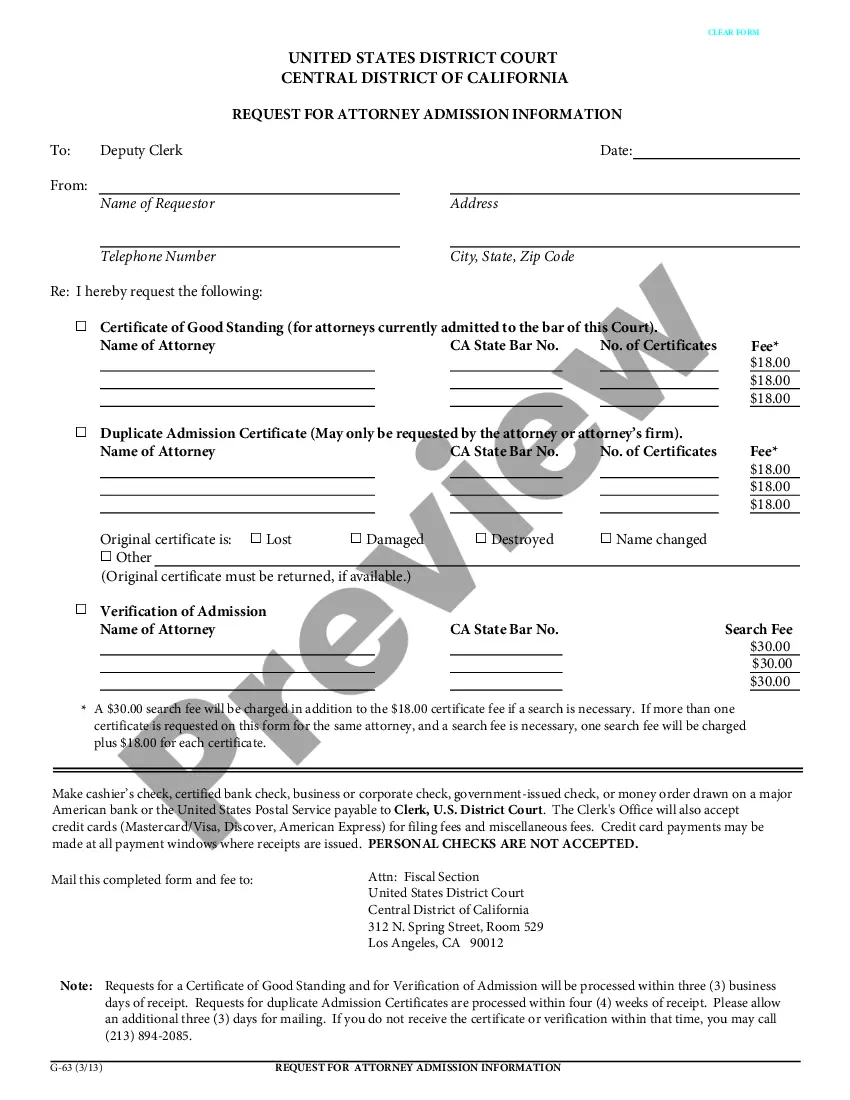

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Title: Los Angeles, California Schedule C: Understanding Disbursements and Property Sale Expenses — Standard Account Introduction: In Los Angeles, California, Schedule C is a crucial element of tax reporting for individuals and businesses engaged in self-employment or sole proprietorship activities, including those related to property sales. This article aims to provide a detailed description of Los Angeles, California Schedule C, focusing specifically on Disbursements and Property Sale Expenses under the Standard Account. Familiarizing yourself with these terms and their different types will help ensure accurate and compliant tax filings. 1. What are Los Angeles, California Schedule C? Los Angeles, California Schedule C is a tax form used by self-employed individuals and sole proprietors to report their business income and expenses. It helps in determining the net profit or loss generated by their business activities, which is then transferred to their personal income tax return. 2. Disbursements Explained: Disbursements, also known as business expenses, are the costs incurred by individuals or businesses in running their operations. In the context of Los Angeles, California Schedule C, disbursements refer to expenses related to property sales made by self-employed individuals or sole proprietors. 3. Property Sale Expenses — Standard Account: Under the Standard Account, property sale expenses include a variety of costs that can be deducted from the gross income derived from selling a property. These expenses help in reducing the taxable gains and, consequently, the overall tax liability. Some common property sale expenses deductible under the Standard Account include: a. Advertising and Marketing Costs: Advertising expenses incurred to promote the property sale, such as online listings, signage, brochures, and open-house events. Keywords: Los Angeles property advertising, real estate marketing expenses. b. Real Estate Professional Fees: Fees paid to real estate agents, brokers, or other professionals involved in the property sale process. Keywords: Los Angeles real estate agent fees, property sales commissions. c. Title Insurance and Escrow Fees: Costs associated with securing title insurance and escrow services during the property sale transaction. Keywords: Los Angeles title insurance fees, property escrow charges. d. Legal and Professional Fees: Fees paid to attorneys, accountants, or other professionals for legal or financial assistance during the property sale. Keywords: Los Angeles property sale legal fees, professional consultation costs. e. Home Staging and Renovation Expenses: Expenses incurred for preparing the property before listing it for sale, including home staging, repairs, renovations, and maintenance. Keywords: Los Angeles home staging costs, property renovation expenses. f. Mortgage and Loan Related Expenses: Interest payments, loan origination fees, and other mortgage-related charges applicable to the property being sold. Keywords: Los Angeles property sale loan expenses, mortgage interest deductions. Note: The specific expenses deductible under Schedule C may vary based on individual circumstances and tax regulations. It is crucial to consult a tax professional or refer to the official IRS guidelines for accurate information. Conclusion: Los Angeles, California Schedule C plays a vital role for self-employed individuals and sole proprietors in reporting their business income and expenses. When it comes to property sales, understanding the various disbursements and property sale expenses under the Standard Account is crucial to accurately deduct eligible costs. By utilizing appropriate keywords and seeking professional advice, individuals can navigate these aspects of tax reporting effectively and ensure