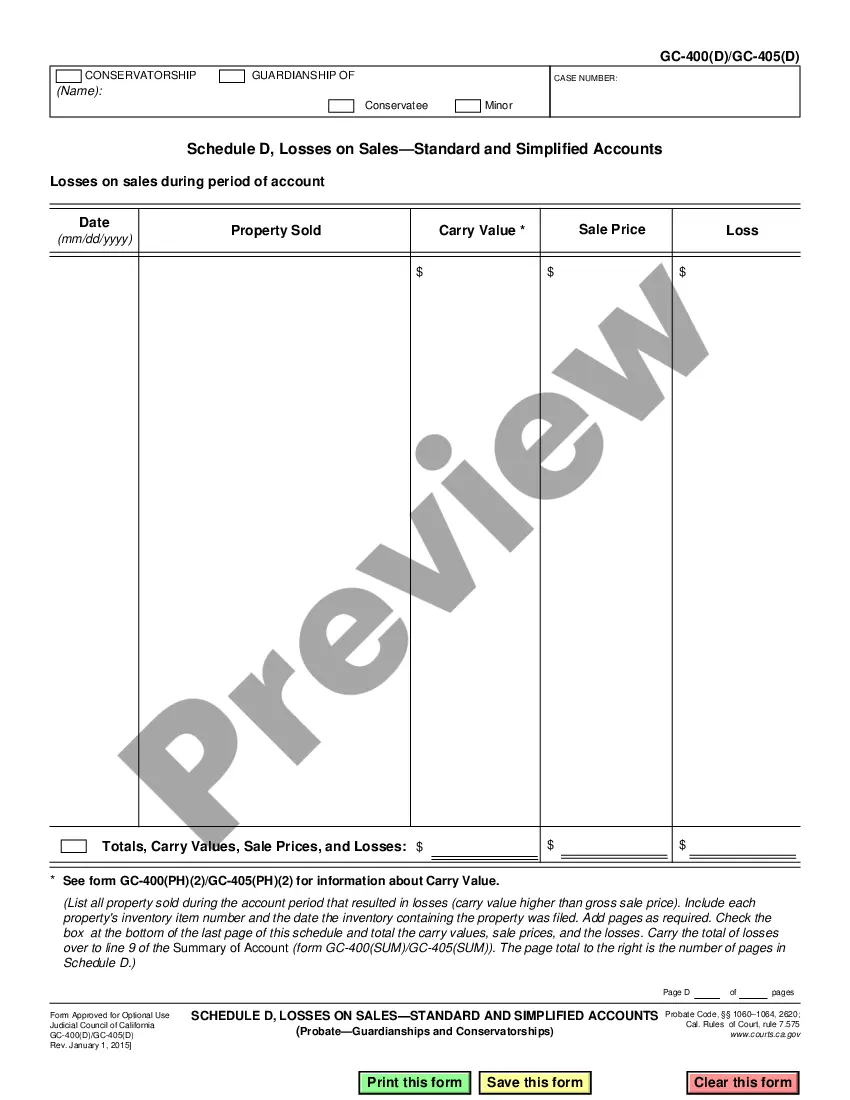

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Elk Grove California Cash Assets on Hand at End of Account Period-Standard and Simplified Accounts refers to the total amount of cash available to a business located in Elk Grove, California, at the end of a specific accounting period. This financial information is crucial for assessing the financial health and liquidity of a company and forms a key component of its balance sheet. In standard accounting practices, Elk Grove businesses maintain a comprehensive record of their cash assets on hand at the end of each accounting period. This includes all physical cash in registers, safes, and vaults, as well as any cash equivalents such as easily convertible investments or highly liquid assets. Cash assets may also comprise bank account balances, including checking and savings accounts, and petty cash funds. However, businesses that opt for simplified accounting methods, such as small sole proprietors or partnerships, may follow a different approach to determine their cash assets on hand at the end of the account period. In simplified accounting, the focus is often on cash transactions and does not include complex financial instruments or transactions. Cash assets for simplified accounts primarily consist of physical cash on hand, cash in bank accounts, and potentially other easily convertible forms of cash. It is important for businesses to accurately calculate their Elk Grove California Cash Assets on Hand at End of Account Period-Standard and Simplified Accounts as it enables them to assess their ability to meet short-term financial obligations, make necessary investments, and evaluate their cash flow management. Effectively managing cash assets is crucial for businesses of all sizes in Elk Grove, as it helps to ensure smooth day-to-day operations, payroll management, inventory purchases, and other essential financial activities. Accurate and up-to-date the tracking of cash assets also provides valuable information for stakeholders, creditors, and potential investors when assessing a company's financial stability and making strategic decisions. Keywords: Elk Grove California, cash assets, account period, standard and simplified accounts, financial health, liquidity, balance sheet, physical cash, cash equivalents, bank account balances, small business, sole proprietors, partnerships, simplified accounting methods, cash transactions, cash on hand, cash in bank accounts, financial instruments, financial obligations, cash flow management, managing cash assets, day-to-day operations, payroll management, inventory purchases, financial stability, stakeholders, creditors, potential investors, strategic decisions.Elk Grove California Cash Assets on Hand at End of Account Period-Standard and Simplified Accounts refers to the total amount of cash available to a business located in Elk Grove, California, at the end of a specific accounting period. This financial information is crucial for assessing the financial health and liquidity of a company and forms a key component of its balance sheet. In standard accounting practices, Elk Grove businesses maintain a comprehensive record of their cash assets on hand at the end of each accounting period. This includes all physical cash in registers, safes, and vaults, as well as any cash equivalents such as easily convertible investments or highly liquid assets. Cash assets may also comprise bank account balances, including checking and savings accounts, and petty cash funds. However, businesses that opt for simplified accounting methods, such as small sole proprietors or partnerships, may follow a different approach to determine their cash assets on hand at the end of the account period. In simplified accounting, the focus is often on cash transactions and does not include complex financial instruments or transactions. Cash assets for simplified accounts primarily consist of physical cash on hand, cash in bank accounts, and potentially other easily convertible forms of cash. It is important for businesses to accurately calculate their Elk Grove California Cash Assets on Hand at End of Account Period-Standard and Simplified Accounts as it enables them to assess their ability to meet short-term financial obligations, make necessary investments, and evaluate their cash flow management. Effectively managing cash assets is crucial for businesses of all sizes in Elk Grove, as it helps to ensure smooth day-to-day operations, payroll management, inventory purchases, and other essential financial activities. Accurate and up-to-date the tracking of cash assets also provides valuable information for stakeholders, creditors, and potential investors when assessing a company's financial stability and making strategic decisions. Keywords: Elk Grove California, cash assets, account period, standard and simplified accounts, financial health, liquidity, balance sheet, physical cash, cash equivalents, bank account balances, small business, sole proprietors, partnerships, simplified accounting methods, cash transactions, cash on hand, cash in bank accounts, financial instruments, financial obligations, cash flow management, managing cash assets, day-to-day operations, payroll management, inventory purchases, financial stability, stakeholders, creditors, potential investors, strategic decisions.