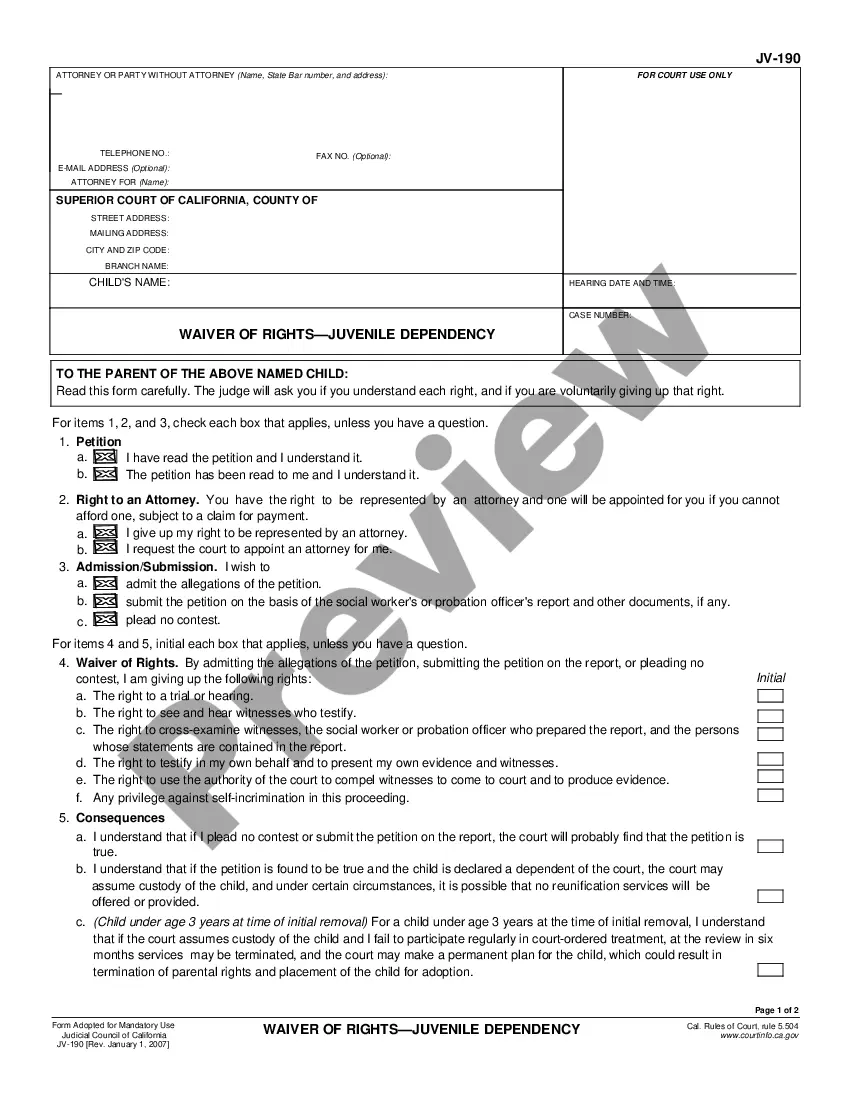

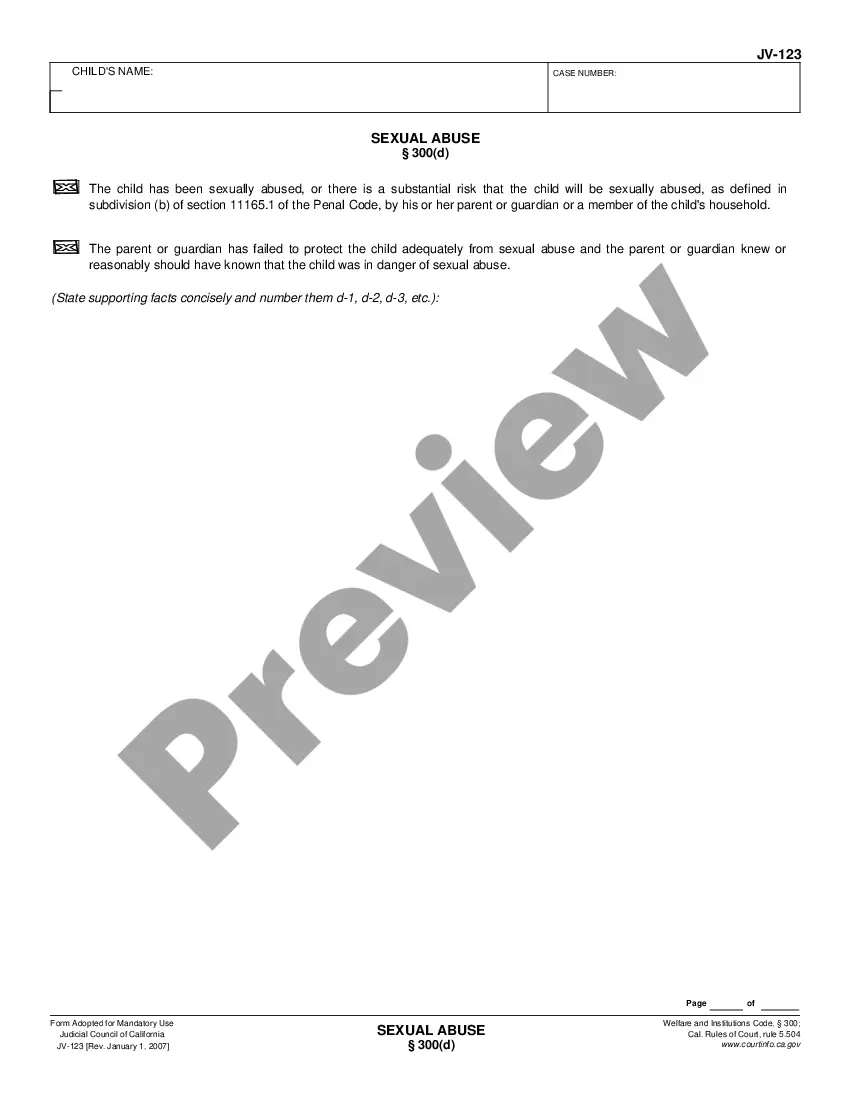

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Oxnard California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D) is a specific form used to report losses incurred from the sale of assets or investments in the city of Oxnard, California. This form is crucial for taxpayers who have experienced a loss on the sale of their assets, as it allows them to deduct these losses from their overall taxable income. There are two types of Oxnard California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D): 1. Standard Schedule D: This is the traditional and more comprehensive version of the form. Taxpayers with complex financial situations or multiple asset sales are required to use this form. The Standard Schedule D provides more detailed information about each specific asset, including the date of sale, purchase price, sale price, and the resulting loss. 2. Simplified Schedule D: For individuals with straightforward financial situations or minimal asset sales, the Simplified Schedule D offers a more streamlined process. This version requires taxpayers to provide a summary of their total losses, without the need for detailed information about each individual asset sale. When completing Oxnard California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D), taxpayers should gather all relevant documentation, including sale receipts, purchase receipts, and any other supporting documents that validate the losses incurred. It is essential to accurately calculate and report the losses to ensure compliance with tax regulations and maximize potential deductions. By using relevant and specific keywords such as "Oxnard California Schedule D," "losses on sales," "standard and simplified accounts," and "405(D)," taxpayers can easily find information and resources related to this particular tax