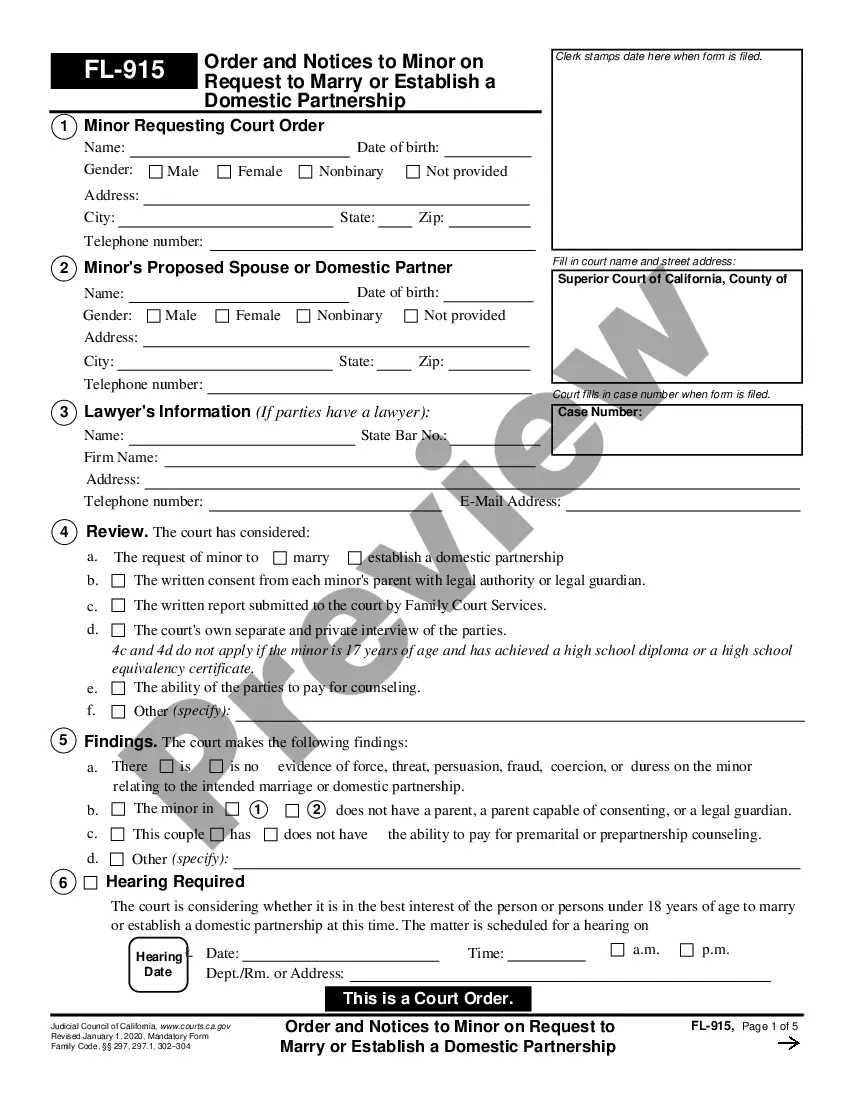

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Escondido California Non-Cash Assets on Hand at End of Account Period-Standard and Simplified Accounts refer to the various non-monetary resources or possessions owned by individuals, businesses, or organizations located in Escondido, California, at the end of an accounting period. These assets are essential for daily operations, investment purposes, or generating future economic benefits. The assets can be categorized into different types, including: 1. Property, Plant, and Equipment (PPE): PPE includes tangible assets such as land, buildings, machinery, vehicles, furniture, and fixtures that are used to carry out business activities or provide services. These assets have a physical existence and are long-term in nature. 2. Intangible Assets: This category comprises non-physical assets that hold value but do not have a physical substance. Examples of intangible assets include patents, copyrights, trademarks, brand names, software, licenses, and goodwill. They are typically created or acquired to enhance business operations or gain a competitive advantage. 3. Investments: Investments represent non-cash assets held by businesses or individuals with the intention of earning a return or future financial gain. These can take the form of stocks, bonds, mutual funds, real estate properties, or other financial instruments. 4. Accounts Receivable: Accounts receivable refer to the amounts owed to a business by its customers for goods or services provided on credit. This non-cash asset indicates the company's right to receive payment, and it is recorded as an asset on the balance sheet until the customer pays off their debt. 5. Prepaid Expenses: Prepaid expenses are payments made in advance for goods or services that will be received in the future. These expenses are recorded as assets since they represent resources already paid for but not yet utilized. Common examples include prepaid rent, insurance premiums, or subscriptions. 6. Inventory: Inventory represents the goods or products held by a business for sale or raw materials used in the production process. It includes both finished goods that are ready for sale and work-in-progress items. Inventory is recorded as an asset until it is sold or consumed. 7. Other Non-Cash Assets: This category encompasses any non-monetary assets not classified under the above categories. It may include items such as prepaid taxes, deferred charges, investments in subsidiaries, or long-term receivables. Tracking and documenting these various Escondido California Non-Cash Assets on Hand at the End of an Account Period-Standard and Simplified Accounts is crucial for accurate financial reporting and assessing the net worth or financial position of an individual or business. By maintaining an inventory of these assets, businesses can make informed decisions, plan for future growth, allocate resources efficiently, and comply with accounting standards and taxation requirements.