compliance with Los Angeles, California tax laws.Title: Los Angeles, California Schedule C: Understanding Disbursements and Property Sale Expenses — Standard Account Introduction: In Los Angeles, California, Schedule C is a crucial element of tax reporting for individuals and businesses engaged in self-employment or sole proprietorship activities, including those related to property sales. This article aims to provide a detailed description of Los Angeles, California Schedule C, focusing specifically on Disbursements and Property Sale Expenses under the Standard Account. Familiarizing yourself with these terms and their different types will help ensure accurate and compliant tax filings. 1. What are Los Angeles, California Schedule C? Los Angeles, California Schedule C is a tax form used by self-employed individuals and sole proprietors to report their business income and expenses. It helps in determining the net profit or loss generated by their business activities, which is then transferred to their personal income tax return. 2. Disbursements Explained: Disbursements, also known as business expenses, are the costs incurred by individuals or businesses in running their operations. In the context of Los Angeles, California Schedule C, disbursements refer to expenses related to property sales made by self-employed individuals or sole proprietors. 3. Property Sale Expenses — Standard Account: Under the Standard Account, property sale expenses include a variety of costs that can be deducted from the gross income derived from selling a property. These expenses help in reducing the taxable gains and, consequently, the overall tax liability. Some common property sale expenses deductible under the Standard Account include: a. Advertising and Marketing Costs: Advertising expenses incurred to promote the property sale, such as online listings, signage, brochures, and open-house events. Keywords: Los Angeles property advertising, real estate marketing expenses. b. Real Estate Professional Fees: Fees paid to real estate agents, brokers, or other professionals involved in the property sale process. Keywords: Los Angeles real estate agent fees, property sales commissions. c. Title Insurance and Escrow Fees: Costs associated with securing title insurance and escrow services during the property sale transaction. Keywords: Los Angeles title insurance fees, property escrow charges. d. Legal and Professional Fees: Fees paid to attorneys, accountants, or other professionals for legal or financial assistance during the property sale. Keywords: Los Angeles property sale legal fees, professional consultation costs. e. Home Staging and Renovation Expenses: Expenses incurred for preparing the property before listing it for sale, including home staging, repairs, renovations, and maintenance. Keywords: Los Angeles home staging costs, property renovation expenses. f. Mortgage and Loan Related Expenses: Interest payments, loan origination fees, and other mortgage-related charges applicable to the property being sold. Keywords: Los Angeles property sale loan expenses, mortgage interest deductions. Note: The specific expenses deductible under Schedule C may vary based on individual circumstances and tax regulations. It is crucial to consult a tax professional or refer to the official IRS guidelines for accurate information. Conclusion: Los Angeles, California Schedule C plays a vital role for self-employed individuals and sole proprietors in reporting their business income and expenses. When it comes to property sales, understanding the various disbursements and property sale expenses under the Standard Account is crucial to accurately deduct eligible costs. By utilizing appropriate keywords and seeking professional advice, individuals can navigate these aspects of tax reporting effectively and ensure compliance with Los Angeles, California tax laws.