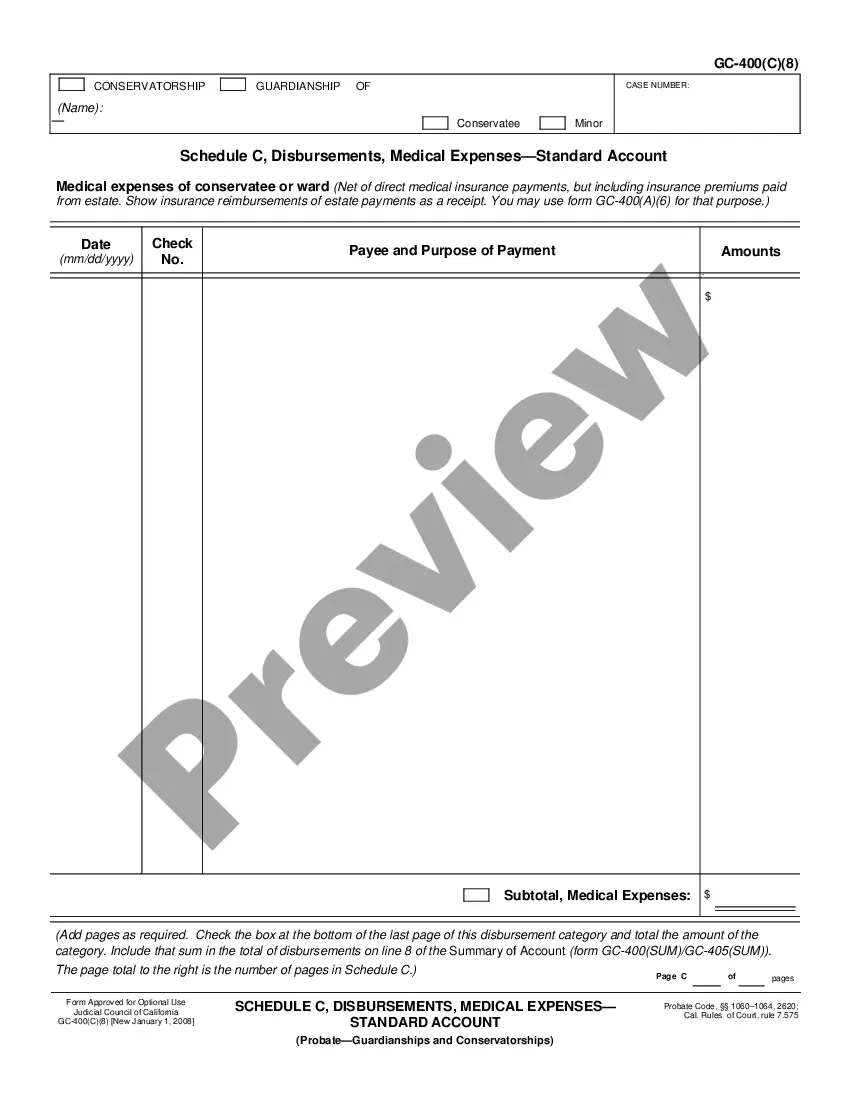

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Sunnyvale California Cash Assets on Hand at End of Account Period: Standard and Simplified Accounts In the world of accounting, the evaluation of a company's financial health is vital. Determining the cash assets on hand at the end of an accounting period is a crucial step to understand the liquidity and stability of a business. This article will delve into the details of Sunnyvale California Cash Assets on Hand at the End of Account Period, specifically focusing on the standard and simplified accounts. Standard Accounts: 1. Cash in Hand: This includes the physical cash held by the company, such as currency notes and coins, readily available for immediate use. It represents the most liquid form of cash assets. 2. Cash in Bank Accounts: Standard accounts also encompass the cash that a company holds in various bank accounts. This includes checking accounts, savings accounts, and money market accounts. These assets are easily accessible and can be used for daily business operations or investment opportunities. 3. Petty Cash Fund: Many businesses maintain a petty cash fund to meet small daily expenses. This fund typically consists of a limited amount of cash and is replenished periodically. It serves as a convenient way to pay for small purchases without having to write a check or use electronic payment methods. 4. Certificates of Deposit (CDs): A company may invest its surplus cash in certificates of deposit, which are time-bound financial instruments offering a higher yield than regular savings accounts. Although they are less liquid than cash in hand or bank accounts, CDs provide a secure and predictable return. Simplified Accounts: 1. Cash on Hand: Similar to standard accounts, simplified accounts include any physical cash maintained by the company for immediate use. 2. Bank Account Balances: In simplified accounting systems, the total balance of all bank accounts is considered as the cash assets on hand at the end of an accounting period. This sum represents the combined value of all funds available in checking, savings, or money market accounts. 3. Cash Equivalents: Simplified accounts may also encompass cash equivalents, which are highly liquid and short-term investments that can be easily converted into cash. Examples include money market funds, treasury bills, and short-term government bonds. It is important to note that while standard accounts provide a more detailed breakdown of cash assets, simplified accounts aim to offer a more broad overview suitable for smaller businesses or entities with less complex financial operations. In conclusion, understanding Sunnyvale California Cash Assets on Hand at the End of Account Period involves an examination of various cash-related elements, such as physical cash, bank account balances, certificates of deposit, petty cash funds, and cash equivalents. By comprehending the different types of cash assets available in standard and simplified accounts, businesses can gain valuable insights into their financial positions, allowing