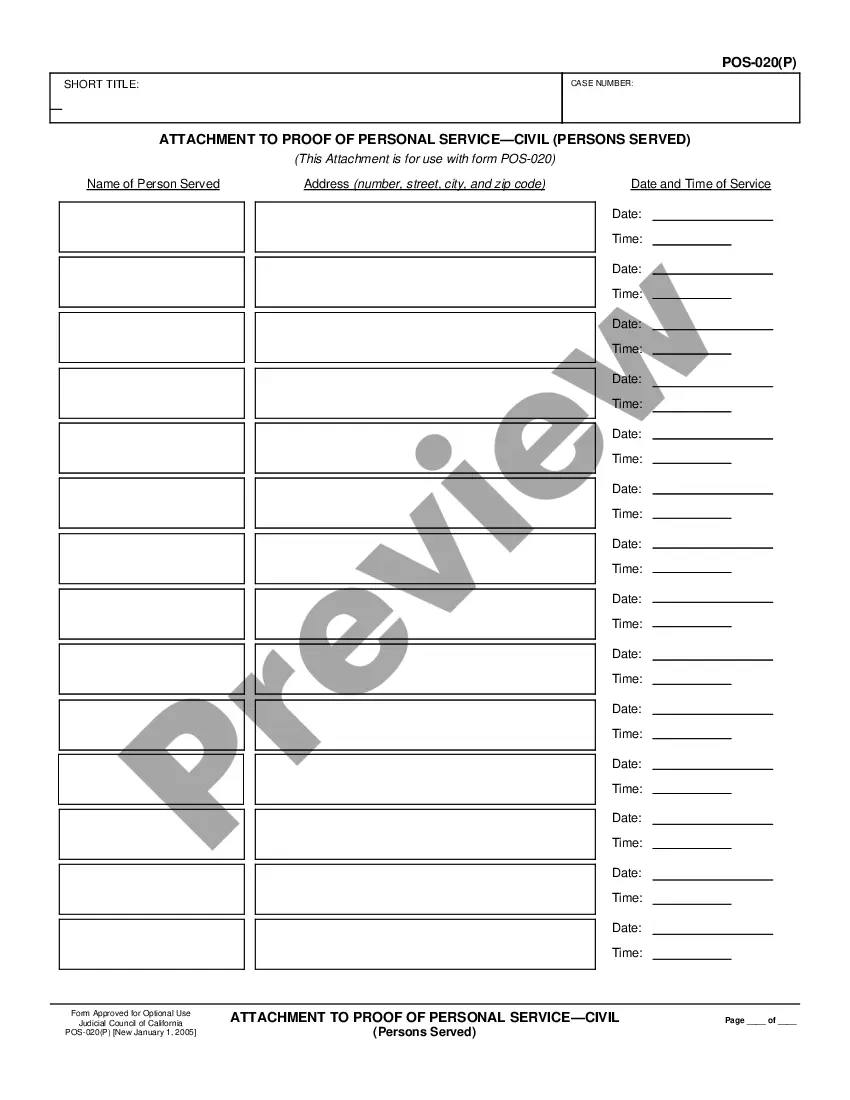

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Chico, California Non-Cash Assets on Hand at End of Account Period-Standard and Simplified Accounts In Chico, California, non-cash assets on hand at the end of an accounting period can be categorized into various types, depending on the type of account system used — standard or simplified. Non-cash assets refer to tangible or intangible items that hold value but are not in the form of cash. Standard Accounts: 1. Inventory: Inventory represents the goods held by a business for sale or those used in the production process. It includes raw materials, work-in-progress, and finished goods that are yet to be sold. 2. Prepaid Expenses: Prepaid expenses are payments made in advance for future goods or services. These can include prepaid insurance premiums, rent, or prepaid advertising costs that haven't been utilized by the end of the accounting period. 3. Long-term Investments: This category includes non-cash assets held by the business for an extended period. Investments can be in the form of stocks, bonds, real estate, or other securities with the intention of earning a return over time. 4. Property, Plant, and Equipment: These assets represent long-term tangible assets used in business operations, such as land, buildings, machinery, vehicles, and furniture. They are not intended for sale but are used to generate income over an extended period. Simplified Accounts: 1. Inventory: As in standard accounts, inventory includes goods held for sale or used in production processes. 2. Prepaid Expenses: Similar to standard accounts, prepaid expenses refer to payments made in advance for goods or services. 3. Fixed Assets: In simplified accounts, non-cash assets such as land, buildings, and equipment are categorized under fixed assets. These are tangible assets with a long useful life that are not intended for sale. 4. Intangible Assets: This category includes non-cash assets without physical substance but with significant value to the business. Examples include patents, copyrights, trademarks, and goodwill. Managing non-cash assets is significant for businesses as they contribute to the overall value of the company and impact financial statements and decision-making processes. Chico, California businesses must accurately track and record these assets to maintain accurate financial records and determine the financial health and future prospects of the organization.