form, helping them navigate the process efficiently and effectively.Oxnard California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D) is a specific form used to report losses incurred from the sale of assets or investments in the city of Oxnard, California. This form is crucial for taxpayers who have experienced a loss on the sale of their assets, as it allows them to deduct these losses from their overall taxable income. There are two types of Oxnard California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D): 1. Standard Schedule D: This is the traditional and more comprehensive version of the form. Taxpayers with complex financial situations or multiple asset sales are required to use this form. The Standard Schedule D provides more detailed information about each specific asset, including the date of sale, purchase price, sale price, and the resulting loss. 2. Simplified Schedule D: For individuals with straightforward financial situations or minimal asset sales, the Simplified Schedule D offers a more streamlined process. This version requires taxpayers to provide a summary of their total losses, without the need for detailed information about each individual asset sale. When completing Oxnard California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D), taxpayers should gather all relevant documentation, including sale receipts, purchase receipts, and any other supporting documents that validate the losses incurred. It is essential to accurately calculate and report the losses to ensure compliance with tax regulations and maximize potential deductions. By using relevant and specific keywords such as "Oxnard California Schedule D," "losses on sales," "standard and simplified accounts," and "405(D)," taxpayers can easily find information and resources related to this particular tax form, helping them navigate the process efficiently and effectively.