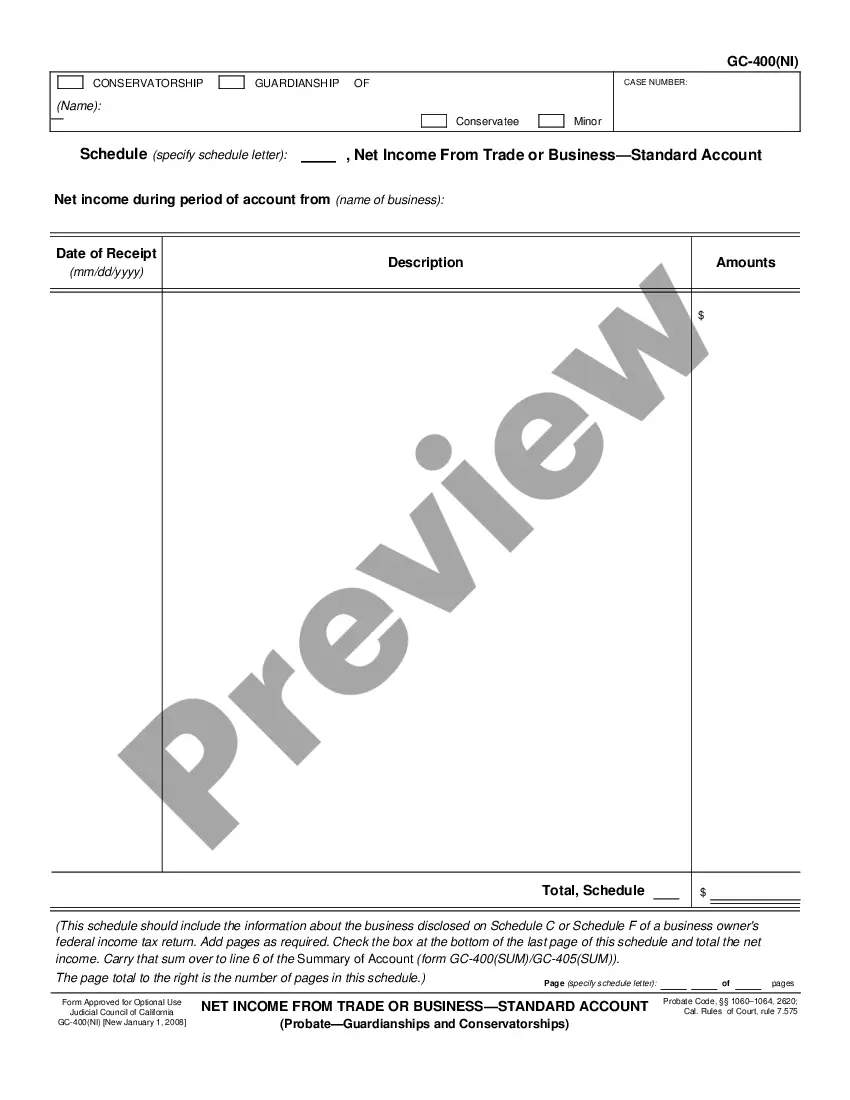

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

San Bernardino California Schedule G, Liabilities at End of Account Period-Standard and Simplified Accounts is a specific financial form used by businesses and individuals residing in San Bernardino, California, to report their liabilities at the end of an account period. This schedule is an essential component of both standard and simplified accounting practices and plays a crucial role in accurately recording an entity's financial obligations. In standard accounting practices, Schedule G requires detailed information regarding various liabilities such as loans, mortgages, credit lines, accounts payable, accrued expenses, and other outstanding debts. It provides a comprehensive snapshot of an organization's obligations, allowing for accurate financial assessments and decision-making. This level of detail is particularly essential for larger businesses with complex financial structures. On the other hand, simplified accounting practices aim to streamline financial reporting for smaller businesses or individuals. The simplified version of Schedule G, also known as Schedule G (Simplified Accounts), requires less detailed information but still covers the basic liabilities that need to be reported. This simplified schedule caters to entities with relatively simpler financial structures and responsibilities. Regardless of the type, both standard and simplified versions of Schedule G have several common elements that must be included when reporting liabilities. These include: 1. Loans and Debts: This section requires the reporting of borrowed funds, unpaid balances on loans, mortgages, and credit facilities. 2. Accounts Payable: Here, businesses need to list any outstanding payments owed to suppliers, vendors, or other creditors. 3. Accrued Expenses: This category encompasses any expenses that have been incurred but not yet paid, such as taxes, wages, or interest. 4. Leases and Rental Agreements: If the business has entered into leases or rental agreements for equipment, property, or other assets, details of these liabilities should be included. 5. Other Liabilities: This section covers any remaining financial obligations that do not fall under the previous categories, such as legal settlements, warranties, or deferred revenue. Accurate completion of Schedule G is crucial for businesses and individuals to present a comprehensive overview of their liabilities. Failing to include any relevant liabilities can lead to inaccuracies in financial statements, legal issues, or missed opportunities for addressing outstanding debts. It is important to consult a certified professional or accountant when preparing Schedule G, as they will ensure compliance with San Bernardino, California's specific accounting regulations and provide guidance on accurately reporting liabilities. This will ultimately help to maintain financial transparency and make informed business decisions.San Bernardino California Schedule G, Liabilities at End of Account Period-Standard and Simplified Accounts is a specific financial form used by businesses and individuals residing in San Bernardino, California, to report their liabilities at the end of an account period. This schedule is an essential component of both standard and simplified accounting practices and plays a crucial role in accurately recording an entity's financial obligations. In standard accounting practices, Schedule G requires detailed information regarding various liabilities such as loans, mortgages, credit lines, accounts payable, accrued expenses, and other outstanding debts. It provides a comprehensive snapshot of an organization's obligations, allowing for accurate financial assessments and decision-making. This level of detail is particularly essential for larger businesses with complex financial structures. On the other hand, simplified accounting practices aim to streamline financial reporting for smaller businesses or individuals. The simplified version of Schedule G, also known as Schedule G (Simplified Accounts), requires less detailed information but still covers the basic liabilities that need to be reported. This simplified schedule caters to entities with relatively simpler financial structures and responsibilities. Regardless of the type, both standard and simplified versions of Schedule G have several common elements that must be included when reporting liabilities. These include: 1. Loans and Debts: This section requires the reporting of borrowed funds, unpaid balances on loans, mortgages, and credit facilities. 2. Accounts Payable: Here, businesses need to list any outstanding payments owed to suppliers, vendors, or other creditors. 3. Accrued Expenses: This category encompasses any expenses that have been incurred but not yet paid, such as taxes, wages, or interest. 4. Leases and Rental Agreements: If the business has entered into leases or rental agreements for equipment, property, or other assets, details of these liabilities should be included. 5. Other Liabilities: This section covers any remaining financial obligations that do not fall under the previous categories, such as legal settlements, warranties, or deferred revenue. Accurate completion of Schedule G is crucial for businesses and individuals to present a comprehensive overview of their liabilities. Failing to include any relevant liabilities can lead to inaccuracies in financial statements, legal issues, or missed opportunities for addressing outstanding debts. It is important to consult a certified professional or accountant when preparing Schedule G, as they will ensure compliance with San Bernardino, California's specific accounting regulations and provide guidance on accurately reporting liabilities. This will ultimately help to maintain financial transparency and make informed business decisions.