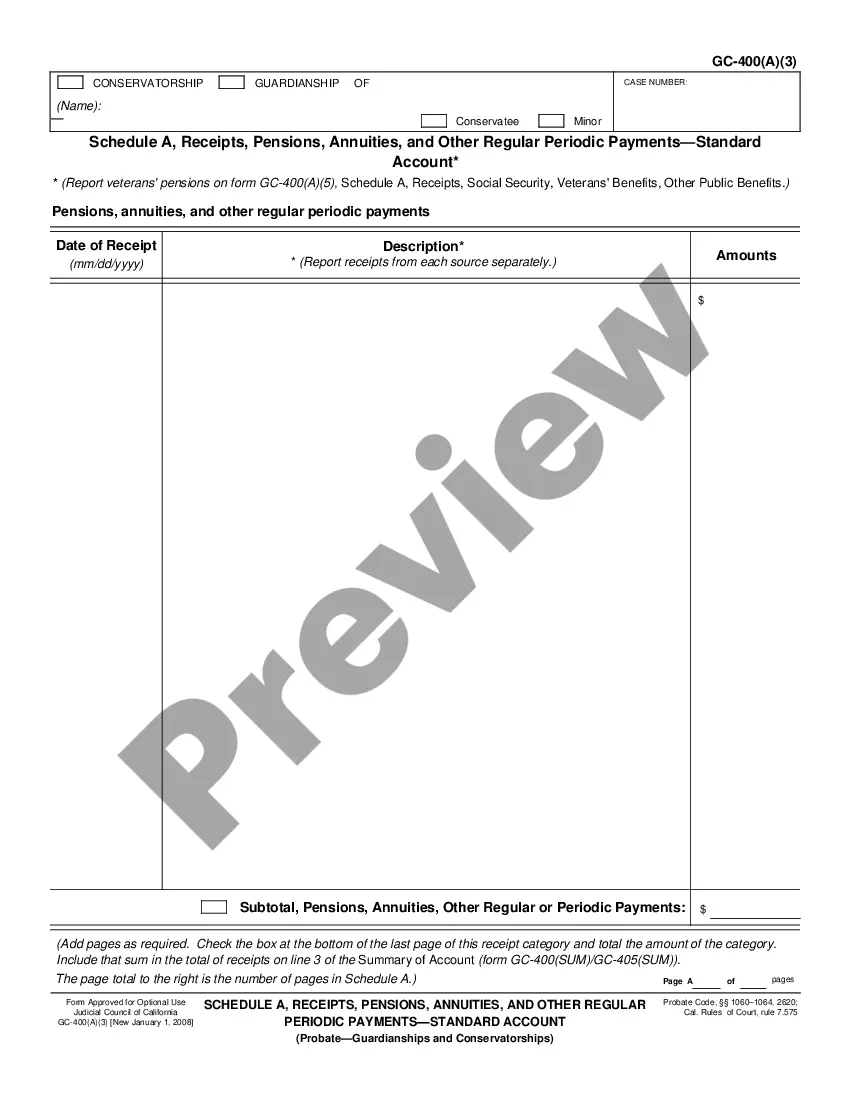

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

The Visalia California Net Income From a Trade or Business-Standard Account refers to the profit generated by individuals or businesses engaged in trade or business activities in the city of Visalia, California. It represents the amount of money earned after deducting all expenses and costs associated with running the business from the total revenue generated. This net income is an essential indicator of a business's financial health and profitability, crucial for assessing its performance and making informed decisions. Keywords: Visalia California, net income, trade or business, standard account, profit, revenue, expenses, costs, financial health, profitability, performance, decision-making. There are various types of Visalia California Net Income From a Trade or Business-Standard Accounts, depending on the nature of the business or trade. Here are a few notable types: 1. Sole Proprietorship: This type of account refers to the net income derived from a trade or business owned and operated by a single individual. In this case, the owner is personally liable for all debts and obligations, and the net income is reported on their individual tax return using Schedule C. 2. Partnership: Partnerships involve multiple individuals operating a business together. Each partner shares in the net income based on their agreed-upon profit-sharing ratio, as outlined in the partnership agreement. The net income is reported on Form 1065, and individual partners receive a Schedule K-1. 3. Limited Liability Company (LLC): LCS are a popular business structure that combines the limited liability protection of a corporation with the tax advantages of a partnership. The net income from an LLC is typically divided among the members according to their ownership percentage, as stated in the operating agreement. It is reported on Form 1065, and members receive a Schedule K-1. 4. Corporation: Corporations are seen as separate legal entities from their owners. The net income is subject to corporate tax rates and reported on Form 1120. The remaining profit can either be reinvested in the business, distributed to shareholders as dividends, or held as retained earnings. It is crucial for businesses in Visalia, California, to accurately calculate and report their net income from a trade or business-standard account to comply with tax regulations and make informed financial decisions. Maintaining organized financial records and seeking professional assistance, such as from accountants or tax advisors, can greatly assist in accurately determining net income and maximizing profitability.