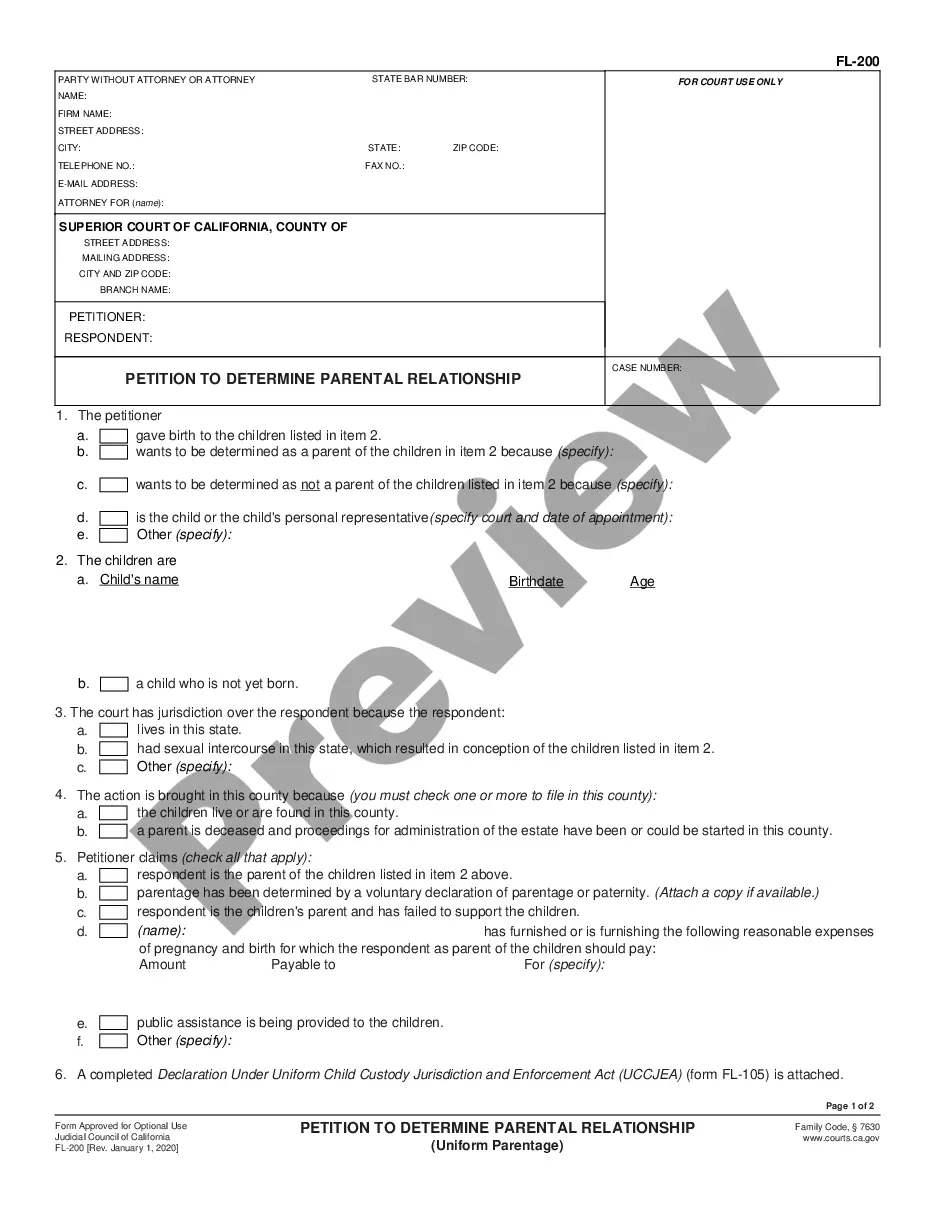

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Long Beach California Schedule C is a tax form used by self-employed individuals to report their income and expenses related to their business. One important category within Schedule C is property sale expenses. These expenses refer to the costs incurred when selling a property. The use of relevant keywords helps to provide a detailed description of this topic. In Long Beach, California, when completing Schedule C, individuals must accurately report their property sale expenses to ensure compliance with tax regulations. The term "disbursements" usually refers to the act of paying out money from a business account to settle expenses. Under the "Property Sale Expenses — Standard Account" section of Long Beach California Schedule C, individuals are required to list all applicable expenses related to the sale of a property. This helps to determine the net gain or loss from the sale and affects the individual's taxable income. Some common property sale expenses that should be reported include: 1. Realtor or agent commissions: These expenses involve payments made to real estate agents or brokers who assisted in the sale of the property. 2. Loan payoff and prepayment penalties: If the property being sold had an outstanding mortgage, any fees associated with paying off the loan or any prepayment penalties should be included. 3. Advertising and marketing costs: Expenses related to advertising the property for sale, such as online listings, newspaper advertisements, or signage, should be accounted for. 4. Legal and escrow fees: Fees paid to attorneys or escrow companies for handling legal documentation and closing the property sale should be documented. 5. Title insurance: Payments made for title insurance, which protects against any ownership disputes, should be included. 6. Home inspection and appraisal fees: Costs associated with professional inspections and property appraisals should be reported as property sale expenses. 7. Repair and maintenance expenses: Any repairs or maintenance performed on the property to prepare it for sale, such as interior and exterior repairs, renovations, or landscaping, should be documented. Different types of Long Beach California Schedule C, Disbursements, Property Sale Expenses — Standard Account may vary based on the nature of the business or specific regulations imposed by the state. However, the mentioned expenses are generally applicable when reporting property sale expenses. It is crucial for individuals in Long Beach, California to keep thorough records of all their property sale expenses for accurate reporting on Schedule C. These expenses can significantly affect the calculation of the individual's taxable income. It is advised to consult with a certified tax professional or utilize tax software for a complete understanding of the reporting