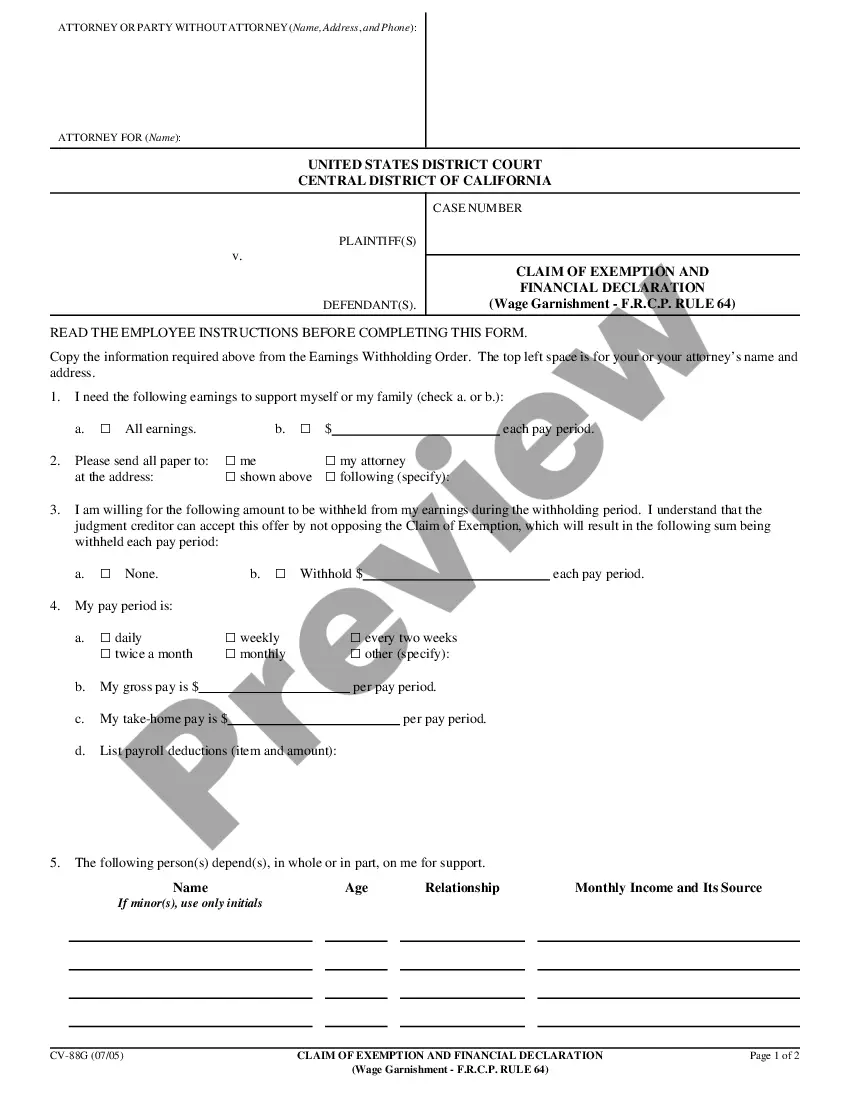

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Vallejo California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D), is a tax form used by individuals and businesses in Vallejo, California, to report capital losses from the sale of assets. This schedule is specifically designed to help individuals and businesses calculate and report any losses incurred from the sale of assets during the tax year. The Standard Accounts 405(D) is the default form used by most individuals and businesses to report capital losses on sales. It requires the taxpayer to provide detailed information about each asset sold, including the date of sale, the purchase price, and the selling price. Additionally, any brokerage or transaction fees associated with the sale should also be reported on this form. On the other hand, the Simplified Accounts 405(D) is an alternative form available for taxpayers who meet specific criteria. This simplified version allows for a streamlined reporting process, reducing the amount of information required. Taxpayers eligible for this form can report their total capital losses without providing detailed information about each asset sold. When filling out either the Standard or Simplified Accounts 405(D), it is essential to accurately calculate and report your capital losses. These losses can be carried forward to offset future capital gains or used to reduce your taxable income. To complete the Vallejo California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D), you will need to gather all relevant information on the assets sold during the tax year, including purchase and selling prices, transaction fees, and any other pertinent details. Make sure to consult with a tax professional or use reliable tax software to ensure accurate reporting and compliance with Vallejo, California, tax laws. Keywords: Vallejo California, Schedule D, Losses on Sales, Standard Accounts 405(D), Simplified Accounts 405(D), tax form, capital losses, assets sold, tax year, calculate, report, brokerage fees, transaction fees, taxable income, carried forward, offset, future gains, tax professional, tax software, compliance, tax laws.Vallejo California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D), is a tax form used by individuals and businesses in Vallejo, California, to report capital losses from the sale of assets. This schedule is specifically designed to help individuals and businesses calculate and report any losses incurred from the sale of assets during the tax year. The Standard Accounts 405(D) is the default form used by most individuals and businesses to report capital losses on sales. It requires the taxpayer to provide detailed information about each asset sold, including the date of sale, the purchase price, and the selling price. Additionally, any brokerage or transaction fees associated with the sale should also be reported on this form. On the other hand, the Simplified Accounts 405(D) is an alternative form available for taxpayers who meet specific criteria. This simplified version allows for a streamlined reporting process, reducing the amount of information required. Taxpayers eligible for this form can report their total capital losses without providing detailed information about each asset sold. When filling out either the Standard or Simplified Accounts 405(D), it is essential to accurately calculate and report your capital losses. These losses can be carried forward to offset future capital gains or used to reduce your taxable income. To complete the Vallejo California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D), you will need to gather all relevant information on the assets sold during the tax year, including purchase and selling prices, transaction fees, and any other pertinent details. Make sure to consult with a tax professional or use reliable tax software to ensure accurate reporting and compliance with Vallejo, California, tax laws. Keywords: Vallejo California, Schedule D, Losses on Sales, Standard Accounts 405(D), Simplified Accounts 405(D), tax form, capital losses, assets sold, tax year, calculate, report, brokerage fees, transaction fees, taxable income, carried forward, offset, future gains, tax professional, tax software, compliance, tax laws.