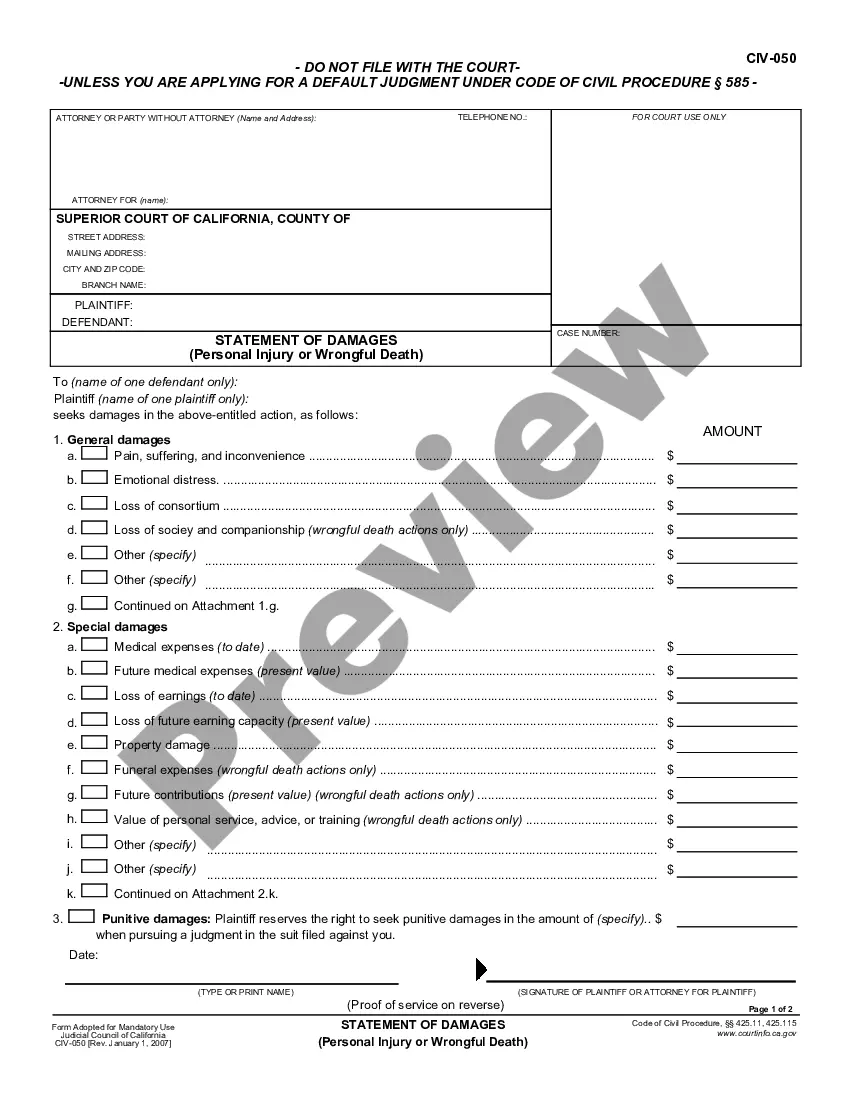

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Sunnyvale California Net Income from a Trade or Business-Standard Account refers to the profit earned by businesses operating within the city of Sunnyvale, California, after deducting all necessary business expenses and taxes. This type of net income is crucial for evaluating the financial performance and overall profitability of businesses in Sunnyvale. Within the framework of federal and state taxation requirements, businesses in Sunnyvale are obligated to maintain accurate and detailed financial records of their income, expenses, and deductions. The net income from a trade or business-standard account is a key component in calculating the taxes owed by a business entity in Sunnyvale. There are several types of Sunnyvale California Net Income from a Trade or Business-Standard Account, each with its specific characteristics, eligibility criteria, and tax implications. Some common types include: 1. Sole Proprietorship Net Income: This refers to the net income generated by sole proprietors, who are self-employed individuals owning and operating their businesses in Sunnyvale. Sole proprietorship report their net income on their personal income tax return using Schedule C. 2. Partnership Net Income: When two or more individuals join together to conduct a business in Sunnyvale, they form a partnership. The net income generated by a partnership is distributed among the partners and reported on the partnership tax return (Form 1065). Each partner then includes their share of the net income on their individual tax return. 3. Limited Liability Company (LLC) Net Income: An LLC is a commonly used business structure in Sunnyvale. LCS combine elements of both partnerships and corporations. The net income generated by an LLC can either be taxed as a partnership (multiple members) or as a corporation (single member). The net income of an LLC taxed as a partnership is reported on Form 1065, whereas an LLC taxed as a corporation files Form 1120. 4. Corporate Net Income: Corporations in Sunnyvale file their net income on a separate corporate tax return, Form 1120. The net income generated by corporations is subject to corporate income tax rates, and shareholders may pay additional taxes on dividends received from the corporation. It is essential for businesses in Sunnyvale to accurately calculate and report their net income from a trade or business-standard account to comply with tax regulations. Seeking the assistance of qualified accountants or tax professionals is highly recommended ensuring compliance and maximize tax efficiency for businesses in Sunnyvale, California.