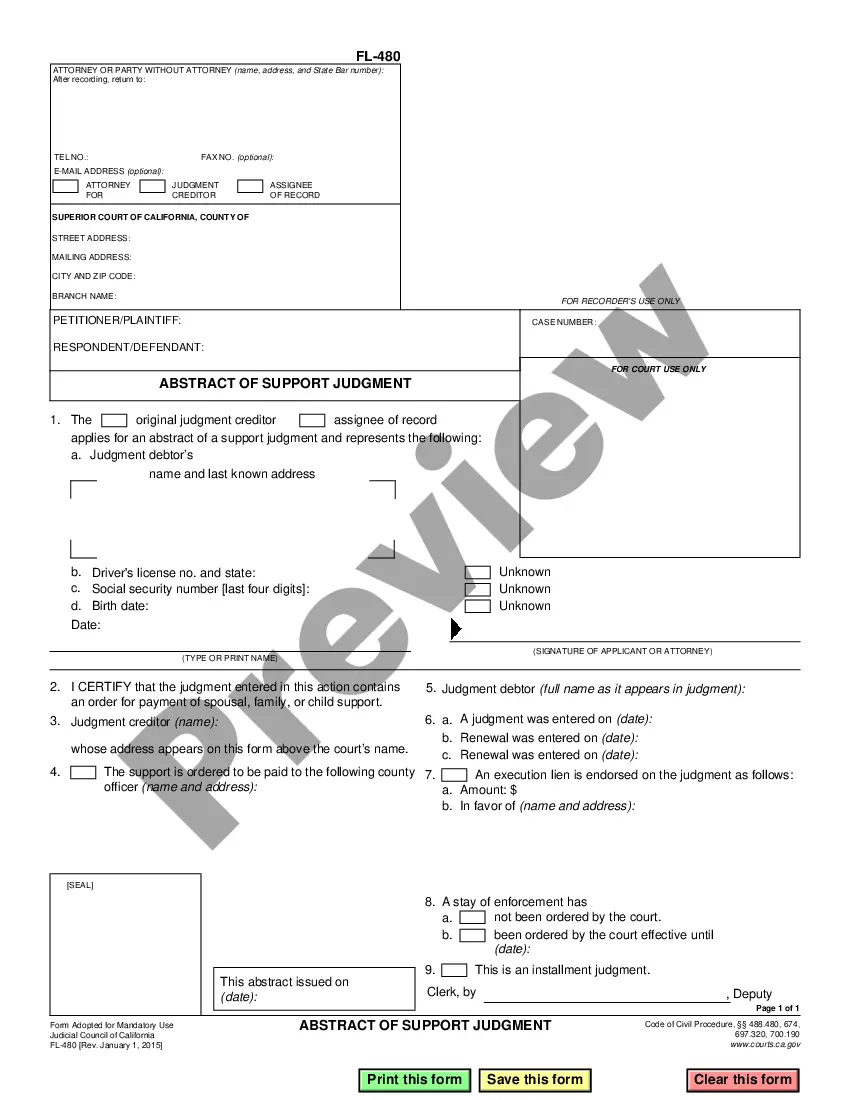

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Net income from a trade or business in Contra Costa, California refers to the profit that is generated through activities conducted by a business entity within the county. This type of income is essential for understanding the financial performance and tax obligations of a business operating in the region. Contra Costa County, located in Northern California, is home to a diverse range of industries and businesses, including retail, manufacturing, technology, and professional services. The net income from a trade or business is calculated by subtracting the total expenses and deductions incurred in the operation of the business from the gross revenue. It represents the amount of profit that is subject to taxation and can be reinvested back into the business or distributed among the owners or shareholders. In Contra Costa County, there are various types of net income accounts that businesses may encounter. One common type is the standard account, which is suitable for businesses that have a straightforward structure and generate income from their primary operations. The standard account typically includes revenue and expense items directly related to the core business activities, such as sales, cost of goods sold, wages, rent, utilities, and advertising expenses. However, depending on the nature of the business, there may be specific subcategories within the net income from a trade or business in Contra Costa, California. For instance, businesses engaged in international trade may have separate accounts for import or export activity. Similarly, businesses in the manufacturing sector may have accounts for raw material costs, production overheads, and distribution expenses. It is important for businesses in Contra Costa County to maintain accurate records and accounts to ensure compliance with tax regulations and financial reporting requirements. By accurately tracking net income from a trade or business, businesses can assess their profitability, make informed decisions, and comply with tax obligations. In conclusion, the net income from a trade or business in Contra Costa, California is a crucial financial metric for businesses operating in the county. It represents the profit generated from core business activities and forms the basis for tax assessment. Businesses must maintain accurate records and accounts to ensure compliance and make informed financial decisions.Net income from a trade or business in Contra Costa, California refers to the profit that is generated through activities conducted by a business entity within the county. This type of income is essential for understanding the financial performance and tax obligations of a business operating in the region. Contra Costa County, located in Northern California, is home to a diverse range of industries and businesses, including retail, manufacturing, technology, and professional services. The net income from a trade or business is calculated by subtracting the total expenses and deductions incurred in the operation of the business from the gross revenue. It represents the amount of profit that is subject to taxation and can be reinvested back into the business or distributed among the owners or shareholders. In Contra Costa County, there are various types of net income accounts that businesses may encounter. One common type is the standard account, which is suitable for businesses that have a straightforward structure and generate income from their primary operations. The standard account typically includes revenue and expense items directly related to the core business activities, such as sales, cost of goods sold, wages, rent, utilities, and advertising expenses. However, depending on the nature of the business, there may be specific subcategories within the net income from a trade or business in Contra Costa, California. For instance, businesses engaged in international trade may have separate accounts for import or export activity. Similarly, businesses in the manufacturing sector may have accounts for raw material costs, production overheads, and distribution expenses. It is important for businesses in Contra Costa County to maintain accurate records and accounts to ensure compliance with tax regulations and financial reporting requirements. By accurately tracking net income from a trade or business, businesses can assess their profitability, make informed decisions, and comply with tax obligations. In conclusion, the net income from a trade or business in Contra Costa, California is a crucial financial metric for businesses operating in the county. It represents the profit generated from core business activities and forms the basis for tax assessment. Businesses must maintain accurate records and accounts to ensure compliance and make informed financial decisions.