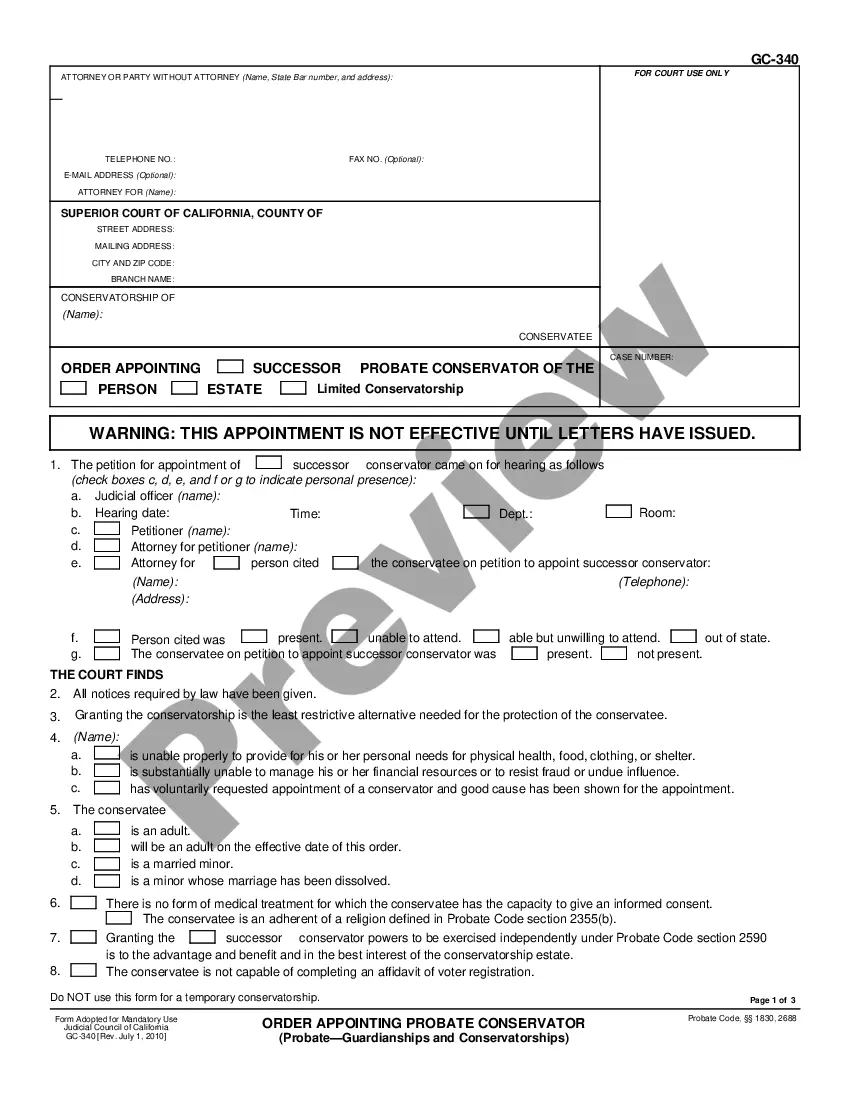

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

In Anaheim, California, cash assets on hand at the end of an accounting period play a critical role in assessing the financial health of individuals and organizations. There are various types of Anaheim California Cash Assets on Hand at End of Account Period-Standard and Simplified Accounts that one should be aware of. Standard Accounts: 1. Cash in the Bank: This refers to the amount of money held in bank accounts, including checking and savings accounts, specifically designated for daily financial transactions and liquidity purposes. It reflects the actual cash balance available for immediate use. 2. Petty Cash Fund: Anaheim California Cash Assets on Hand at End of Account Period-Standard Accounts also includes the petty cash fund, which represents a small amount of cash set aside for day-to-day minor expenses, such as office supplies, postage, or minor emergency purchases. 3. Cash Equivalents: Under standard accounting practices, cash equivalents refer to highly liquid assets that can be quickly converted into cash within a short time frame (usually three months or less). Examples of cash equivalents may include Treasury bills, commercial papers, or money market funds. Simplified Accounts: 1. Cash on Hand: Individuals or small businesses in Anaheim, California, with simplified accounts often record cash on hand. This category covers any physical cash retained outside of bank accounts, such as in a cash register or a secure location, to fulfill immediate payment obligations. 2. Cash Under the Mattress: In some cases, individuals may choose to keep cash at home, referred to as "cash under the mattress." Although not a recommended practice due to security concerns, this category represents cash assets physically stored within an individual's residence. 3. Cash Investments: Simplified accounts may also include cash assets that have been invested in short-term, low-risk investments, such as certificates of deposit (CDs) or government savings bonds. While not as liquid as other cash assets, they can be converted into cash without significant penalties or delays. It is essential for individuals and organizations to maintain accurate records of these cash assets on hand at the end of an accounting period. Understanding the different types of cash assets allows for better financial planning, decision-making, and evaluation of financial performance in Anaheim, California.In Anaheim, California, cash assets on hand at the end of an accounting period play a critical role in assessing the financial health of individuals and organizations. There are various types of Anaheim California Cash Assets on Hand at End of Account Period-Standard and Simplified Accounts that one should be aware of. Standard Accounts: 1. Cash in the Bank: This refers to the amount of money held in bank accounts, including checking and savings accounts, specifically designated for daily financial transactions and liquidity purposes. It reflects the actual cash balance available for immediate use. 2. Petty Cash Fund: Anaheim California Cash Assets on Hand at End of Account Period-Standard Accounts also includes the petty cash fund, which represents a small amount of cash set aside for day-to-day minor expenses, such as office supplies, postage, or minor emergency purchases. 3. Cash Equivalents: Under standard accounting practices, cash equivalents refer to highly liquid assets that can be quickly converted into cash within a short time frame (usually three months or less). Examples of cash equivalents may include Treasury bills, commercial papers, or money market funds. Simplified Accounts: 1. Cash on Hand: Individuals or small businesses in Anaheim, California, with simplified accounts often record cash on hand. This category covers any physical cash retained outside of bank accounts, such as in a cash register or a secure location, to fulfill immediate payment obligations. 2. Cash Under the Mattress: In some cases, individuals may choose to keep cash at home, referred to as "cash under the mattress." Although not a recommended practice due to security concerns, this category represents cash assets physically stored within an individual's residence. 3. Cash Investments: Simplified accounts may also include cash assets that have been invested in short-term, low-risk investments, such as certificates of deposit (CDs) or government savings bonds. While not as liquid as other cash assets, they can be converted into cash without significant penalties or delays. It is essential for individuals and organizations to maintain accurate records of these cash assets on hand at the end of an accounting period. Understanding the different types of cash assets allows for better financial planning, decision-making, and evaluation of financial performance in Anaheim, California.