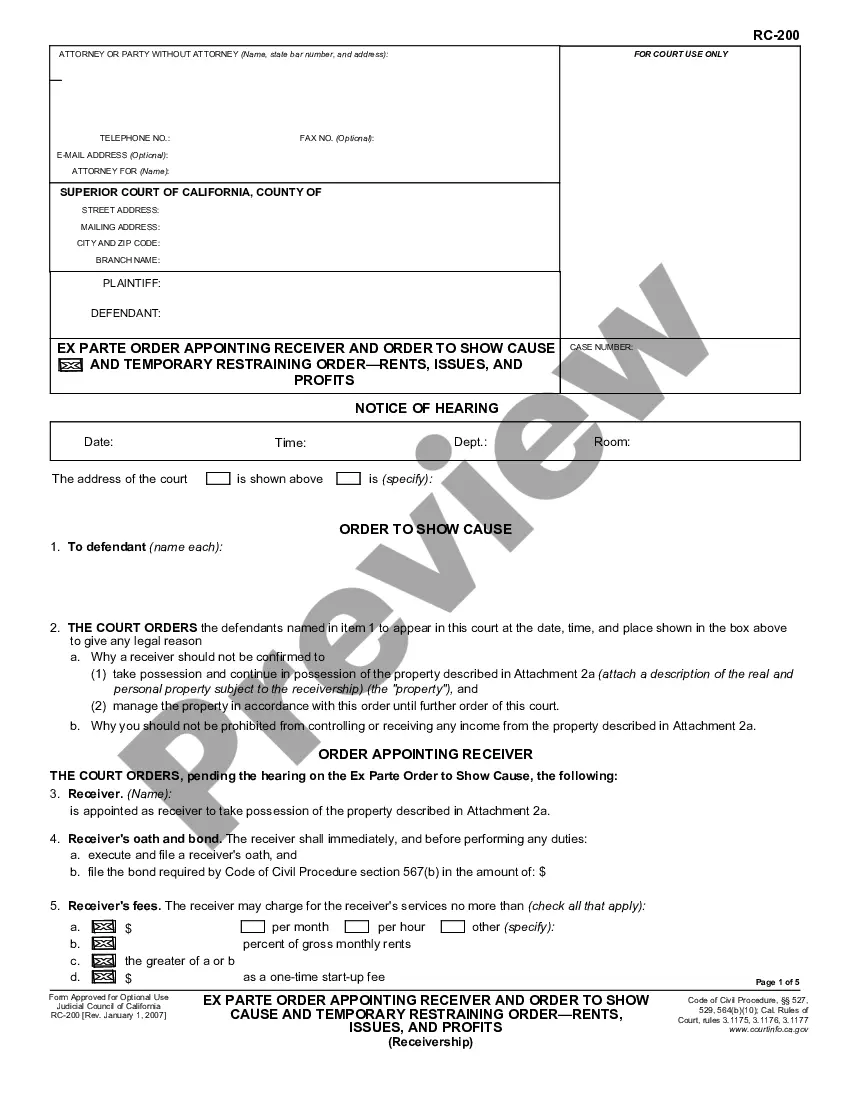

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Chico California Schedule F, Changes in Form of Assets — Standard and Simplified Accounts is a tax form used by individuals and businesses in Chico, California to report any changes made in the form of assets throughout the tax year. This form is particularly relevant for individuals who have acquired, disposed of, or modified assets during the year. There are two types of Chico California Schedule F, Changes in Form of Assets — Standard and Simplified Accounts. The Standard Account is comprehensive and requires detailed information about each change made in the form of assets, including the date of the change, nature of the change (acquisition, disposal, or modification), a description of the asset, and its value before and after the change. On the other hand, the Simplified Account is a condensed version of Schedule F, designed for individuals or businesses with fewer changes in their assets. This account requires less detailed information and is suitable for those who have made relatively simple changes, such as acquiring or disposing of a single asset. When filling out Chico California Schedule F, individuals and businesses need to ensure that they provide accurate and complete information. Failure to do so may result in penalties or potential audits by the tax authorities. It is advisable to consult a tax professional or refer to the official guidelines provided by the Chico California tax department to ensure all requirements are met. Keywords: Chico California, Schedule F, Changes in Form of Assets, Standard Account, Simplified Account, tax form, individuals, businesses, acquired assets, disposed assets, modified assets, tax year, comprehensive, detailed information, nature of change, asset description, value before change, value after change, Simplified Account, condensed version, accurate information, complete information, penalties, tax authorities.

Chico California Schedule F, Changes in Form of Assets — Standard and Simplified Accounts is a tax form used by individuals and businesses in Chico, California to report any changes made in the form of assets throughout the tax year. This form is particularly relevant for individuals who have acquired, disposed of, or modified assets during the year. There are two types of Chico California Schedule F, Changes in Form of Assets — Standard and Simplified Accounts. The Standard Account is comprehensive and requires detailed information about each change made in the form of assets, including the date of the change, nature of the change (acquisition, disposal, or modification), a description of the asset, and its value before and after the change. On the other hand, the Simplified Account is a condensed version of Schedule F, designed for individuals or businesses with fewer changes in their assets. This account requires less detailed information and is suitable for those who have made relatively simple changes, such as acquiring or disposing of a single asset. When filling out Chico California Schedule F, individuals and businesses need to ensure that they provide accurate and complete information. Failure to do so may result in penalties or potential audits by the tax authorities. It is advisable to consult a tax professional or refer to the official guidelines provided by the Chico California tax department to ensure all requirements are met. Keywords: Chico California, Schedule F, Changes in Form of Assets, Standard Account, Simplified Account, tax form, individuals, businesses, acquired assets, disposed assets, modified assets, tax year, comprehensive, detailed information, nature of change, asset description, value before change, value after change, Simplified Account, condensed version, accurate information, complete information, penalties, tax authorities.