and deductible expenses to calculate the net profit or loss for tax purposes. It is crucial for business owners to consult with a tax professional or certified public accountant (CPA) to ensure proper understanding and accurate reporting on their Schedule C. This will help minimize the risk of errors, potential audits, and ensure compliance with the IRS regulations.Jurupa Valley California Schedule C is a specific form used by self-employed individuals or sole proprietors to report their business income and expenses to the Internal Revenue Service (IRS). This form is commonly used by small business owners, freelancers, and independent contractors who file their taxes using a standard accounting method. Disbursements, as referred to in Jurupa Valley California Schedule C, are expenses incurred by the business that are necessary and ordinary for operating the business. These expenses can include various categories such as advertising, office supplies, travel, utilities, insurance, and more. It is important for the business owner to accurately track and document each disbursement to ensure accurate reporting on the Schedule C. Property sale expenses are also included in this form if the business owner has sold any property related to their business during the tax year. These expenses can vary and may include costs such as commissions paid to real estate agents, legal fees, advertisement fees, title search fees, and any other expenses directly related to the property sale. The Standard Account refers to the regular method of accounting used by most businesses, where income is reported when it is earned and expenses are deducted when incurred. It is the most commonly used accounting method for small businesses. While there are no specific types of Jurupa Valley California Schedule C, Disbursements, Property Sale Expenses — Standard Account, the form itself may have variations depending on the individual business's specific circumstances. However, the general purpose of the form remains the same — to report business income and deductible expenses to calculate the net profit or loss for tax purposes. It is crucial for business owners to consult with a tax professional or certified public accountant (CPA) to ensure proper understanding and accurate reporting on their Schedule C. This will help minimize the risk of errors, potential audits, and ensure compliance with the IRS regulations.