requirements and to ensure compliance with tax laws.Long Beach California Schedule C is a tax form used by self-employed individuals to report their income and expenses related to their business. One important category within Schedule C is property sale expenses. These expenses refer to the costs incurred when selling a property. The use of relevant keywords helps to provide a detailed description of this topic. In Long Beach, California, when completing Schedule C, individuals must accurately report their property sale expenses to ensure compliance with tax regulations. The term "disbursements" usually refers to the act of paying out money from a business account to settle expenses. Under the "Property Sale Expenses — Standard Account" section of Long Beach California Schedule C, individuals are required to list all applicable expenses related to the sale of a property. This helps to determine the net gain or loss from the sale and affects the individual's taxable income. Some common property sale expenses that should be reported include: 1. Realtor or agent commissions: These expenses involve payments made to real estate agents or brokers who assisted in the sale of the property. 2. Loan payoff and prepayment penalties: If the property being sold had an outstanding mortgage, any fees associated with paying off the loan or any prepayment penalties should be included. 3. Advertising and marketing costs: Expenses related to advertising the property for sale, such as online listings, newspaper advertisements, or signage, should be accounted for. 4. Legal and escrow fees: Fees paid to attorneys or escrow companies for handling legal documentation and closing the property sale should be documented. 5. Title insurance: Payments made for title insurance, which protects against any ownership disputes, should be included. 6. Home inspection and appraisal fees: Costs associated with professional inspections and property appraisals should be reported as property sale expenses. 7. Repair and maintenance expenses: Any repairs or maintenance performed on the property to prepare it for sale, such as interior and exterior repairs, renovations, or landscaping, should be documented. Different types of Long Beach California Schedule C, Disbursements, Property Sale Expenses — Standard Account may vary based on the nature of the business or specific regulations imposed by the state. However, the mentioned expenses are generally applicable when reporting property sale expenses. It is crucial for individuals in Long Beach, California to keep thorough records of all their property sale expenses for accurate reporting on Schedule C. These expenses can significantly affect the calculation of the individual's taxable income. It is advised to consult with a certified tax professional or utilize tax software for a complete understanding of the reporting requirements and to ensure compliance with tax laws.