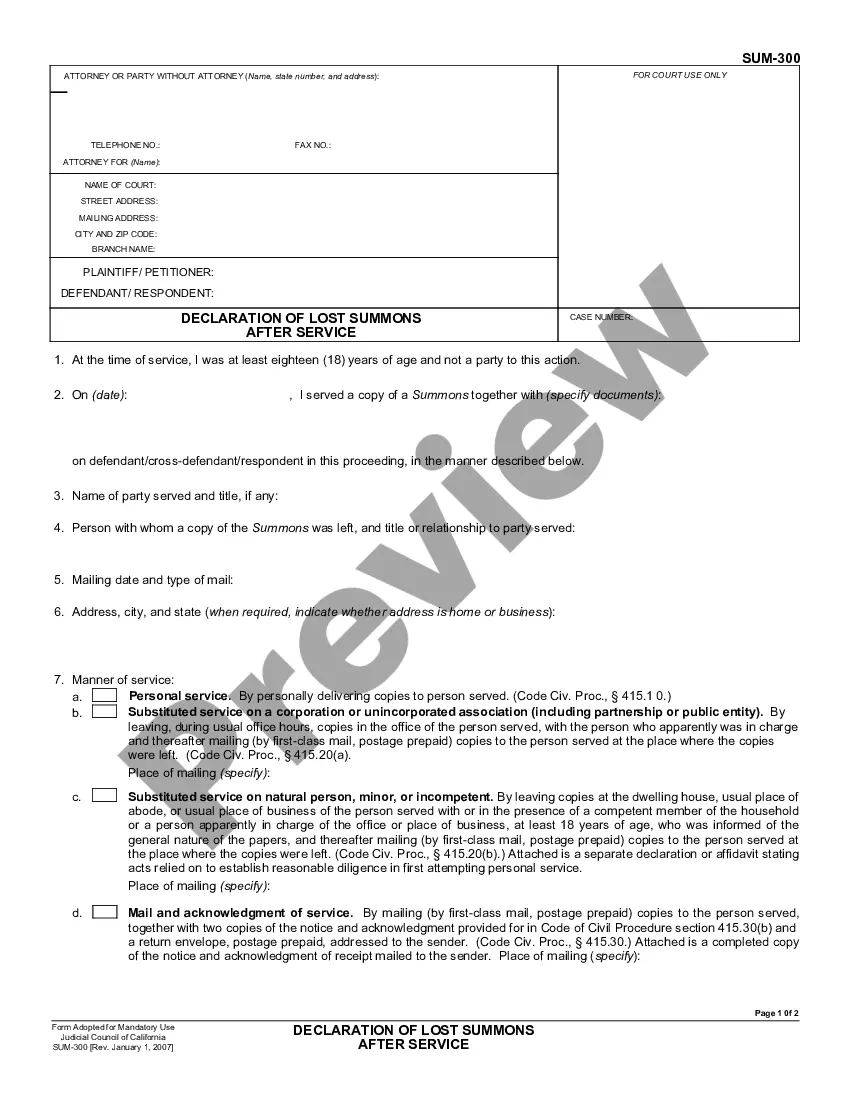

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Irvine California Other Charges — Standard and Simplified Accounts In Irvine, California, residents and businesses have the option to choose between two types of accounts when it comes to managing their finances — Standard and Simplified Accounts. Both account types cater to the specific needs of individuals and businesses, offering various benefits and services. Let's delve into what Irvine California Other Charges — Standard and Simplified Accounts encompass, highlighting the features and distinguishing factors of each type. Standard Account: Irvine's Standard Account is a comprehensive financial management solution designed to meet the diverse requirements of customers. This account offers a wide range of services and features, ensuring a seamless and hassle-free banking experience. Customers can expect competitive interest rates, quick and secure online transactions, and a plethora of financial tools to efficiently manage their funds. Key Features of the Standard Account in Irvine, California: 1. Interest Rates: The Standard Account offers attractive interest rates on deposits, allowing customers to grow their savings over time. 2. Online Banking: Customers can access their accounts 24/7 through online banking, enabling them to check balances, transfer funds, and pay bills conveniently from anywhere. 3. Debit Card: Account holders receive a debit card, granting them easy access to their funds for ATM withdrawals and point-of-sale purchases. 4. Check Writing: The Standard Account includes the ability to write checks, providing a traditional method for making payments. 5. Overdraft Protection: Customers can opt-in for overdraft protection, ensuring their transactions are covered even if their account balance is insufficient. Simplified Account: Irvine's Simplified Account is designed to streamline everyday financial transactions and cater to individuals who seek a more straightforward banking experience. This account type eliminates complexities and focuses on essential banking features, making it an ideal option for those who prefer simplicity and ease of use. Key Features of the Simplified Account in Irvine, California: 1. Basic Banking Services: The Simplified Account offers essential banking services without unnecessary frills, providing a simplified approach to managing finances. 2. Minimal Fees: This account aims to keep fees to a minimum, making it an economical choice for customers seeking cost-effective banking. 3. Online and Mobile Banking: Account holders can conveniently access their accounts through intuitive online and mobile banking platforms, enabling them to perform various financial transactions on the go. 4. Debit Card: Customers are provided with a debit card, allowing them to make purchases or withdraw cash at ATMs anytime. 5. Limited Check Writing: While the Simplified Account includes check-writing capabilities, it emphasizes electronic banking methods, such as online bill pay or electronic fund transfers. Both the Standard and Simplified Accounts in Irvine, California contribute to the vibrant financial ecosystem of the city, catering to the diverse needs and preferences of individuals and businesses alike. Whether you value comprehensive financial management or prefer a more streamlined approach, Irvine's various banking options ensure convenience and