for better decision-making and planning.Sunnyvale California Cash Assets on Hand at End of Account Period: Standard and Simplified Accounts In the world of accounting, the evaluation of a company's financial health is vital. Determining the cash assets on hand at the end of an accounting period is a crucial step to understand the liquidity and stability of a business. This article will delve into the details of Sunnyvale California Cash Assets on Hand at the End of Account Period, specifically focusing on the standard and simplified accounts. Standard Accounts: 1. Cash in Hand: This includes the physical cash held by the company, such as currency notes and coins, readily available for immediate use. It represents the most liquid form of cash assets. 2. Cash in Bank Accounts: Standard accounts also encompass the cash that a company holds in various bank accounts. This includes checking accounts, savings accounts, and money market accounts. These assets are easily accessible and can be used for daily business operations or investment opportunities. 3. Petty Cash Fund: Many businesses maintain a petty cash fund to meet small daily expenses. This fund typically consists of a limited amount of cash and is replenished periodically. It serves as a convenient way to pay for small purchases without having to write a check or use electronic payment methods. 4. Certificates of Deposit (CDs): A company may invest its surplus cash in certificates of deposit, which are time-bound financial instruments offering a higher yield than regular savings accounts. Although they are less liquid than cash in hand or bank accounts, CDs provide a secure and predictable return. Simplified Accounts: 1. Cash on Hand: Similar to standard accounts, simplified accounts include any physical cash maintained by the company for immediate use. 2. Bank Account Balances: In simplified accounting systems, the total balance of all bank accounts is considered as the cash assets on hand at the end of an accounting period. This sum represents the combined value of all funds available in checking, savings, or money market accounts. 3. Cash Equivalents: Simplified accounts may also encompass cash equivalents, which are highly liquid and short-term investments that can be easily converted into cash. Examples include money market funds, treasury bills, and short-term government bonds. It is important to note that while standard accounts provide a more detailed breakdown of cash assets, simplified accounts aim to offer a more broad overview suitable for smaller businesses or entities with less complex financial operations. In conclusion, understanding Sunnyvale California Cash Assets on Hand at the End of Account Period involves an examination of various cash-related elements, such as physical cash, bank account balances, certificates of deposit, petty cash funds, and cash equivalents. By comprehending the different types of cash assets available in standard and simplified accounts, businesses can gain valuable insights into their financial positions, allowing for better decision-making and planning.