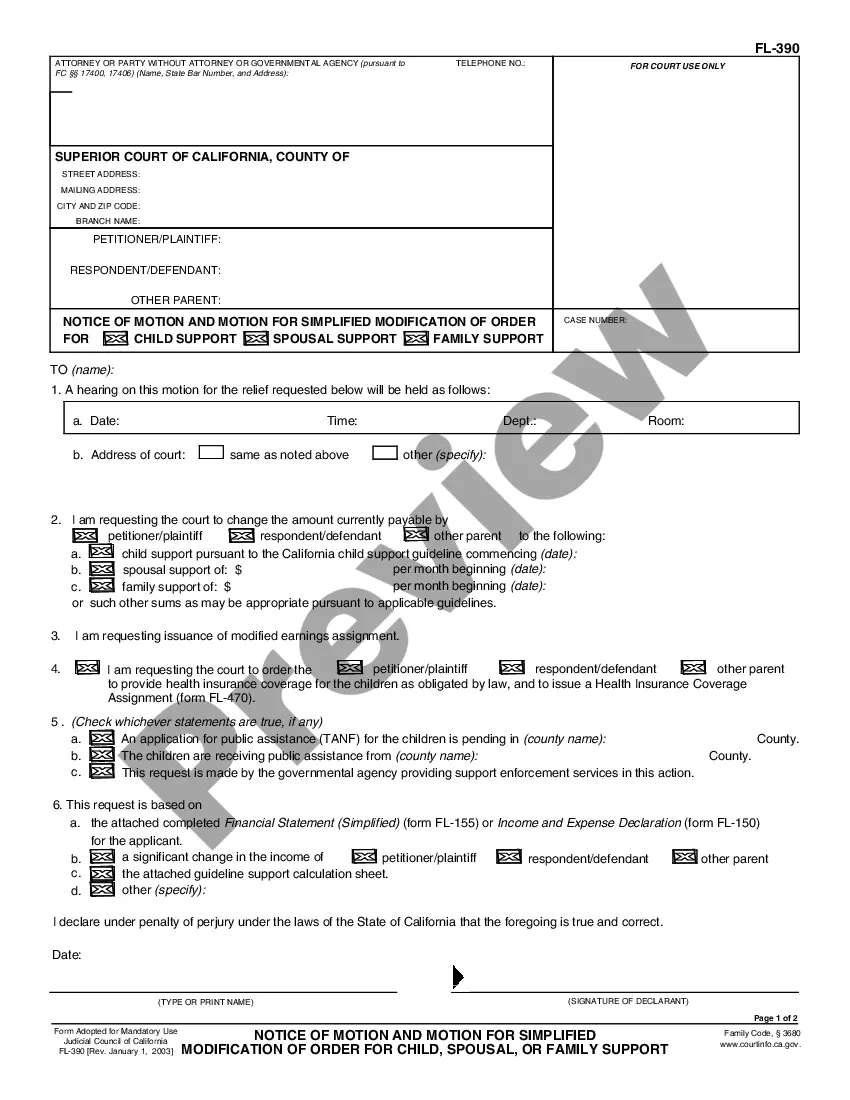

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Oceanside California Schedule G, Liabilities at End of Account Period-Standard and Simplified Accounts is a financial document that provides a detailed overview of the liabilities incurred by a business or individual in Oceanside, California, at the end of an accounting period. This schedule is typically used in both standard and simplified accounting systems to accurately track and report liabilities. The purpose of Oceanside California Schedule G is to ensure transparency and compliance with financial reporting requirements. It assists businesses, accountants, and tax authorities in understanding the financial health of an entity by listing and categorizing liabilities. Liabilities refer to financial obligations or debts owed by a business or individual to other parties, such as suppliers, lenders, employees, and tax authorities. They can include accounts payable, loans, accrued expenses, taxes payable, and other outstanding liabilities. Oceanside California Schedule G allows for the identification and documentation of these liabilities, providing a clear picture of the entity's financial obligations. Various types of Oceanside California Schedule G, Liabilities at End of Account Period-Standard and Simplified Accounts may exist depending on the reporting system used: 1. Standard Accounts: This type of Oceanside California Schedule G follows standard accounting principles and practices. It typically includes detailed line items for different categories of liabilities, such as accounts payable, notes payable, accrued expenses, current portion of long-term debt, and deferred revenue. 2. Simplified Accounts: In contrast to standard accounts, simplified accounts are designed for smaller businesses or individuals with simpler financial reporting needs. Simplified Oceanside California Schedule G may have fewer line items and group liabilities into broader categories, such as current liabilities and long-term liabilities. Both versions of Oceanside California Schedule G are essential for accurate financial reporting and analysis. They allow businesses to assess their financial position, plan for future expenditures, and fulfill tax obligations. It is crucial to consult with a qualified accountant or financial professional to ensure proper completion of the schedule and compliance with applicable regulations. In conclusion, Oceanside California Schedule G, Liabilities at End of Account Period-Standard and Simplified Accounts, is a vital financial document that provides a comprehensive overview of an entity's liabilities in Oceanside, California. By documenting various categories of liabilities, this schedule contributes to transparent financial reporting and compliance with regulatory requirements. Remember to consult a professional for assistance with completing this schedule accurately.