accessibility in handling your finances effectively.Irvine California Other Charges — Standard and Simplified Accounts In Irvine, California, residents and businesses have the option to choose between two types of accounts when it comes to managing their finances — Standard and Simplified Accounts. Both account types cater to the specific needs of individuals and businesses, offering various benefits and services. Let's delve into what Irvine California Other Charges — Standard and Simplified Accounts encompass, highlighting the features and distinguishing factors of each type. Standard Account: Irvine's Standard Account is a comprehensive financial management solution designed to meet the diverse requirements of customers. This account offers a wide range of services and features, ensuring a seamless and hassle-free banking experience. Customers can expect competitive interest rates, quick and secure online transactions, and a plethora of financial tools to efficiently manage their funds. Key Features of the Standard Account in Irvine, California: 1. Interest Rates: The Standard Account offers attractive interest rates on deposits, allowing customers to grow their savings over time. 2. Online Banking: Customers can access their accounts 24/7 through online banking, enabling them to check balances, transfer funds, and pay bills conveniently from anywhere. 3. Debit Card: Account holders receive a debit card, granting them easy access to their funds for ATM withdrawals and point-of-sale purchases. 4. Check Writing: The Standard Account includes the ability to write checks, providing a traditional method for making payments. 5. Overdraft Protection: Customers can opt-in for overdraft protection, ensuring their transactions are covered even if their account balance is insufficient. Simplified Account: Irvine's Simplified Account is designed to streamline everyday financial transactions and cater to individuals who seek a more straightforward banking experience. This account type eliminates complexities and focuses on essential banking features, making it an ideal option for those who prefer simplicity and ease of use. Key Features of the Simplified Account in Irvine, California: 1. Basic Banking Services: The Simplified Account offers essential banking services without unnecessary frills, providing a simplified approach to managing finances. 2. Minimal Fees: This account aims to keep fees to a minimum, making it an economical choice for customers seeking cost-effective banking. 3. Online and Mobile Banking: Account holders can conveniently access their accounts through intuitive online and mobile banking platforms, enabling them to perform various financial transactions on the go. 4. Debit Card: Customers are provided with a debit card, allowing them to make purchases or withdraw cash at ATMs anytime. 5. Limited Check Writing: While the Simplified Account includes check-writing capabilities, it emphasizes electronic banking methods, such as online bill pay or electronic fund transfers. Both the Standard and Simplified Accounts in Irvine, California contribute to the vibrant financial ecosystem of the city, catering to the diverse needs and preferences of individuals and businesses alike. Whether you value comprehensive financial management or prefer a more streamlined approach, Irvine's various banking options ensure convenience and accessibility in handling your finances effectively.